**CPI Report Exceeded Market Expectations: Analysis and Impact**

**Who:** Investors, analysts, and economists were taken aback by the unexpected reaction in the bond market to the latest Consumer Price Index (CPI) report.

**What:** The Core Month-over-Month (M/M) CPI data came in at 0.2, in line with forecasts, but the real surprise was the subsequent 15 basis point drop in 10-year yields, a move that defied expectations.

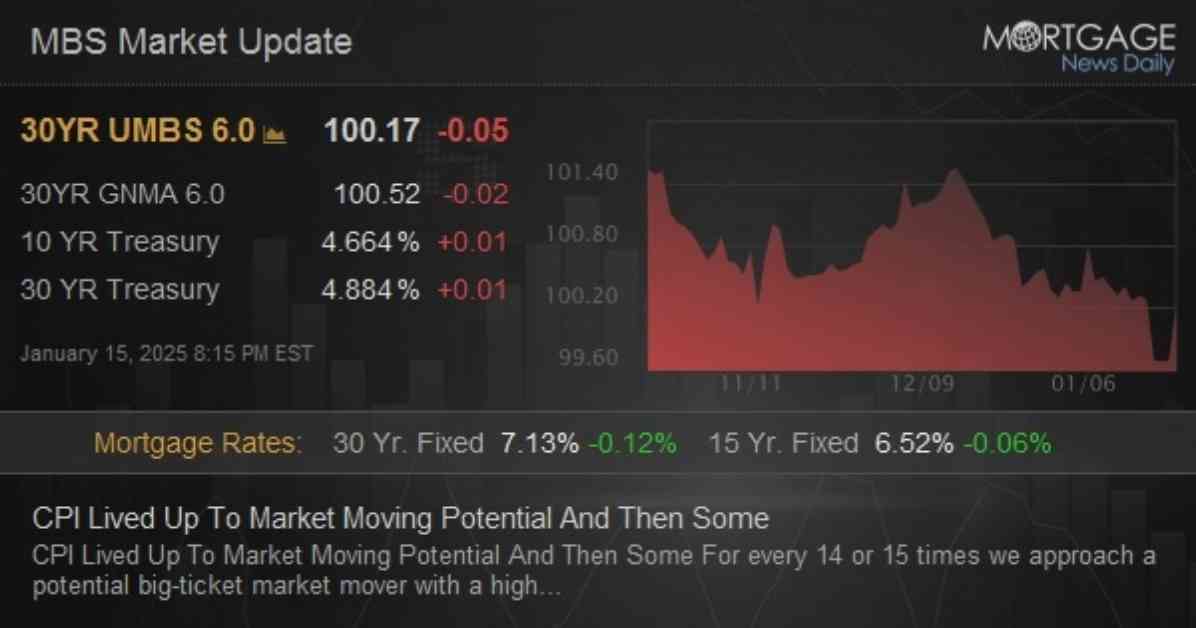

**When:** The market’s reaction unfolded on Wednesday, January 15, 2025, with the CPI report released in the morning.

**Where:** This market-moving event took place in the financial realm, impacting bond yields and investor sentiment.

**Why:** The unexpected bond market reaction to the CPI report could be attributed to a combination of factors, including market anxiety, favorable data composition, and corrections following long-term high yields.

**How:** The 10-year yields dropped significantly after the CPI data release, indicating a strong market response to the seemingly neutral report.

Monthly Core CPI Results

The Core Month-over-Month (M/M) CPI results showed a slight uptick at 0.2, matching the forecast and slightly below the previous month’s 0.3. When unrounded, the data revealed a value of 0.225, slightly lower than the expected 0.240.

Annual Core CPI Analysis

On an annual basis, the Core CPI came in at 3.2, slightly below the forecast of 3.3, but in line with the previous month’s figure of 3.3. This data point provided further context for the market’s reaction to the monthly CPI report.

Market Reaction and Stability

Throughout the day, the bond market experienced significant fluctuations in response to the CPI report. Despite the initial drop in yields, the market remained stable, with minimal volatility in the hours following the data release. This unexpected lack of movement highlighted the unique nature of the market’s response to the CPI report.

As investors and analysts continue to dissect the implications of the CPI report and its impact on the bond market, one thing remains clear: market expectations were exceeded, leading to a day of surprises and strategic adjustments for all involved.

Remember, in the fast-paced world of finance, even the most seemingly routine data releases can have significant implications. Stay informed, stay vigilant, and be prepared for the unexpected twists and turns that define the financial landscape.

So, what will tomorrow bring? Stay tuned for more updates and analysis as we navigate the ever-changing currents of the market together.