Mortgage Rates Hold Steady Following Minimal Increase

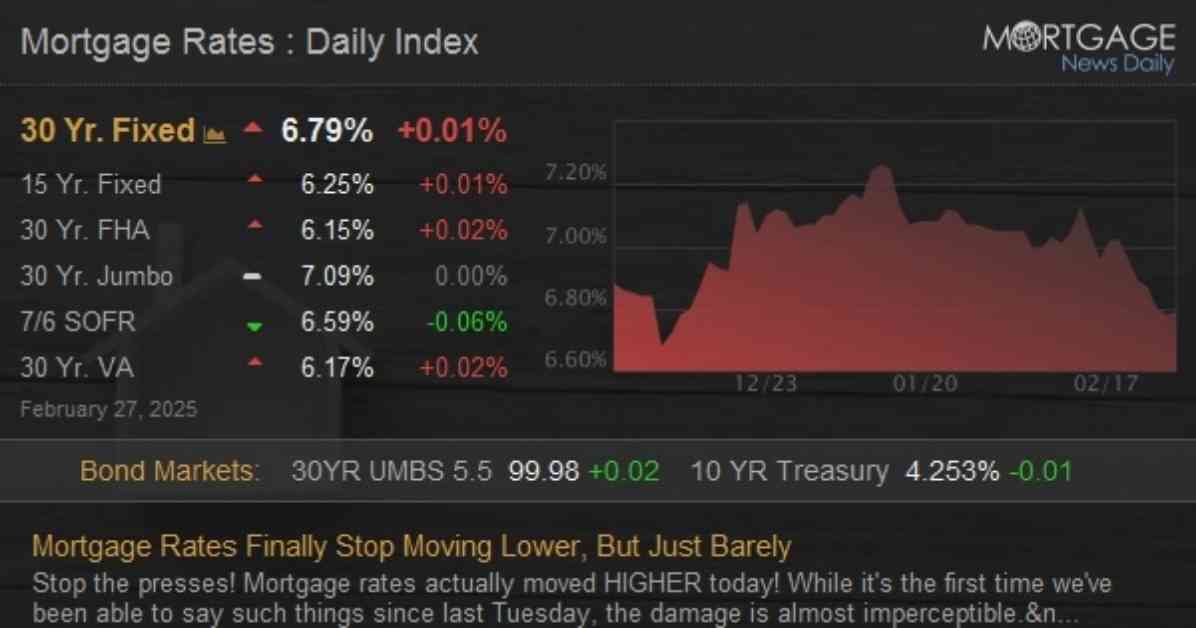

In a surprising turn of events, mortgage rates have inched higher today, marking the end of a recent downward trend. Although the rise is barely noticeable, it is the first time in over a week that rates have not declined. When comparing today’s rates to yesterday morning’s, they remain relatively unchanged, with only a slight decrease. However, rates appear slightly worse when compared to the slightly lower rates observed after yesterday’s mid-day adjustments.

Lenders typically set mortgage rates once daily, with the hope that the bond market remains stable enough to avoid mid-day repricing. The extent of the bond market’s movement influences lenders’ decisions to make such adjustments. Today, the bond market experienced only modest weakening, resulting in minimal fluctuations in mortgage rates. Consequently, today’s rates remain among the lowest seen since early December.

Looking ahead, tomorrow presents the best opportunity this week for potential volatility in rates. The release of the PCE Price Index for January at 8:30 AM ET is anticipated to have a significant impact. This report is considered the most crucial economic indicator of the week. Traders have been closely monitoring inflation reports over the past two weeks, with recent data suggesting that the PCE Price Index may outperform its counterparts.

For those seeking clarity, here’s a breakdown of the situation:

Understanding the Inflation Indices:

The Consumer Price Index (CPI) and Producer Price Index (PPI) are two other inflation indices released two weeks before the PCE Price Index. While these indices provide more timely data, they are not as comprehensive in terms of the information they cover. Traders have been analyzing these reports to predict the outcome of the PCE Price Index. Based on their assessments, there is an expectation that the PCE Price Index will portray a slightly more favorable inflation outlook. This anticipation has contributed to the recent decline in rates despite higher inflation numbers.

It’s natural to wonder whether the market has already factored in the positive implications of tomorrow’s data. The reality is that the market cannot predict the future with absolute certainty. There are equal chances of rates moving up or down following the release of the data. Nevertheless, it is plausible that any adverse surprises in tomorrow’s report could have a more significant negative impact on rates than any positive surprises would have.

As we await the unveiling of the PCE Price Index tomorrow, the mortgage market remains poised for potential fluctuations. It’s a waiting game that keeps both lenders and borrowers on their toes, with the outcome hanging in the balance.