Federal appellate judges have recently ruled that President Biden’s student loan repayment plan can continue to operate as legal challenges to the program make their way through the courts. This decision comes after a saga of legal battles that began last week when two federal judges temporarily suspended parts of the plan known as SAVE. The SAVE program, which has around eight million enrollees, links borrowers’ monthly payment amounts to their income and household size, aiming to provide relief to those burdened by student debt.

### Biden’s Student Loan Repayment Plan: The Key Focus

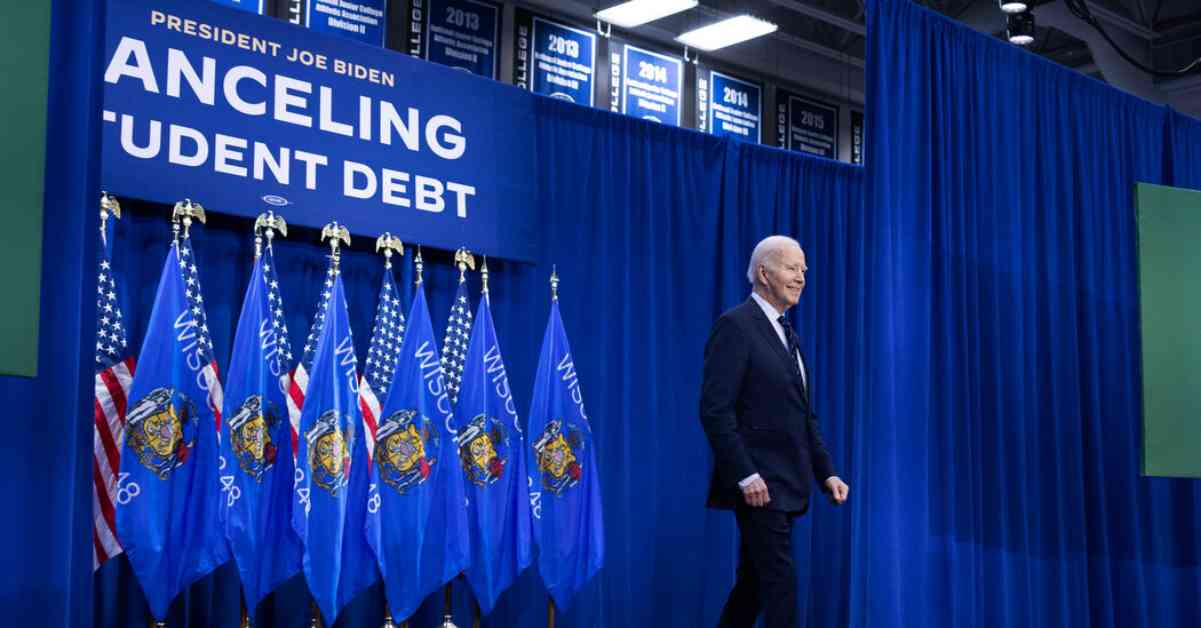

President Biden has been vocal about his administration’s efforts to address the issue of student loan debt. His student loan repayment plan includes significant components that aim to ease the financial burden on borrowers. One of the key features of the plan is the reduction in monthly payments for certain borrowers by as much as half. This benefit, which had previously been scheduled but blocked, is now set to be implemented following the recent ruling by the U.S. Court of Appeals for the 10th Circuit in Denver.

### Legal Challenges and Temporary Injunctions

The SAVE program faced legal challenges from two groups of Republican-led states, leading to preliminary injunctions issued by federal judges in Kansas and Missouri. These injunctions temporarily suspended parts of the program that were set to go into effect, causing uncertainty among borrowers who were expecting relief. The Kansas injunction, for example, halted a significant decrease in monthly payments for individuals with undergraduate debt, while the Missouri ruling blocked new debt cancellation through the SAVE program.

### Impact on Borrowers and the Education Department

The legal battles surrounding the SAVE program have created confusion and concern among borrowers who were counting on the promised reductions in their monthly payments. The Education Department has been working to navigate these challenges, pausing monthly bills for affected borrowers and reconfiguring payment amounts as necessary. More than four million low-income borrowers qualify for $0 monthly payments under the program, highlighting the importance of resolving these legal issues swiftly to ensure that relief reaches those who need it most.

### Appeals Court Decision and Next Steps

With the recent decision by the appeals court to temporarily lift the Kansas injunction, the Biden administration can now proceed with rolling out the rest of the SAVE program. This includes the much-anticipated reduction in payments for undergraduate borrowers, a move that is expected to provide significant financial relief to many individuals struggling with student debt. While the legal battles are far from over, this latest development offers a glimmer of hope for borrowers who have been eagerly awaiting the implementation of the repayment plan.

In conclusion, the Biden administration’s student loan repayment plan has faced legal challenges and temporary injunctions, causing uncertainty among borrowers. However, the recent decision by the appeals court to allow the program to continue operating is a positive step towards providing much-needed relief to individuals burdened by student debt. As the administration moves forward with implementing the SAVE program, it is crucial to ensure that the benefits reach those who need them most, and that efforts to address the student loan crisis are carried out effectively and efficiently.