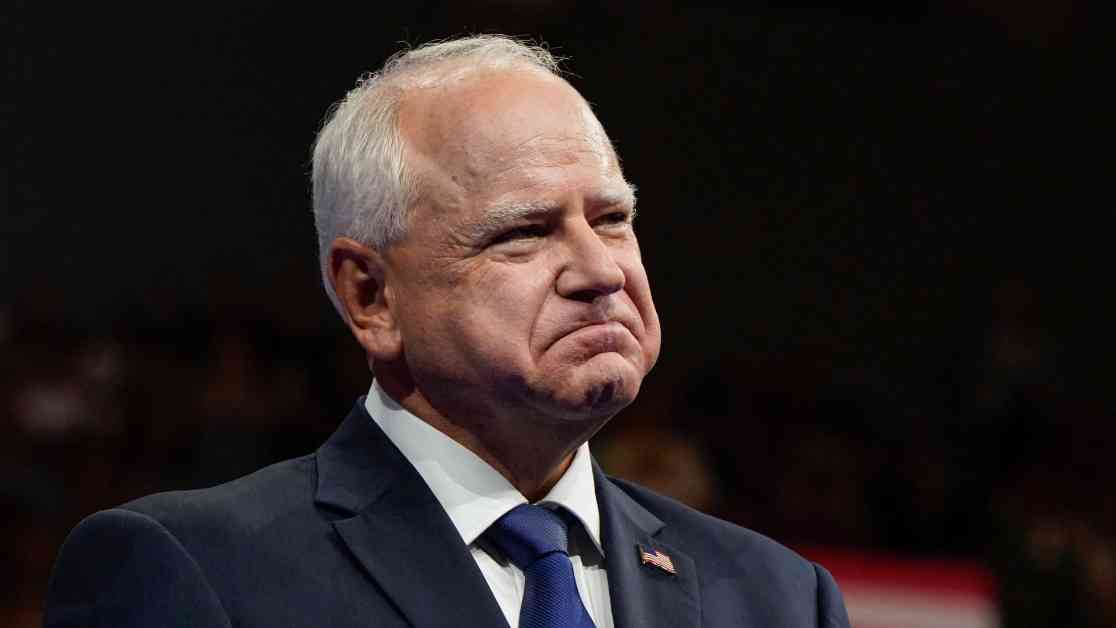

Tim Walz and Trump’s Social Security Tax Proposals: A Detailed Comparison

Minnesota Governor Tim Walz and former President Donald Trump have put forth contrasting proposals regarding Social Security taxes. These proposals have significant implications for seniors and the overall funding of the Social Security program. Let’s take a closer look at the details of each plan and how they could impact American taxpayers.

Understanding Current Social Security Taxation

Currently, federal income taxes on Social Security benefits are determined by an individual’s combined income. Combined income is calculated using adjusted gross income, non-taxable interest, and half of the Social Security benefits received. If an individual’s combined income falls between $25,000 and $34,000 (or between $32,000 and $44,000 for married couples filing jointly), up to 50% of their Social Security benefits may be subject to taxation. For those with combined income above these thresholds, up to 85% of their benefits could be taxable.

According to data from the Social Security Administration, approximately 40% of Americans who receive Social Security payments end up paying federal income tax on those benefits. This taxation has been a point of contention for many seniors who rely on Social Security as a primary source of income.

Trump’s Transformative Proposal

Richard Auxier, a principal policy associate for the Urban-Brookings Tax Policy Center, has described Trump’s proposed changes to Social Security taxation as “transformative.” Under Trump’s plan, Social Security benefits would be completely exempt from federal income tax. While this may sound appealing to retirees, the implications of such a change are far-reaching.

Estimates from the Tax Foundation suggest that Trump’s proposal could increase the budget deficit by $1.6 trillion over a 10-year period. Additionally, this policy shift could expedite the insolvency of the Social Security and Medicare trust funds. For Social Security, including disability benefits, the projected insolvency date could move up two years, from 2035 to 2033. Similarly, Medicare’s insolvency date could be pushed up by six years, from 2036 to 2030.

The potential impact of Trump’s proposal on the federal budget and the stability of these vital programs is a cause for concern. However, the Trump campaign has yet to provide a response to inquiries about the details and implications of this plan.

Minnesota’s Targeted Exemption

In contrast to Trump’s broad federal proposal, Minnesota implemented a more targeted exemption for Social Security taxes in 2023. This state-level policy expands the tax exemption for Social Security benefits, effectively eliminating taxation for most seniors in Minnesota.

Under the Minnesota policy, individuals with adjusted gross incomes below $78,000 (or $100,000 for married couples filing jointly) can deduct their Social Security benefits from their taxable earnings. This targeted exemption aligns Minnesota’s tax code with those of other states and aims to alleviate the tax burden on seniors.

Jared Walczak, vice president of state projects at the Tax Foundation, notes that Minnesota’s policy is designed to benefit seniors specifically and has a significantly lower revenue cost compared to Trump’s federal proposal. As of June 21, only nine states in the U.S. impose some level of taxation on Social Security benefits, according to research conducted by AARP.

The Differences in Impact

While both Trump and Walz have proposed changes to Social Security taxation, their approaches differ significantly in terms of scope and potential consequences. Trump’s plan to entirely exempt Social Security benefits from federal income tax could have sweeping effects on the federal budget and the solvency of Social Security and Medicare trust funds.

On the other hand, Minnesota’s targeted exemption seeks to provide relief to seniors in the state without the same level of financial impact as Trump’s proposal. The contrasting approaches highlight the complexity of balancing tax policies with the need to support vulnerable populations, such as retirees relying on Social Security benefits.

Looking Ahead: Implications for American Taxpayers

As discussions around Social Security taxation continue, it is essential for policymakers to consider the long-term implications of proposed changes. The financial stability of Social Security and Medicare programs is crucial for millions of Americans who rely on these benefits for their well-being in retirement.

By understanding the nuances of each proposal and the potential impact on taxpayers, policymakers can make informed decisions that prioritize the needs of seniors and ensure the sustainability of vital social programs. The comparison between Trump’s transformative federal proposal and Minnesota’s targeted exemption offers valuable insights into the complexities of Social Security taxation and the challenges of funding these essential programs.