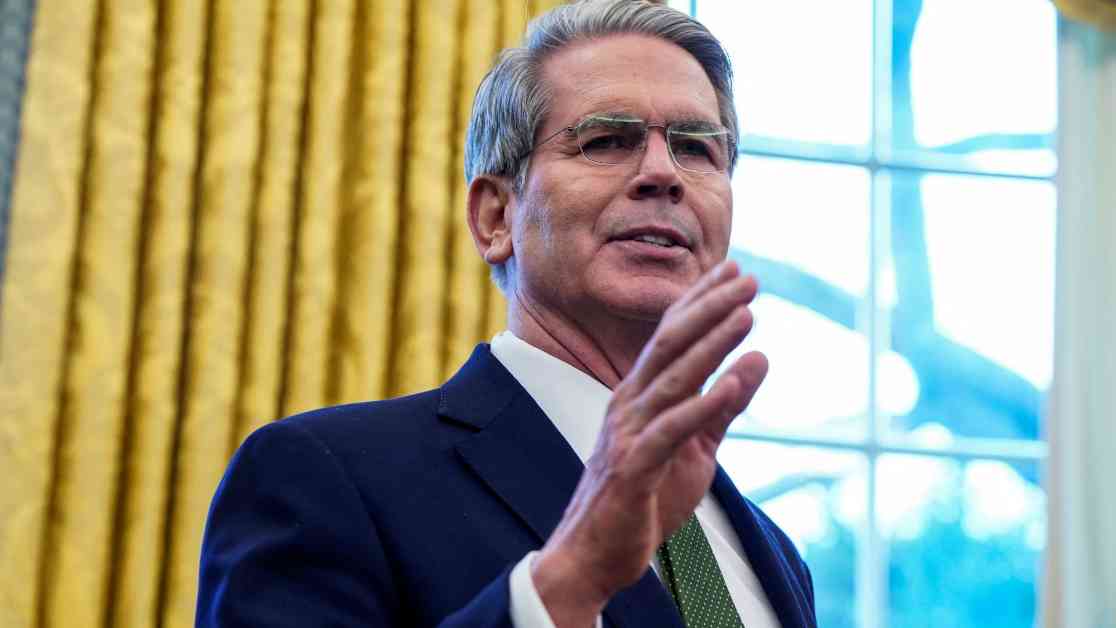

The Trump administration, led by U.S. Secretary of the Treasury Scott Bessent, is shifting its focus from pressuring the Federal Reserve to cut rates to a strategy centered around maintaining low Treasury yields. In an interview with Fox Business host Larry Kudlow, Bessent emphasized that the administration’s primary concern is the 10-year Treasury benchmark rate rather than the federal funds rate controlled by the central bank.

Shifting Strategies: A Focus on Treasury Yields

While President Donald Trump has previously urged the Fed to reduce its benchmark rate, the current approach involves leveraging fiscal policy to keep rates low. This adjustment in strategy marks a departure from past demands for rate cuts. Bessent clarified that the emphasis is now on monitoring the 10-year Treasury yield as a key indicator of economic performance. This shift in focus signifies a new direction in economic policy, with a greater emphasis on long-term stability.

The 10-year Treasury yield, a crucial benchmark influencing various interest rates such as car loans, mortgages, and credit cards, has experienced fluctuations in reaction to the Fed’s rate cuts. Despite the rate reductions initiated by the Fed, Treasury yields have seen an increase, leading to a rise in market-based indicators of inflation expectations. However, the administration’s targeted approach to managing the 10-year Treasury has resulted in a downward trajectory in yields, reflecting a measured and deliberate strategy.

Expert Insights and Market Trends

Analysts have weighed in on the administration’s focus on maintaining low Treasury yields, highlighting the potential implications for the broader economy. Krishna Guha, head of global policy and central bank strategy at Evercore ISI, noted that the administration’s goal of curbing Treasury yields aligns with broader economic objectives. By preventing the 10-year yield from exceeding a critical threshold of 5 percent, the administration aims to sustain economic stability and growth. Guha’s analysis underscores the interconnected nature of bond yields, equity markets, and other rate-sensitive sectors, emphasizing the importance of maintaining equilibrium in interest rates.

The recent market trends reveal a nuanced picture of economic policy under the Trump administration. While initial calls for lower interest rates set a precedent for Fed intervention, recent statements from the president indicate a shift towards a more balanced approach. Trump’s endorsement of the Fed’s decision to maintain the funds rate, coupled with Bessent’s strategic emphasis on fiscal measures, signals a collaborative effort to navigate economic challenges. This alignment of policy objectives and market dynamics offers a glimpse into the evolving landscape of economic governance and financial stability.

As the administration continues to pursue its economic agenda, including efforts to make the Tax Cuts and Jobs Act permanent, promote energy exploration, and reduce deficits, the focus on Treasury yields remains a central tenet of its strategy. By prioritizing fiscal policies aimed at sustaining low rates, the administration seeks to create a conducive environment for economic growth and stability. The interplay between regulatory initiatives, tax reforms, and energy policies underscores the complexity of economic governance and the multifaceted approach required to address contemporary challenges.

In conclusion, the Trump administration’s strategic shift towards managing Treasury yields reflects a nuanced approach to economic policy. By prioritizing fiscal levers over monetary interventions, the administration aims to promote stability and growth in a dynamic economic landscape. The emphasis on the 10-year Treasury benchmark underscores a commitment to long-term economic sustainability and prudent governance. As market trends and expert analyses converge, the administration’s economic strategy takes shape, navigating the complexities of contemporary economic challenges with resilience and foresight.