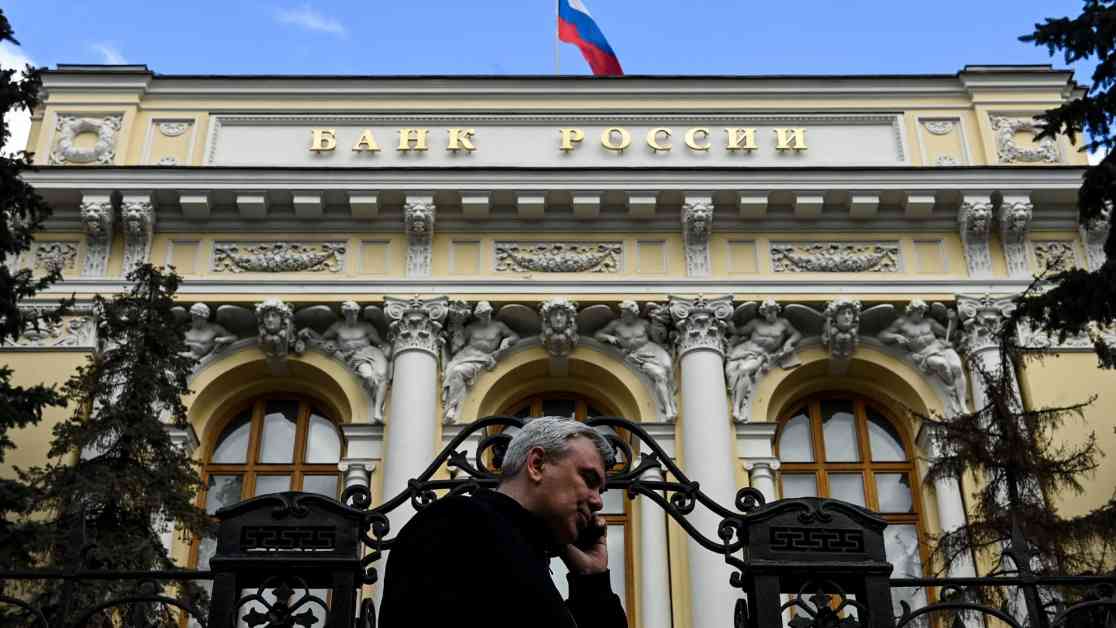

Russian Central Bank Keeps Key Rate at 21% Amid Inflation Concerns

In a surprising move, the Russian central bank decided to maintain its key interest rate at 21%, despite expectations of a potential hike. This decision marks the third time since late February that the bank has refrained from changing the rate, citing reasons such as cooling inflation and a recovering ruble.

Market Expectations vs. Central Bank Decision

Market analysts had anticipated a 200 basis point increase in interest rates, given the ongoing efforts to combat soaring inflation fueled by the aftermath of the Ukraine invasion and Western sanctions. However, the bank justified its decision by highlighting the effectiveness of the existing monetary policies in curbing inflation and stabilizing the economy.

President Putin’s Perspective on Inflation and Economic Growth

During a recent Q&A session with Russian citizens, President Vladimir Putin acknowledged the challenges posed by high inflation rates but remained optimistic about achieving a growth rate of 3.9%-4% this year. He emphasized the importance of real wage growth and increased disposable income as positive indicators amidst the economic challenges faced by the nation.

IMF Forecast and Economic Outlook

Contrary to Putin’s projections, the International Monetary Fund (IMF) predicts a more modest growth rate of 3.6% for Russia in the current year, followed by a significant slowdown to 1.3% in 2025. The IMF attributes this deceleration to reduced labor market tightness, slowing wage growth, and an overall cooling of private consumption and investment activities.

As the Russian economy grapples with the impact of capacity constraints and overheating, the IMF underscores the crucial role of monetary policy in managing inflation and sustaining long-term economic stability. With inflation rates hovering around 9.5% and persistent pressures on household and business sectors, the central bank’s decision to maintain the key rate signals a cautious approach towards balancing growth objectives and price stability.

The future trajectory of Russia’s economy remains uncertain, with a delicate balance between addressing immediate inflation concerns and fostering sustainable economic growth. The central bank’s upcoming meeting in February will provide further insights into the evolving monetary policies and their implications for the broader economic landscape.