Mortgage Rates Stay Steady Despite Jobs Report

Mortgage rates experienced a slight decrease throughout the week, despite a modest bounce on Friday following the release of the monthly jobs report. While this report typically has the power to cause significant fluctuations in rates, this time around, the impact was relatively muted.

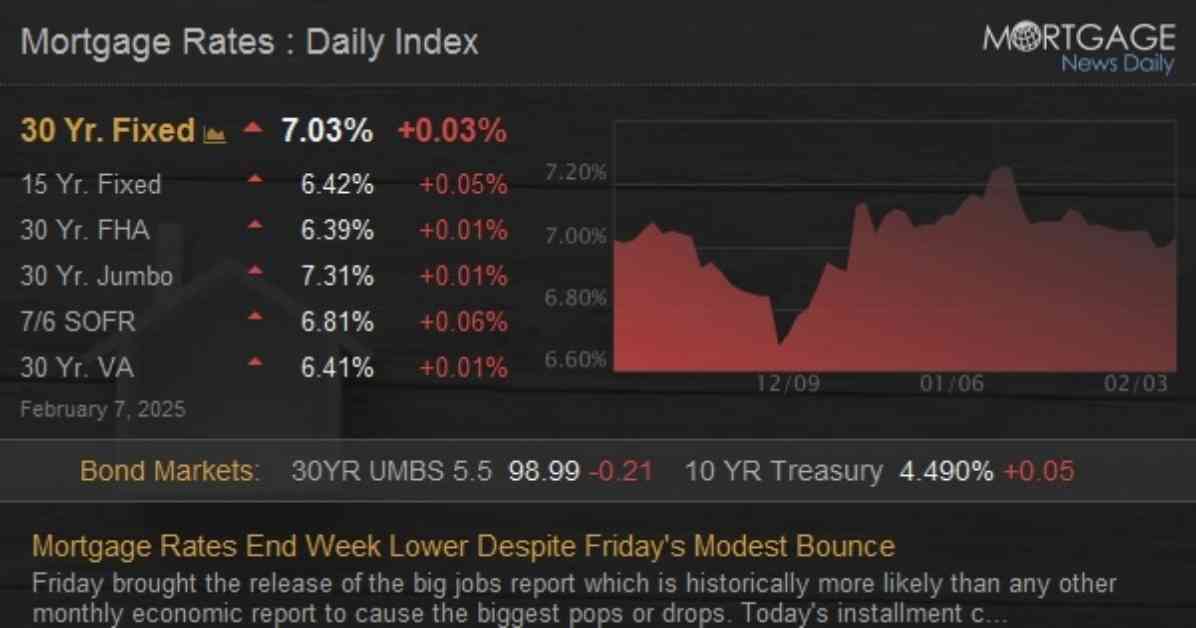

Earlier in the week, rates had actually dropped by a larger margin, resulting in a 0.06% decrease in the average lender’s top tier 30-year fixed rate. In comparison, Friday’s jobs report only led to a 0.03% increase in rates. As a result, the average 30-year fixed rate currently hovers just above 7%.

This trend indicates that mortgage rates are more responsive to economic data rather than news headlines. Looking ahead, the next major economic report that could potentially shake things up is the Consumer Price Index (CPI). This index, which measures inflation, is closely monitored by the Federal Reserve, especially in light of recent statements emphasizing the importance of inflation in their decision-making process.

The Fed has made it clear that while they are satisfied with the current state of the labor market, they are waiting for further progress on inflation before considering any changes to interest rates. If the CPI report reveals unexpected downward trends in inflation next Wednesday, mortgage rates could see a decline in response.

The Impact of Economic Data on Mortgage Rates

Economic data plays a crucial role in shaping mortgage rate movements. While news headlines can certainly influence market sentiment, it is the hard data on job growth, inflation, and other key indicators that truly drive rate fluctuations. Investors closely monitor reports like the jobs report and CPI to gauge the health of the economy and anticipate potential shifts in interest rates.

Experts emphasize the importance of staying informed about economic indicators and their implications for mortgage rates. By understanding how data releases can impact borrowing costs, homeowners and prospective buyers can make informed decisions about when to lock in a rate or pursue a home purchase.

Strategies for Navigating Rate Volatility

In a market environment where rates can shift based on a single data release, it’s essential for borrowers to be proactive in managing their mortgage decisions. One strategy to consider is working with a knowledgeable loan officer who can provide guidance on rate trends and help borrowers secure favorable terms.

Additionally, staying informed about economic developments and upcoming reports can give borrowers a competitive edge when it comes to timing their mortgage transactions. By monitoring rate movements and keeping an eye on key indicators, individuals can position themselves to take advantage of favorable rate environments.

As the mortgage market continues to respond to economic signals, borrowers should remain vigilant and adaptable in their approach to securing financing. By leveraging expert insights and staying attuned to market dynamics, homeowners can navigate rate fluctuations with confidence and make informed choices that align with their financial goals.