How to Manage Your Student Loan Payments in 2025: Tips and...

This article provides essential strategies and resources for effectively managing student loan payments in 2025, ensuring borrowers can navigate their financial obligations with confidence...

How to Manage Your SBA Loan: A Guide for Business Owners

This article provides essential insights and strategies for business owners on effectively managing their SBA loans, ensuring financial stability, and fostering growth.Understanding SBA loans...

How to Use a Federal Student Loan to Pay for College...

This article explores the process of utilizing federal student loans for college funding in 2025, detailing eligibility, application procedures, and repayment options to ensure...

How to Save Money with a Loan Amortization Calculator

This article delves into the significant advantages of utilizing a loan amortization calculator to enhance your financial decision-making. By offering detailed insights into payment...

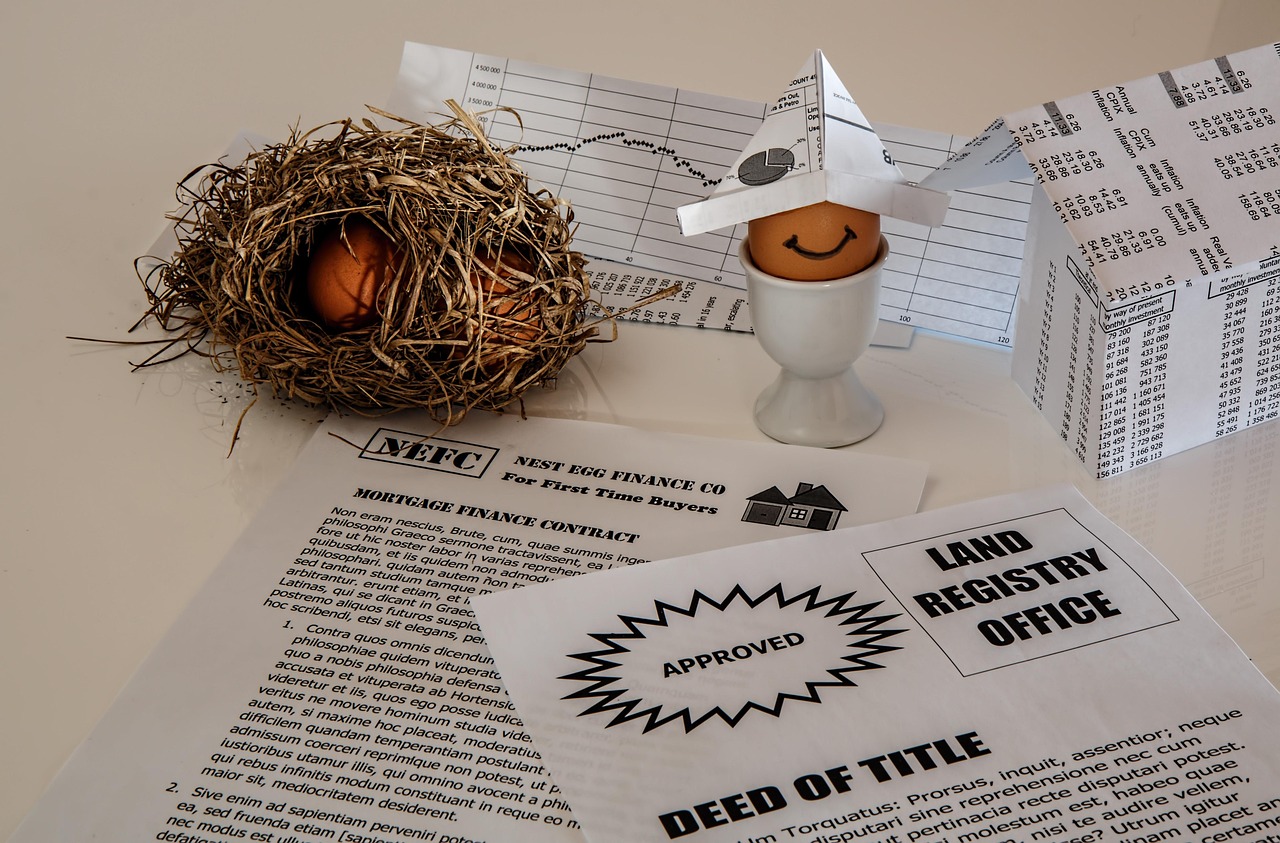

How to Get the Best Home Loan Rates in 2025

This article serves as a comprehensive guide for securing the most favorable home loan rates in 2025. With the mortgage landscape constantly evolving, it...

How to Secure a Loan for Your Business Start-Up in 2025

This article serves as a comprehensive guide on how to secure a loan for your business start-up in 2025. It covers essential strategies, various...

How to Get Personal Loans for Debt Consolidation in 2025

Obtaining personal loans for debt consolidation in 2025 can be a strategic move for individuals seeking to regain control of their finances. This article...

How to Refinance Your Home Loan and Save Money on Interest

Refinancing your home loan can be a strategic move that helps homeowners achieve significant financial benefits. This article delves into the refinancing process, outlining...

Why I Stopped Trusting ‘Financial Gurus’ and Started Trusting Myself

Look, I Was a Sucker Back in 2017, I was a total sucker. I mean, I swallowed every word some guy named Marcus (let's call...

Why I Stopped Trusting ‘Financial Experts’ and Started Making My Own...

My Financial Awakening at a Dive Bar in Milwaukee Look, I'm gonna be honest with you. I used to be that guy. The one nodding...

Why I Stopped Trusting ‘Financial Gurus’ and Started Listening to Myself

Look, I'm gonna be honest here I used to eat up every word those finance guys on TV said. You know the type—perfect hair, expensive...

Why I Stopped Trusting Banks and What I Did Instead

Look, I'm Gonna Be Honest Banks are kinda like that friend who always borrows money and never pays you back. You know the one. Let's...

Why I Stopped Trusting Banks and What I Did Instead

My Bank Betrayed Me Look, I'm gonna be honest with you. I used to be one of those people who thought banks were basically your...

How to Get Approved for a VA Home Loan in 2025:...

This article provides essential insights and guidance on securing approval for a VA home loan in 2025, covering eligibility requirements, the application process, and...

How to Save Money by Refinancing Your Car Loan

This article delves into the benefits and steps involved in refinancing your car loan, guiding you on how to save money and make informed...

Why I Stopped Trusting ‘Financial Gurus’ and Started Managing My Own...

My Financial Awakening Look, I'm gonna be honest with you. I used to be that person. The one who bought every book, attended every seminar,...

I Tried the ‘Set It and Forget It’ Investing Strategy for...

Look, I'm not some fancy financial advisor Honestly, I'm just a guy who's made a lot of mistakes with money. But about three months ago,...

I Tried the ‘Set It and Forget It’ Investing Strategy for...

Look, I'm not some fancy financial advisor Honestly, I'm just a guy who's made a lot of mistakes with money. But about three months ago,...

Why I Stopped Trusting ‘Financial Gurus’ and Started Trusting Myself

Confessions of a Finance Junkie Okay, full disclosure: I'm a finance nerd. I always have been. Back in '98, I was that kid in high...

Why I Stopped Trusting ‘Financial Gurus’ and Started Listening to My...

Let me tell you about the time I got financially roasted It was 2017, Austin, Texas. I was at this fancy schmancy financial seminar, right?...

Why I Stopped Trusting ‘Experts’ and Started Managing My Own Damn...

My Financial Awakening at a Dive Bar It was a Tuesday night at Lou's, that grimy little bar on 3rd where the neon sign flickers...

Why I Stopped Trusting ‘Financial Gurus’ and Started Listening to My...

Let me tell you about Marcus Okay, so there's this guy, Marcus. We met at a conference in Austin back in 2018. Big shot financial...

Why I Stopped Trusting ‘Financial Gurus’ and Started Listening to My...

Let Me Tell You About Marcus Okay, so there's this guy, let's call him Marcus. We met at a coffee shop in Chicago, back in...

The Honest Truth About Investing: I Messed Up, You Shouldn’t

Confessions of a Finance Editor Who Should Know Better Okay, look. I'm gonna be straight with you. I've been in this industry for over 20...

I Tried Every Budgeting App Out There—Here’s What Actually Works

Look, I'm Bad at Money Let's just get that out of the way. I'm that person who always has good intentions but ends up ordering...

Why I Stopped Trusting ‘Financial Gurus’ and Started Listening to My...

Or, How I Learned to Stop Worrying and Love the Side Hustle Let me tell you something, folks. I'm Sarah, and I've been in this...

Why I Stopped Trusting ‘Financial Experts’ and Started Managing My Own...

Look, I’m gonna level with you… I used to be that guy. The one who’d nod along at financial seminars, scribble notes during webinars, and...

How to Qualify for a USDA Loan: A Guide for Homebuyers

This article provides an in-depth look at USDA loans, detailing eligibility requirements, application processes, and tips for prospective homebuyers seeking affordable housing options in...

How to Qualify for a Student Loan with Bad Credit

Securing a student loan can be a daunting task, especially for individuals with bad credit. However, there are effective strategies to navigate this challenge....

Why I Stopped Trusting Banks and What I Did Instead

My Banking Breakup Look, I get it. Banks are supposed to be the safe, responsible choice. But let me tell you, after 20 years of...

Why I Stopped Trusting Banks and Started Managing My Own Damn...

Confessions of a Finance Skeptic Look, I’ll admit it. I was that guy. The one who walked into a bank, blindly trusted the guy in...

I Tried Crypto for a Year—Here’s What Happened

Look, I'm Not a Genius Let's get this out of the way right now. I'm not some Wall Street hotshot. I'm not a tech bro...

Why I Stopped Trusting ‘Experts’ and Started Managing My Own Damn...

My Financial Awakening at a Dive Bar in Chicago Look, I’m gonna be honest with you. I used to be that guy. The one who’d...

The Honest Truth About Personal Finance: I’ve Been Doing It Wrong

Confessions of a Finance Flunkie Okay, let me just say this upfront: I’m not some fancy financial guru. I’m just a guy who’s made a...

The Honest Truth About Loans: What Nobody’s Telling You

Why I Hate Loans (But Use Them Anyway) Look, I’m gonna be honest here. I hate loans. Hate them. Like, viscerally. It’s not the loans...

How to Refinance Student Loans for Lower Rates

Refinancing student loans can be a strategic move for many borrowers looking to improve their financial situation. This article delves into the intricacies of...

How to Get Approved for a Car Loan with No Credit...

Navigating the car loan process without a credit history can be challenging. However, with the right strategies and insights, you can secure financing even...

Why I Stopped Trusting ‘Financial Gurus’ and Started Trusting Myself

Look, I’m gonna level with you About three months ago, I was at this conference in Austin. You know the type—overpriced coffee, too many power...

Why I Stopped Trusting ‘Financial Experts’ and Started Managing My Own...

Look, I’m gonna level with you I used to be that person. The one who nodded along at financial seminars, who bought every book with...

I Tried Every Budgeting Trick Out There—Here’s What Actually Works

My Financial Wake-Up Call Look, I’m gonna be honest. I was that person. The one with the fancy coffee every morning, the new gadget every...

Financial Fitness: Managing Your Finances Like a Pro

Introduction to Financial Fitness In today’s fast-paced world, managing your finances effectively is crucial for achieving long-term financial goals. Just as physical fitness requires regular...

The Intersection of Personal Finance and Sustainable Living: A Comprehensive Guide

Introduction The world of personal finance is vast and ever-evolving, encompassing everything from traditional banking to modern cryptocurrency investments. However, one aspect that is gaining...

The Intersection of Personal Finance and Sustainable Living: A Comprehensive Guide

Introduction The world of personal finance is vast and ever-evolving, encompassing everything from traditional banking to modern cryptocurrency investments. However, one aspect that is gaining...

How to Qualify for a Personal Loan with Low Credit Scores

This article explores strategies and insights on qualifying for personal loans even with low credit scores, providing practical tips and expert advice for potential...

How to Qualify for a Personal Loan Without a Credit Check

This article delves into strategies for obtaining personal loans without the necessity of a credit check. It aims to provide valuable insights on eligibility...

How to Get a Loan Without a Credit Check: Your Complete...

This comprehensive guide explores the various options available for obtaining a loan without undergoing a credit check, detailing methods, eligibility, and tips for securing...

How to Manage Your Personal Loan Repayment Plan Like a Pro

This article provides an in-depth guide on effectively managing personal loan repayments. It includes strategies, tips, and common pitfalls to avoid, ensuring financial stability...

How to Qualify for a Federal Student Loan in 2025

This article provides a detailed guide on the qualifications needed for federal student loans in 2025, including essential criteria, application processes, and tips for...

How to Get a Home Equity Line of Credit in 2025:...

This article provides a comprehensive overview of securing a Home Equity Line of Credit (HELOC) in 2025, including eligibility, application steps, and tips for...

How to Get Approved for a Loan with Poor Credit History

Securing a loan with a poor credit history can be a daunting task, but it is not impossible. This article delves into effective strategies...

How to Get Student Loan Forgiveness for Public Service Workers

This article explores the various pathways for public service workers to achieve student loan forgiveness, detailing eligibility requirements, application processes, and valuable tips to...

How to Get Personal Loans for Bad Credit with Guaranteed Approval

This article explores effective strategies and options available for individuals seeking personal loans despite having bad credit. We will cover various aspects, including eligibility,...

How to Get a Loan with No Credit Check in 2025

In 2025, obtaining a loan without a credit check has become increasingly accessible for those seeking financial assistance. This article delves into the various...

How to Find the Best Home Equity Loan Rates in 2025

This article serves as a comprehensive guide for homeowners seeking to secure the best home equity loan rates in 2025. With the ever-changing financial...

How to Get a Loan with No Credit Check in 2025:...

This article explores various avenues for securing a loan without a credit check in 2025, detailing options, eligibility, and practical tips to help borrowers...

How to Find Fast Payday Loans with Instant Approval in 2025

This article delves into the effective strategies for obtaining fast payday loans with instant approval in 2025. With the increasing demand for quick financial...

How to Get No Credit Check Loans: Is It Possible in...

This article explores the feasibility of obtaining no credit check loans in 2025, discussing the types of loans available, eligibility criteria, and tips for...

How to Choose the Right Personal Loan for Your Financial Needs...

This article provides a comprehensive guide on selecting the best personal loan tailored to your financial situation, covering key factors, tips, and expert insights...

How to Get a Fast Cash Loan and Avoid Common Pitfalls

This article provides a comprehensive guide on how to secure a fast cash loan while avoiding common pitfalls that can lead to financial distress....

How to Get Approved for an Auto Loan with Bad Credit...

This article serves as a comprehensive guide for securing an auto loan in 2025, specifically tailored for individuals facing the challenges of bad credit....

How to Calculate Your Monthly Home Loan Payments with a Loan...

This article delves into the intricacies of calculating your monthly home loan payments using a loan calculator. Understanding this process is crucial for prospective...

How to Find the Best Loan Rates Near Me: Tips for...

This article provides practical strategies for locating the best loan rates available in your area, ensuring you make informed financial decisions in 2025.Understanding Loan...

How to Get a Loan with Bad Credit: A Complete Guide

This article serves as a comprehensive guide for individuals seeking to secure a loan despite having bad credit. It includes essential tips, various loan...

Mastering Your Finances: A Comprehensive Guide to Personal Finance and Investing

Understanding Personal Finance Personal finance is a critical aspect of our lives that often gets overlooked. It encompasses everything from budgeting and saving to investing...

Navigating the Financial Landscape: Smart Strategies for Personal Finance and Investing

The Importance of Financial Literacy In today’s complex financial landscape, understanding the basics of personal finance and investing is crucial. Financial literacy empowers individuals to...

Navigating the Financial Landscape: A Comprehensive Guide to Smart Money Management

Understanding Personal Finance Personal finance is a critical aspect of our daily lives, yet it often remains shrouded in mystery and complexity. At its core,...

How to Calculate Your Loan Amortization Schedule with a Loan Calculator

This article serves as a comprehensive guide on how to effectively calculate your loan amortization schedule using a loan calculator. By exploring essential concepts,...

How to Find a Personal Loan with Guaranteed Approval in 2025

This article serves as a comprehensive guide on how to secure a personal loan with guaranteed approval in 2025. It covers essential topics such...

Navigating the Financial Landscape: Smart Strategies for Personal Finance and Investing

Understanding the Basics of Personal Finance Personal finance is a critical aspect of our lives that often gets overlooked. It involves managing your money, including...

Navigating Personal Finance: Strategies for a Secure Financial Future

The Importance of Financial Literacy In today’s fast-paced world, financial literacy is more important than ever. Understanding the basics of personal finance can help you...

Navigating the Financial Landscape: Smart Strategies for Personal Finance and Investing

Understanding the Financial Landscape The financial world is vast and complex, encompassing everything from personal finance and banking to investing and cryptocurrency. Navigating this landscape...

Navigating the Financial Landscape: A Comprehensive Guide to Personal Finance and...

Understanding the Basics of Personal Finance Personal finance is a critical aspect of our lives that often gets overlooked. It encompasses everything from budgeting and...

How to Avoid Payday Loan Traps and Find Safer Alternatives

This article delves into the complexities of payday loans and presents practical alternatives that empower individuals to manage their finances effectively, steering clear of...

How to Get a Loan Online: What You Need to Know

This article provides essential insights into securing an online loan, covering the types of loans available, application processes, and tips for choosing the right...

Navigating Personal Finance: A Comprehensive Guide to Smart Money Management

Understanding the Basics of Personal Finance Personal finance is a critical aspect of our daily lives, yet many people overlook its importance until they face...

Navigating the Financial Landscape: Smart Strategies for Personal Finance and Investing

Understanding the Basics of Personal Finance Personal finance is a critical aspect of our daily lives, yet it often remains shrouded in complexity and jargon....

Smart Financial Strategies for Seniors: Maximizing Savings and Investments

Introduction As we age, our financial priorities often shift. Seniors typically focus on preserving wealth, ensuring a steady income stream, and planning for long-term care....

Smart Financial Strategies for Seniors: Maximizing Savings and Investments

Introduction As we age, our financial priorities often shift. Seniors typically focus on preserving wealth, ensuring a steady income stream, and planning for long-term care....

Navigating the Financial Landscape: Essential Tips for Smart Money Management

Understanding the Financial Ecosystem The financial world is vast and complex, encompassing everything from personal savings to global investment markets. To navigate this landscape effectively,...

Navigating the Financial Landscape: Smart Strategies for Personal Finance and Investing

Understanding the Basics of Personal Finance Personal finance is a critical aspect of our lives that often gets overlooked. It encompasses everything from budgeting and...

Mastering Personal Finance: A Comprehensive Guide to Smart Money Management

Understanding the Basics of Personal Finance Personal finance is a critical aspect of our lives that often gets overlooked. It encompasses everything from budgeting and...

Navigating the Financial Landscape: Smart Strategies for 2024 and Beyond

Understanding the Current Financial Climate The financial landscape is constantly evolving, influenced by technological advancements, economic shifts, and global events. As we move through 2024,...

How to Choose Between Home Equity Loans and HELOCs

This article explores the key differences between home equity loans and Home Equity Lines of Credit (HELOCs), offering insights to help homeowners make informed...

How to Calculate Your Monthly Payment with a Loan Payment Calculator

This article delves into the effective use of a loan payment calculator, a vital tool for anyone looking to manage their finances efficiently. By...

Mastering Your Finances: A Comprehensive Guide to Smart Money Management

The Importance of Financial Literacy In today’s fast-paced world, financial literacy is more important than ever. Understanding how to manage your money effectively can mean...

Mastering Personal Finance: A Comprehensive Guide to Secure Your Financial Future

Understanding the Basics of Personal Finance Personal finance is a critical aspect of our lives that often gets overlooked. It encompasses everything from budgeting and...

Navigating Personal Finance: Strategies for Success in 2023

Understanding the Basics of Personal Finance Personal finance is a critical aspect of our lives that often gets overlooked. It involves managing your money, including...

Navigating the Financial Landscape: A Comprehensive Guide to Personal Finance and...

Understanding the Basics of Personal Finance Personal finance is a critical aspect of our daily lives, yet it is often overlooked or misunderstood. At its...

Navigating Personal Finance: Smart Strategies for a Secure Future

Understanding the Basics of Personal Finance Personal finance is a critical aspect of our lives that often gets overlooked until it’s too late. It encompasses...

Navigating the Financial Landscape: A Comprehensive Guide to Personal Finance and...

Understanding the Basics of Personal Finance Personal finance is a critical aspect of our lives that often gets overlooked. It encompasses everything from budgeting and...

Navigating the Financial Landscape: Tips for Smart Money Management

Understanding the Financial Ecosystem The world of finance is vast and complex, encompassing everything from personal budgeting to global investment strategies. Understanding the financial ecosystem...

Navigating the Financial Landscape: Smart Strategies for Personal Wealth Management

Understanding the Basics of Personal Finance Personal finance is a critical aspect of our daily lives, yet it often remains shrouded in complexity and jargon....

Navigating the Future of Finance: A Comprehensive Guide to Emerging Trends

Introduction to Modern Financial Landscapes The financial world is evolving at an unprecedented pace, driven by technological advancements and shifting consumer behaviors. Understanding these changes...

How to Get a Business Loan in 2025: Tips for Entrepreneurs

This article provides essential strategies and insights for entrepreneurs seeking business loans in 2025, covering everything from preparation to application and approval processes.As the...

How to Find the Best Student Loan Forgiveness Options for Your...

This article delves into the various student loan forgiveness options available for different careers, offering insights into eligibility criteria, application processes, and strategies to...

Navigating Personal Finance: A Comprehensive Guide to Smart Money Management

Understanding the Basics of Personal Finance Personal finance is a critical aspect of our lives that often gets overlooked. It encompasses everything from budgeting and...

Navigating the Financial Landscape: Smart Strategies for 2026

The Importance of Financial Literacy In an ever-evolving financial landscape, staying informed and making smart financial decisions is crucial. Whether you're managing personal finances, investing,...

Navigating the Financial Landscape: Smart Strategies for Personal Finance and Investing

Understanding the Basics of Personal Finance Personal finance is a critical aspect of our lives that often gets overlooked. It encompasses everything from budgeting and...

Navigating the Financial Landscape: Smart Strategies for Personal Finance and Investing

Understanding the Financial Landscape The financial world is vast and ever-evolving, encompassing everything from personal finance and banking to the burgeoning realm of cryptocurrency. Navigating...

Navigating the Financial Landscape: Smart Strategies for Personal Finance and Investing

The Importance of Financial Literacy In today’s complex financial landscape, understanding the basics of personal finance and investing is crucial for achieving long-term financial stability...

Navigating the Financial Landscape: Smart Strategies for Personal Finance and Investing

Understanding the Financial Ecosystem The financial landscape is a complex and ever-evolving ecosystem that encompasses personal finance, investing, banking, and even the burgeoning world of...

Navigating Personal Finance: A Comprehensive Guide to Smart Money Management

Understanding the Basics of Personal Finance Personal finance is a critical aspect of our daily lives, yet it often remains shrouded in mystery for many....

Navigating the Financial Landscape: A Comprehensive Guide to Personal Finance and...

Understanding Personal Finance Personal finance is a critical aspect of our daily lives, yet it is often overlooked or misunderstood. It encompasses everything from budgeting...

Navigating the Financial Landscape: Smart Strategies for Personal Finance and Investing

Understanding the Basics of Personal Finance Personal finance is a critical aspect of our daily lives, yet it is often overlooked or misunderstood. At its...

Navigating the Complex World of Personal Finance: A Comprehensive Guide

Understanding the Basics of Personal Finance Personal finance is a critical aspect of our lives that often gets overlooked. It encompasses everything from budgeting and...

How to Avoid Common Mistakes When Applying for Personal Loans

This article delves into the frequent mistakes individuals face when applying for personal loans and offers practical strategies to enhance the application process while...

How to Apply for Title Loans: What You Need to Know...

This article provides an in-depth look at the essential steps and considerations for applying for title loans in 2025. As financial needs evolve, understanding...

Navigating Personal Finance: A Comprehensive Guide to Smart Money Management

Understanding the Basics of Personal Finance Personal finance is a critical aspect of our daily lives, yet it is often overlooked or misunderstood. At its...

Navigating the Financial Landscape: Smart Strategies for Personal Finance and Investing

Understanding the Basics of Personal Finance Personal finance is a critical aspect of our lives that often gets overlooked until it’s too late. It encompasses...

Navigating the Financial Landscape: Smart Strategies for Personal Finance and Investing

Understanding the Financial Landscape The world of finance can be complex and overwhelming, especially for those who are just starting to manage their personal finances...

Smart Financial Planning for Your Next Weekend Getaway

Introduction The allure of a weekend getaway is undeniable. It’s a chance to unwind, explore new places, and create lasting memories. However, the financial aspect...

Smart Financial Planning for Your Next Weekend Getaway

Introduction The allure of a weekend getaway is undeniable. It's a chance to unwind, explore new places, and create lasting memories. However, the financial aspect...

The Intersection of Financial Wellness and Personal Well-being

Understanding Financial Wellness Financial wellness is a state where an individual has control over their financial situation, meets financial obligations, and has the financial freedom...

The Intersection of Financial Wellness and Personal Well-being

Understanding Financial Wellness Financial wellness is a state where an individual has control over their financial situation, meets financial obligations, and has the financial freedom...

Navigating Personal Finance: A Comprehensive Guide to Smart Money Management

Understanding the Basics of Personal Finance Personal finance is a critical aspect of our lives that often gets overlooked. It encompasses everything from budgeting and...

Navigating the Financial Landscape: Smart Strategies for Personal Finance and Investing

Understanding the Financial Landscape The financial landscape is vast and ever-evolving, encompassing personal finance, investing, banking, and even the burgeoning world of cryptocurrency. Navigating this...

Navigating the World of Personal Finance: A Comprehensive Guide

Understanding Personal Finance Personal finance is a broad term that encompasses all financial decisions and activities of an individual or household. It includes budgeting, saving,...

Navigating the Financial Landscape: Tips and Trends for 2023

The Ever-Evolving World of Finance The financial landscape is constantly evolving, shaped by technological advancements, regulatory changes, and global economic trends. As we navigate through...

Navigating the Financial Landscape: A Comprehensive Guide to Personal Finance and...

The Importance of Financial Literacy In today’s complex financial landscape, understanding the basics of personal finance and investing is crucial for securing your financial future....

Navigating Personal Finance: A Comprehensive Guide to Smart Money Management

The Importance of Personal Finance Personal finance is a critical aspect of our daily lives, yet it is often overlooked or mismanaged. Understanding and effectively...