As the sun rose on the financial markets this morning, bonds found themselves in a bit of a tug-of-war. The Durable Goods data released earlier in the day painted a mixed picture, with stronger internal components offsetting a weaker headline. Sellers initially held the reins during the morning hours, but the tide turned following the 7-year Treasury auction. Despite a rebound in equities markets – a factor of lesser importance today compared to yesterday – bonds managed to put on a solid showing.

Looking ahead, all eyes are on the upcoming Powell press conference scheduled for 2:30 pm tomorrow. While the announcement itself may not bring any groundbreaking news, Federal Reserve Chairman Powell’s remarks always have the potential to move the market. However, with mildly positive cues from recent inflation data and lingering policy uncertainties, the odds of any major surprises seem relatively low this time around.

Diving into the numbers, the Durable Goods report revealed a decline of 2.2% versus an expected increase of 0.8%, with the previous figure standing at -2.0%. Excluding defense and aircraft, durable goods orders rose by 0.5%, surpassing the forecast of 0.3% after a previous reading of 0.9%. On the consumer confidence front, the index came in at 104.1, falling short of the 105.6 forecast and down from the previous 109.5.

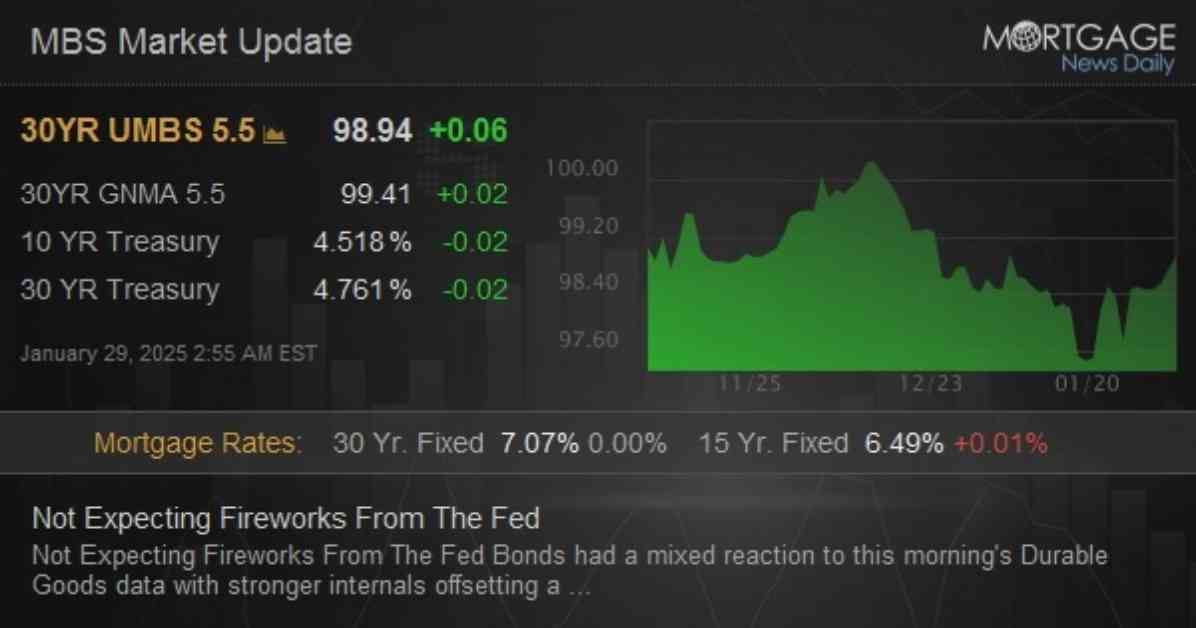

In the wee hours of the morning, bond markets saw a slight weakening following the Durable Goods data release, with Mortgage-Backed Securities (MBS) down 2 ticks (0.06) and the 10-year Treasury yield up 2.8 basis points at 4.566%. As the day progressed, bonds hovered near their weakest levels as stocks bounced back, with MBS down an eighth and the 10-year yield up 3.5 basis points at 4.574%. However, the tide turned once again after the 7-year Treasury auction, leading to a stronger performance in bonds with MBS remaining unchanged and the 10-year yield up only 1.6 basis points at 4.554%.

In the fast-paced world of finance, staying ahead of the curve is crucial. To keep up with the latest developments in the bond market and receive real-time alerts, consider downloading our mobile app for access to MBS commentary and streaming prices of MBS and Treasury securities.

The intricate dance between economic data, market sentiment, and policy actions by the Federal Reserve creates a dynamic environment that keeps investors and analysts on their toes. While today’s market movements may not have been as dramatic as some had anticipated, the stage is set for potential shifts in response to Chairman Powell’s upcoming press conference. As always, in the world of finance, expect the unexpected.