Global Trade Tensions Escalate: Impacts of Trump Tariffs Unveiled

This weekend, U.S. President Donald Trump set off a seismic shift in the global economic landscape by announcing hefty tariffs on his country’s top three trading partners. The repercussions of these decisions are being felt far and wide, with investors scrambling to navigate the treacherous waters of an impending global trade war. The stakes are high, tensions are mounting, and the world is bracing for impact.

**Canada and Mexico React**

In a bold move, Canada and Mexico now face a 25% duty on their exports to the U.S., while Chinese goods will be subjected to a lower 10% levy. The response from Canada has been swift, with retaliatory tariffs of 25% imposed on $155 billion worth of U.S. goods. This tit-for-tat escalation is sending shockwaves through the international markets, leaving many industry experts and analysts on edge.

**European Union and UK in the Line of Fire**

As the dust settles on the initial tariff announcements, all eyes are now turning to the European Union, which Trump has singled out as his next target. The UK is also under consideration, adding another layer of uncertainty to an already volatile situation. While these moves were foreshadowed during Trump’s campaign, the market, according to Deutsche Bank analyst Jim Reid, had grossly underestimated the risks at play, leaving it ill-prepared for the fallout.

**Impacts on Global Sectors**

The effects of these tariffs will reverberate far beyond the U.S. and its immediate trading partners. Sectors around the world are bracing themselves for the impending storm, with each industry facing its own set of challenges and vulnerabilities. Here are some of the key areas expected to bear the brunt of the tariffs:

**Automotives: A Bumpy Ride Ahead**

The automotive industry, from car manufacturers to parts suppliers, is set to be among the hardest hit by the escalating trade tensions. Companies like Germany’s Volkswagen, which operates Mexico’s largest car factory, are facing significant earnings cuts due to the tariffs. The ripple effects of these levies were felt immediately on Monday, with European automakers taking a nosedive on the regional index.

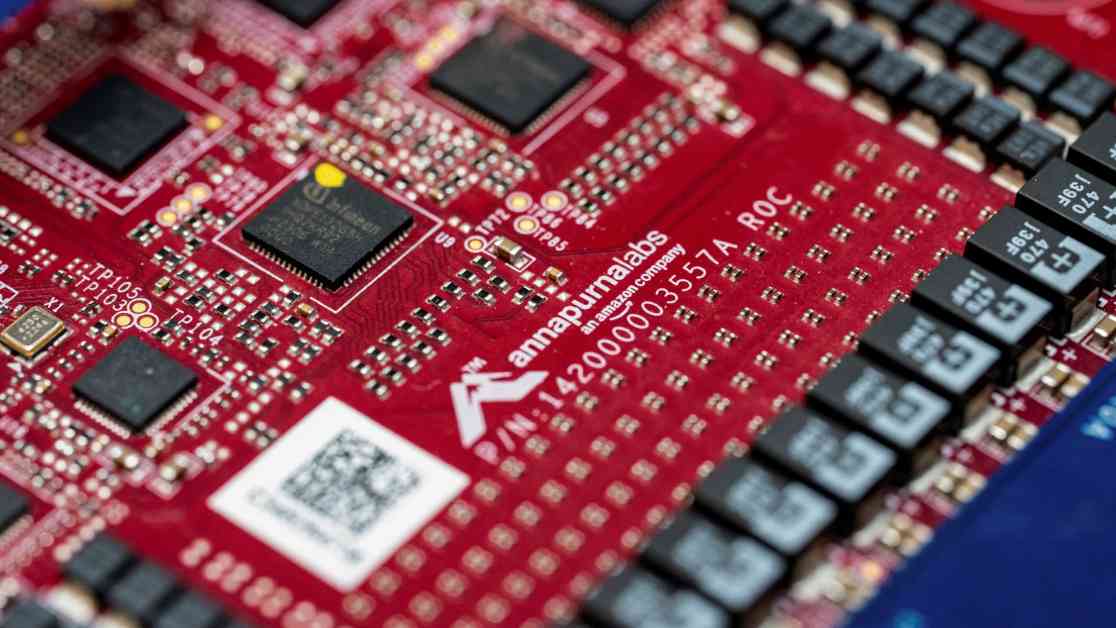

**Chip Firms: Weathering the Storm**

Makers of chips and semiconductor equipment are bracing themselves for the tariff impact, given their intricate global supply chains and the potential slowdown in demand. Companies like Taiwan Semiconductor Manufacturing Co and ASML are on high alert, as any disruptions in their operations could have far-reaching consequences for the tech industry.

**Consumer Goods: Price Hikes on the Horizon**

For consumers, the tariffs spell trouble in the form of higher prices on a wide range of household and leisure goods. From furniture to electronics, clothing, and toys, the cost of imported products is set to skyrocket. Companies like Diageo, a major drinks giant, are already feeling the pinch as they navigate the complex web of tariffs and trade restrictions.

**Conclusion**

As the global trade landscape shifts beneath our feet, the implications of Trump’s tariffs are becoming increasingly clear. From automakers to chip manufacturers, consumer goods to green energy producers, no industry is immune to the far-reaching effects of these decisions. The road ahead is uncertain, and only time will tell how the world will weather this storm. The only certainty in this tumultuous time is that the impacts of these tariffs will be felt far and wide, reshaping the global economy in ways we have yet to fully comprehend.