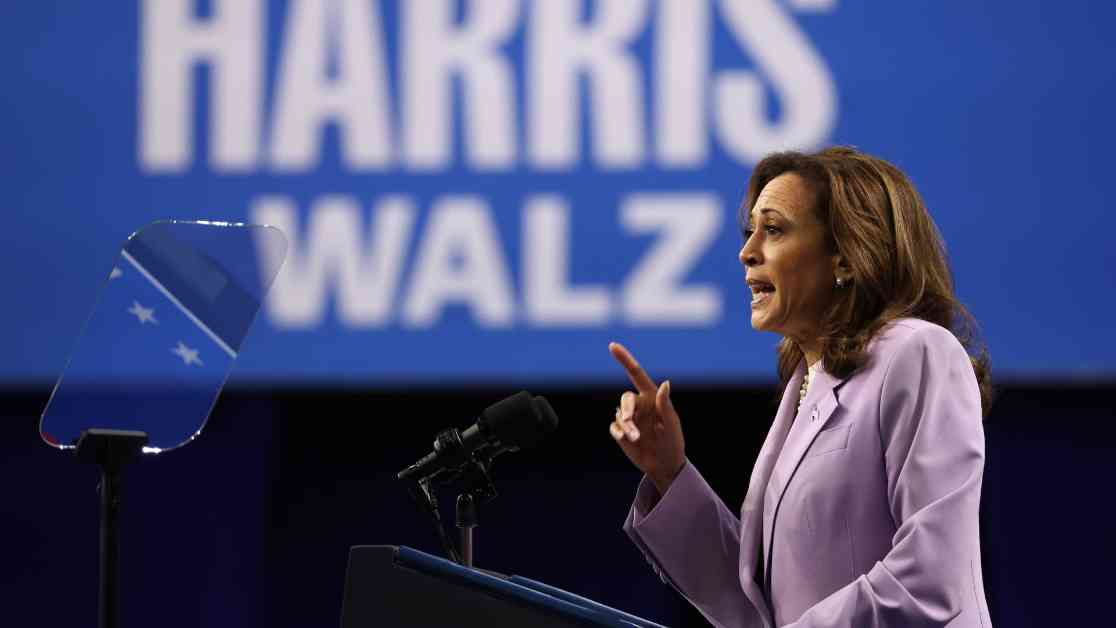

Democratic U.S. presidential candidate, Vice President Kamala Harris, recently unveiled her affordable housing proposals during a campaign rally in Las Vegas. The housing affordability challenges facing the nation have been a bipartisan concern, with experts emphasizing the need to increase supply in order to address the shortage of affordable homes. The initiatives put forth by Harris aim to incentivize home builders to construct starter homes for first-time buyers, as well as provide down-payment assistance and support for renters.

Supply-Side Solutions: Tax Breaks for Home Builders

In response to the housing affordability crisis, experts have highlighted the importance of increasing supply to meet the demand for affordable homes. Dennis Shea, executive director of the Bipartisan Policy Center’s J. Ronald Terwilliger Center for Housing Policy, emphasized the bipartisan consensus around the need to boost housing supply. Janneke Ratcliffe, vice president of the Housing Finance Policy Center at the Urban Institute, pointed out the significant decrease in new construction of single-family and multi-family homes following the foreclosure crisis, which has exacerbated the shortage of affordable housing.

To address this issue, Harris has proposed a “first-ever tax incentive” for home builders who construct starter homes sold to first-time homebuyers. This initiative would complement the Neighborhood Homes Tax Credit, which is part of the pending Neighborhood Home Investment Act. The tax credit aims to promote the creation and rehabilitation of starter homes for sale in distressed communities, with strong bipartisan support in Congress. However, some experts like Edward Pinto, senior fellow at the American Enterprise Institute’s Housing Center, have raised concerns about the effectiveness of such supply-side proposals in addressing the housing affordability crisis.

Former President Donald Trump has also emphasized the need to increase housing supply by opening up federal land for housing construction. While supply-side solutions have been proposed by both political parties, the challenges of high labor costs, land costs, and material costs make it difficult to build affordable starter homes in many markets. James Tobin, CEO of the National Association of Home Builders, highlighted the importance of defining a range of price points for starter homes, as affordability varies across different regions.

Innovation Fund and Down-Payment Assistance

Harris’ housing proposals also include a $40 billion innovation fund to empower local governments to fund housing solutions at the community level. While the intention behind the innovation fund is to support local initiatives to build housing, some experts question its effectiveness, noting the limited authority of the federal government over local planning commissions. The high cost of the innovation fund may also hinder bipartisan support in Congress, with concerns about the market’s ability to bear such a price tag.

In addition to the innovation fund, Harris has proposed providing $25,000 in down-payment assistance to first-time homebuyers who have paid rent on time for two years. The down-payment assistance aims to help more than 4 million qualifying applicants over four years, with additional support for qualifying first-generation homeowners. However, there is limited bipartisan support for such initiatives, with concerns raised by experts like Dennis Shea about the potential impact on housing demand and prices.

Sen. Tim Scott, R-S.C., expressed skepticism about Harris’ down-payment assistance program, warning that it could drive up demand without addressing the underlying supply issues. Without embedding financial literacy in such programs, there may be a higher risk of default among homebuyers. The need for a comprehensive approach to housing affordability that addresses both supply and demand concerns is crucial to ensuring sustainable solutions for first-time buyers and renters.

Legislation and Support for Renters

In addition to her proposals for first-time homebuyers, Harris has called on Congress to pass legislation aimed at addressing predatory investing in the housing market. The Stop Predatory Investing Act would remove key tax benefits for investors who own 50 or more single-family properties, curbing the influence of major investors in the rental housing market. Harris has also supported the Preventing the Algorithmic Facilitation of Rental Housing Cartels Act, which seeks to regulate companies that use algorithms to fix market rent prices.

The focus on protecting renters and promoting affordable homeownership reflects Harris’ commitment to addressing the complex challenges of the housing market. By targeting predatory practices and promoting sustainable housing solutions, Harris aims to create a more equitable and accessible housing market for all Americans. While bipartisan support for these initiatives remains a challenge, the need for comprehensive housing reform is increasingly urgent in light of the ongoing affordability crisis.

Overall, Harris’ affordable housing proposals represent a multifaceted approach to addressing the housing affordability crisis in the United States. By incentivizing home builders, providing down-payment assistance, and supporting renters, Harris seeks to create a more inclusive and sustainable housing market. While challenges remain in garnering bipartisan support and implementing these initiatives effectively, the commitment to affordable housing remains a critical priority for policymakers and advocates alike.