Bond market trading on Monday, February 10, 2025, proved to be uneventful, with minimal movement despite early excitement and consistent selling throughout the day. The day began with a surge in trading activity, followed by a period of steady selling that established a narrow range for bond prices. Despite significant trades occurring at the opening bell and a couple of hours later, little changed in overall market conditions as the day progressed. Surprisingly, even news of tariffs failed to impact bond prices significantly, although it briefly influenced foreign exchange markets.

### Expert Insights on Market Trends

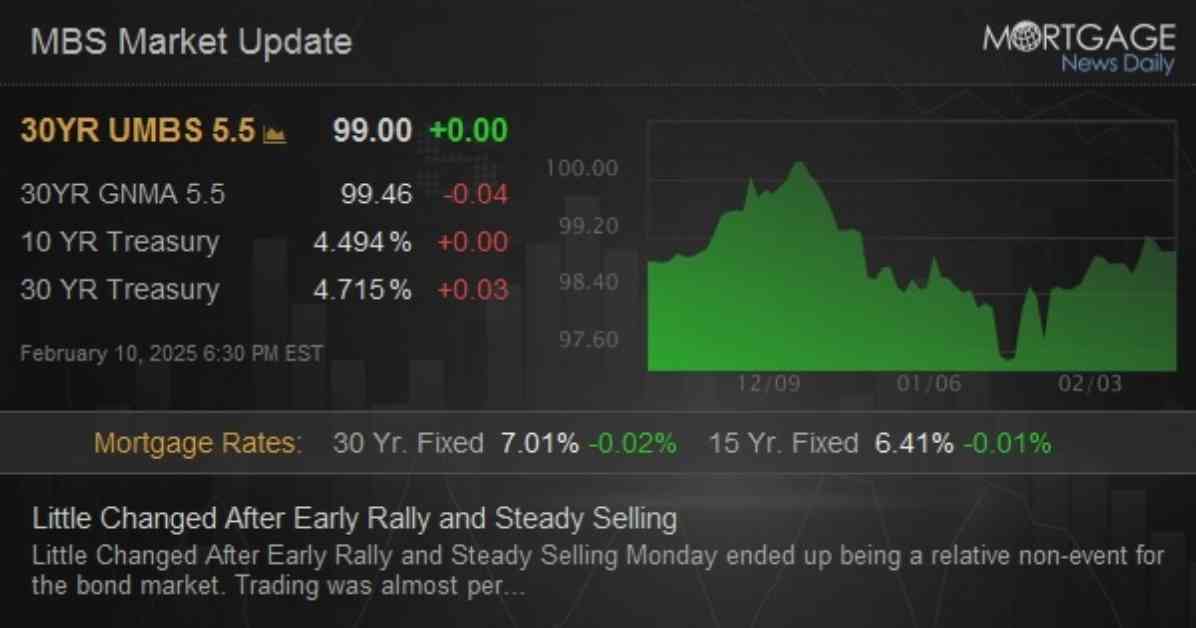

At 10:17 AM, bond prices remained flat overnight, showing a slight strengthening trend. Mortgage-backed securities (MBS) saw a modest increase of 3 ticks (.09), while the 10-year Treasury yield dropped by 2.6 basis points to 4.466, indicating a potential shift in investor sentiment towards bonds.

By 12:59 PM, the 10-year yield had decreased by a marginal 0.2 basis points to 4.49, with MBS prices returning to their initial levels. This stabilization suggested that market participants were cautious and hesitant to make significant moves, possibly due to lingering uncertainties or external factors influencing trading decisions.

### Market Closing and Analysis

As the trading day neared its end at 3:15 PM, bond prices remained relatively unchanged, hovering at their weakest levels. MBS prices remained stagnant, while the 10-year yield increased by half a basis point to 4.497. This lack of movement indicated a sense of equilibrium in the market, with buyers and sellers maintaining a delicate balance in their transactions.

Despite the day’s unremarkable performance, investors and analysts remained vigilant for any potential shifts in market dynamics that could influence future trading sessions. The overall sentiment suggested a cautious approach among market participants, highlighting the importance of staying informed and adaptable in response to changing economic conditions and geopolitical events.

### Impact of External Factors on Market Behavior

Throughout the day, the bond market exhibited resilience in the face of external stimuli, such as tariff-related news that failed to trigger significant reactions. This demonstrated the market’s ability to absorb information and maintain stability, reflecting a level-headed approach by investors amid potential uncertainties.

In conclusion, the bond market’s limited movement on Monday underscored the importance of patience and strategic decision-making in navigating fluctuating market conditions. While initial excitement and steady selling provided brief moments of activity, the overall trend remained subdued, emphasizing the need for a cautious and informed approach to trading in the current economic landscape. As investors reflect on the day’s events, they are reminded of the dynamic nature of financial markets and the importance of adaptability in pursuing long-term investment success.