Ajit Jain, the long-time insurance chief and top executive at Berkshire Hathaway, made headlines recently when he sold over half of his stake in the conglomerate. This move came as a surprise to many, as Jain has been a key figure in Berkshire’s success for the past 40 years. Let’s take a closer look at this development and its potential implications for the company and its investors.

Background and Context

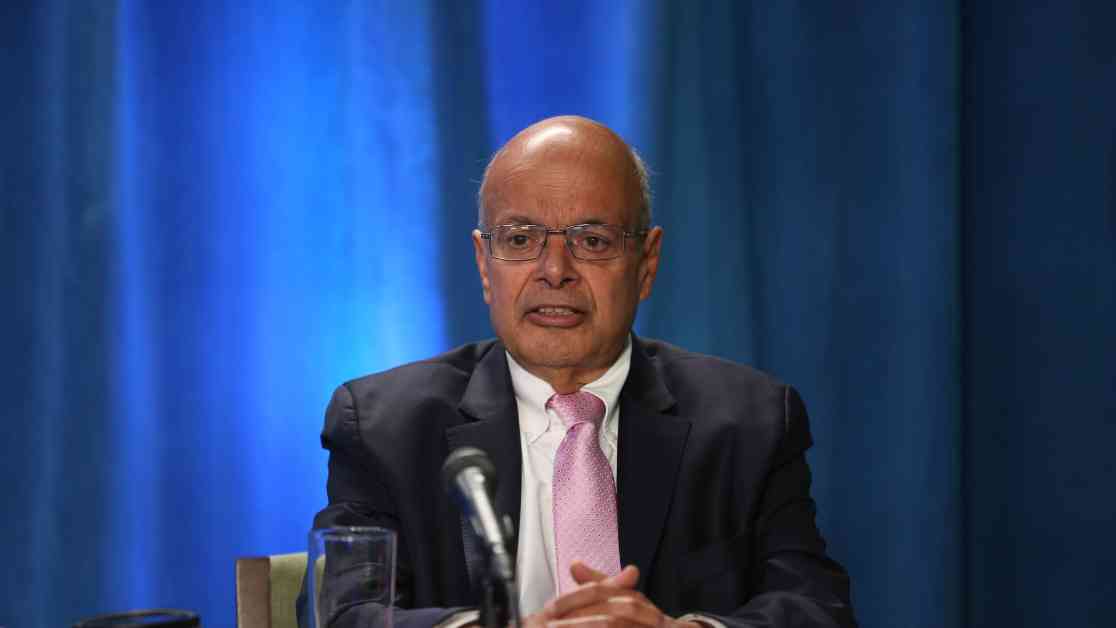

Ajit Jain, a 73-year-old vice chairman of insurance operations, has been a trusted lieutenant of Warren Buffett since he joined Berkshire Hathaway in 1986. Over the years, Jain has played a pivotal role in shaping the company’s insurance business and driving its overall growth. His expertise and strategic acumen have been instrumental in Berkshire’s unmatched success in the insurance industry.

Jain’s decision to sell over half of his stake in Berkshire Hathaway came as a surprise to many investors and analysts. The sale, which amounted to 200 shares of Berkshire Class A shares at an average price of $695,418 per share, raised approximately $139 million. This move left Jain with just 61 shares in the company, with the remaining shares held by family trusts and his nonprofit corporation, the Jain Foundation.

Analysis of the Sale

While the exact reasons behind Jain’s decision to sell a significant portion of his stake in Berkshire are not clear, some experts believe that it may be a signal that he views the company as being fully valued. Berkshire’s recent high price, with the conglomerate trading above $700,000 and hitting a $1 trillion market capitalization, may have influenced Jain’s decision to cash in on his holdings.

David Kass, a finance professor at the University of Maryland’s Robert H. Smith School of Business, noted that Jain’s sale is consistent with a significant slowdown in Berkshire’s share buyback activity. The company repurchased just $345 million worth of its own stock in the second quarter, a significant decline from the previous quarters. This slowdown in buyback activity may indicate that Berkshire’s management believes the stock is not undervalued at current levels.

Bill Stone, CIO at Glenview Trust Co. and a Berkshire shareholder, echoed this sentiment, stating that Berkshire’s stock is likely trading around Buffett’s conservative estimate of intrinsic value. At over 1.6 times book value, the stock may not be considered cheap, which could have influenced Jain’s decision to sell a portion of his stake.

Jain’s Contributions to Berkshire

Despite the recent sale of his stake, Ajit Jain’s contributions to Berkshire Hathaway over the past four decades cannot be understated. Jain has been instrumental in driving the company’s success in the insurance industry, facilitating its entry into reinsurance and leading a turnaround at Geico, Berkshire’s auto insurance business.

In 2018, Jain was named vice chairman of insurance operations and appointed to Berkshire’s board of directors, a testament to his importance within the company. Warren Buffett himself has praised Jain’s contributions, stating in his annual letter in 2017 that Jain has created tens of billions of value for Berkshire shareholders.

Jain’s leadership and expertise have been key factors in Berkshire’s consistent growth and profitability over the years. His deep understanding of the insurance business and his strategic vision have helped Berkshire navigate challenges and capitalize on opportunities in the industry.

Speculation and Future Outlook

Before it was announced that Greg Abel, Berkshire’s vice chairman of noninsurance operations, would eventually succeed Warren Buffett as CEO, there were rumors that Jain could one day lead the conglomerate. However, Buffett recently clarified that Jain had never expressed interest in running Berkshire and that there was no competition between the two executives.

The recent sale of Jain’s stake in Berkshire Hathaway has sparked speculation about the company’s future direction and leadership succession. While Jain’s decision to reduce his holdings may be seen as a signal of Berkshire’s valuation, it is important to note that Jain remains a key executive within the company and continues to play a critical role in its operations.

As Berkshire Hathaway continues to navigate the challenges of a changing business landscape, the company’s leadership team, including Jain, will be crucial in driving its future growth and success. Investors will be closely watching how Berkshire adapts to evolving market conditions and capitalizes on new opportunities under the guidance of its experienced executives.

In conclusion, Ajit Jain’s recent sale of over half of his stake in Berkshire Hathaway has raised questions and speculation about the company’s valuation and future direction. While the exact reasons behind Jain’s decision remain unclear, his contributions to Berkshire’s success over the past 40 years are undeniable. As one of Warren Buffett’s most trusted lieutenants, Jain’s leadership and strategic vision will continue to play a key role in shaping Berkshire’s future trajectory.