**Stable Mortgage Rates: Predictions for the Future**

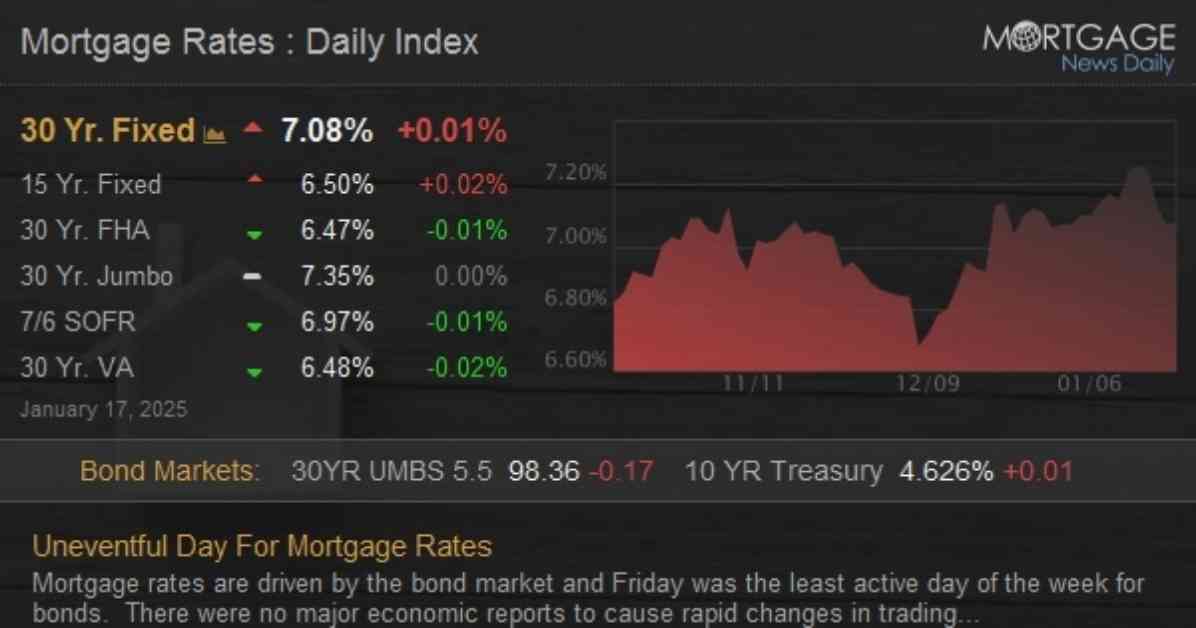

Mortgage rates remained stable on Friday due to limited activity in the bond market, with no major economic reports causing significant fluctuations. This allowed rates to stay consistent with the previous day, with most lenders refraining from making any sudden changes. While this lack of movement may seem uneventful, it marks a positive outcome considering the recent progress made in the past two days, which saw the best improvement since November.

**The Ups and Downs of Mortgage Rates**

Despite this short-term victory, the beginning of the week saw rates at their highest levels since May 2024. Typically, larger gains are expected when rates are rebounding from long-term highs, which slightly diminishes the significance of the recent stability. However, the overall lack of drastic changes can be seen as a positive sign for homeowners and potential buyers alike.

**Looking Ahead: Potential Market Activity**

With bonds closed for the holiday on Monday, Tuesday presents the possibility of increased market activity in response to political news. The uncertainty surrounding this potential activity makes it difficult to predict whether it will have a positive or negative impact on rates. As the market remains unpredictable, it’s essential for those in the housing market to stay informed and be prepared for any potential changes that may arise.

**Navigating the Mortgage Market with Confidence**

In a constantly fluctuating market, staying informed and being proactive is key to making informed decisions about mortgage rates. Whether you are a current homeowner looking to refinance or a prospective buyer searching for the best rates, understanding the factors that influence mortgage rates can help you navigate the market with confidence.

**Conclusion: Stability in an Unpredictable Market**

While stability in mortgage rates may not always make headlines, it provides a sense of reassurance for those navigating the housing market. As we look towards the future, it’s important to remain vigilant and adaptable in the face of potential changes that could impact mortgage rates. By staying informed and prepared, homeowners and buyers can make informed decisions that align with their financial goals and aspirations.