Federal Reserve officials are finding themselves in a precarious position as they navigate the potential impact of President Donald Trump’s tariffs on inflation. The looming threat of broad-ranging duties on goods from Canada, Mexico, China, and possibly the European Union has sparked concerns among central bank policymakers.

Speaking at an auto symposium in Detroit, Chicago Fed President Austan Goolsbee highlighted the supply chain risks posed by escalating tariffs and the looming specter of a trade war. He emphasized the significance of distinguishing between inflation resulting from overheating and inflation stemming from tariffs, noting the critical role this distinction will play in shaping the Fed’s response.

The Federal Open Market Committee, which includes Goolsbee as a voting member, recently opted to maintain its benchmark interest rate amidst the backdrop of trade tensions between the U.S. and its key trading partners. Trump’s tariff maneuvers, such as postponing levies against Canada and Mexico while imposing tariffs on China, have further complicated the economic landscape.

While economists typically view tariffs as temporary drivers of inflation, Trump’s expansive tariff proposals have raised concerns about the potential for more enduring inflationary pressures. Boston Fed President Susan Collins underscored the challenges of assessing the wide-ranging impact of such sweeping tariffs, pointing to the uncertainties surrounding their duration and broader economic implications.

Collins emphasized the importance of monitoring underlying inflation trends and the need to consider various factors influencing policy decisions in the face of unprecedented tariff actions. Other Fed officials, including Philadelphia President Patrick Harker and Atlanta Fed’s Raphael Bostic, echoed these sentiments, expressing apprehensions about the long-term effects of tariffs on inflation.

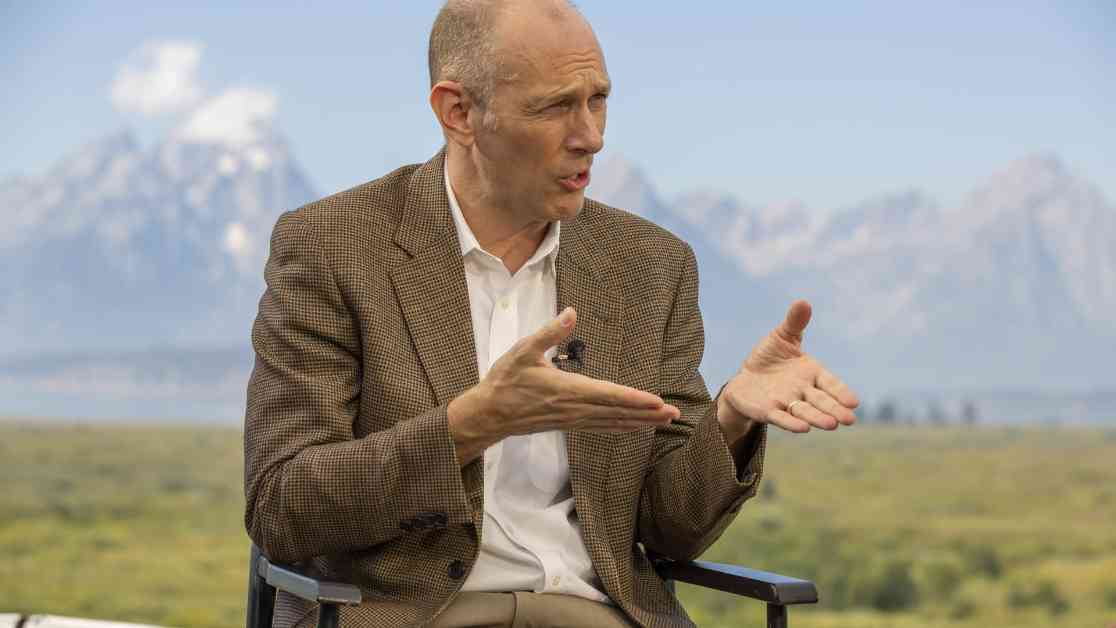

Chair Jerome Powell emphasized the need for caution in drawing conclusions about the economic implications of tariffs, underscoring the uncertainty surrounding fiscal policies and their potential impacts. Despite mounting concerns about inflationary pressures, Fed officials are treading cautiously as they await further clarity on the evolving trade dynamics.

As the Fed grapples with the complex interplay of tariffs, inflation, and monetary policy, the path forward remains shrouded in uncertainty. The delicate balance between addressing inflationary risks and supporting economic growth in the face of escalating trade tensions underscores the challenges confronting policymakers in the current economic landscape.

In the coming months, Fed officials will continue to monitor developments closely, assessing the evolving impact of tariffs on inflation and economic conditions. The intricate dance between fiscal policy, trade dynamics, and monetary policy decisions will shape the Fed’s response to the challenges posed by the uncertain tariff environment.

In the face of unprecedented trade uncertainties, the Fed’s ability to navigate the inflationary risks posed by tariffs while supporting economic stability will be put to the test. The coming months will reveal the extent to which tariffs shape the economic landscape and influence the Fed’s policy decisions, underscoring the importance of vigilance and adaptability in responding to evolving economic conditions.