**Lowest Mortgage Rates in 2 Weeks: What You Need to Know**

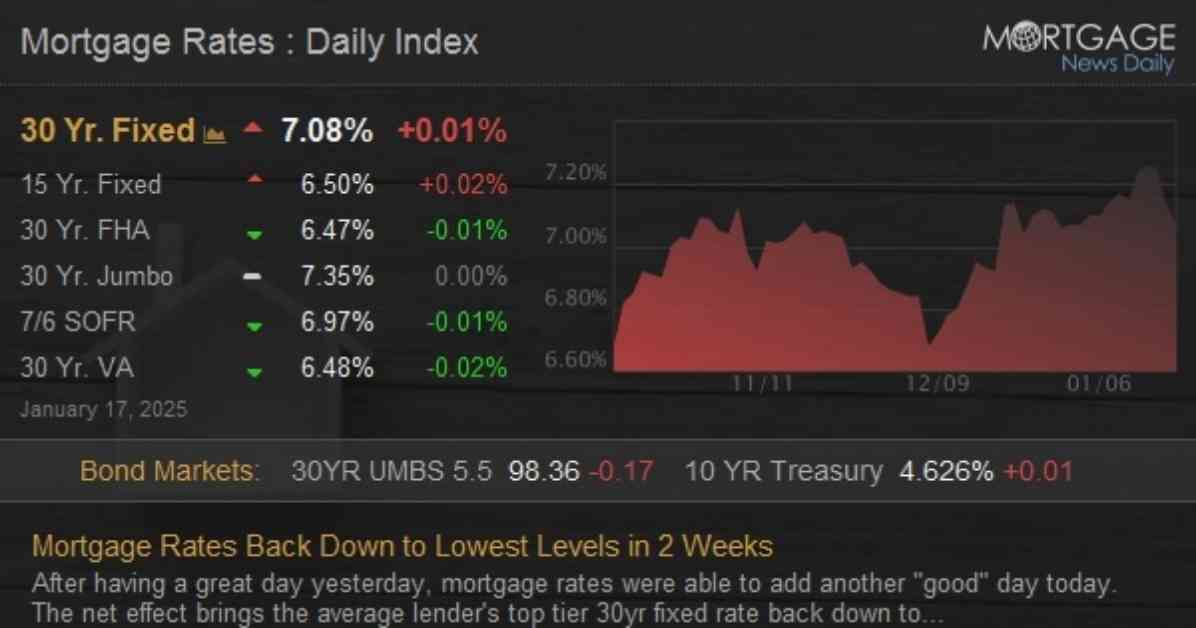

After a positive day yesterday, mortgage rates have experienced another favorable trend today, leading to the average lender’s top tier 30-year fixed rate dropping to levels last observed on January 2nd, precisely 2 weeks ago.

**Influential Factors**

The recent decline in mortgage rates can be attributed to various factors, with yesterday’s significant data on the Consumer Price Index (CPI) playing a crucial role. While today’s economic data did not have a substantial impact, a slight decrease in Retail Sales figures this morning further supported the downward trajectory of mortgage rates.

**Federal Reserve and Treasury Secretary Nominee’s Impact**

Comments made by key figures such as a member of the Federal Reserve, Waller, and the Treasury Secretary nominee, Bessent, have also contributed to the current mortgage rate situation. Waller’s optimistic outlook on inflation aligning with potential Fed rate cuts in the first half of the year provided a positive sentiment to the market. Similarly, Bessent’s commitment to fiscal discipline during his confirmation hearing resonated well with bond markets, indirectly influencing higher rates but in a significant manner.

**Outlook and Implications**

As mortgage rates continue to trend downwards to their lowest levels in 2 weeks, homeowners and potential buyers are presented with an opportune moment to secure favorable rates for their financing needs. Whether it be refinancing existing mortgages or purchasing new homes, the current market conditions offer a window of advantage that should not be overlooked.

**Conclusion**

In conclusion, the recent developments in the mortgage rate landscape emphasize the importance of staying informed and vigilant when it comes to financial decisions. By closely monitoring market trends and expert opinions, individuals can navigate the complexities of the mortgage industry with confidence and make informed choices that align with their long-term goals and aspirations.