U.S. Mortgage Rates Plunge, 30-Year at 6.47%: What It Means for Homebuyers

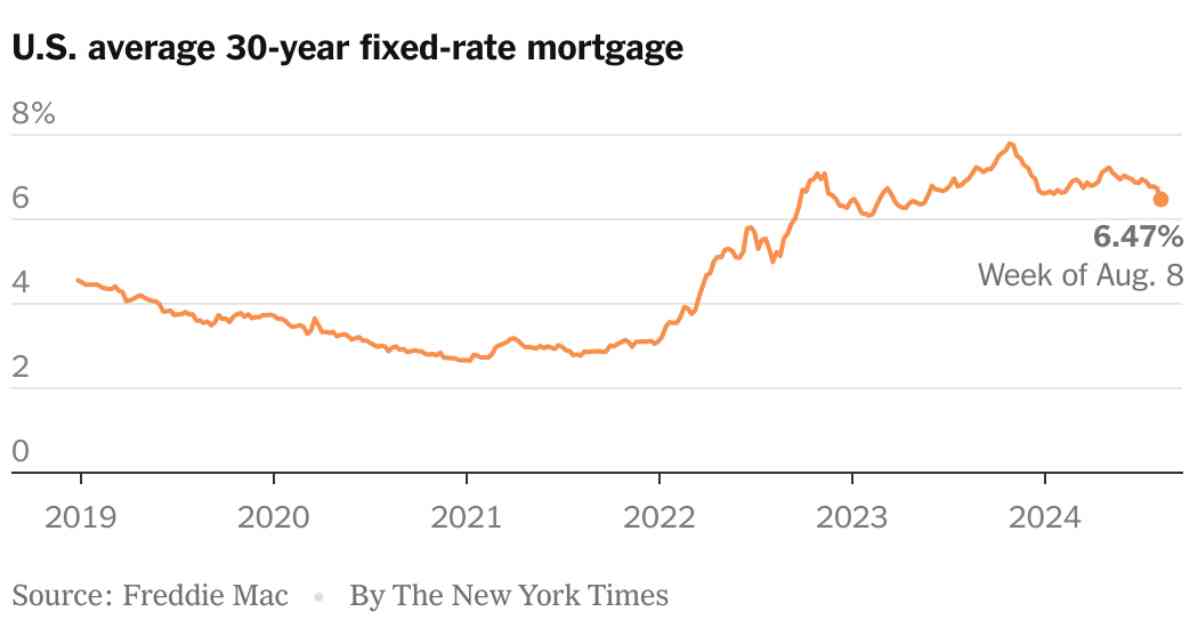

The U.S. housing market has seen a significant shift in mortgage rates recently, with the average 30-year fixed-rate mortgage dropping to 6.47%. This marks the lowest level in 15 months and the biggest one-week decline of the year. The decrease in mortgage rates has brought relief to both prospective home buyers and sellers in a challenging real estate market, offering new opportunities and possibilities for those looking to enter the housing market.

Impact on Homebuyers and Sellers

The average rate on 30-year mortgages has been steadily decreasing since April, when it rose above 7%. This decline in rates has provided much-needed relief for buyers who may have been hesitant to enter the market due to high borrowing costs. Additionally, potential sellers who have been holding off on listing their homes due to lower rates on their existing loans now have the opportunity to reconsider their options.

Sam Khater, Freddie Mac’s chief economist, emphasized the positive impact of the decline in mortgage rates, stating that it increases prospective home buyers’ purchasing power and should spark their interest in making a move. This shift in rates could also encourage existing homeowners to refinance, as reflected in the increase in market mortgage applications for refinancing, which is at its highest level in over two years.

Federal Reserve’s Role

The Federal Reserve’s decision to raise its benchmark rate to combat inflation earlier this year led to the increase in mortgage rates, reaching levels not seen in two decades. However, as the Fed is expected to start lowering interest rates in September after holding them steady at 5.3% for the past year, investors are anticipating a half-percentage point cut in the initial rate reduction.

While the Fed’s benchmark rate and mortgage rates are not directly linked, a rate cut by the Fed could indirectly put additional downward pressure on mortgage rates. The recent drop in mortgage rates can also be attributed to the decline in the 10-year U.S. Treasury yield, which influences borrowing costs and decreased following a weaker-than-expected jobs report.

Impact on Housing Market

Despite the positive shift in mortgage rates, the housing market has shown signs of continued sluggishness. Sales of existing homes slipped 5.4% in June compared to the previous year, indicating a slowdown in market activity. Homes have been sitting on the market longer, and sellers are receiving fewer offers, reflecting the challenges faced by the real estate industry.

Julia Fonseca, an assistant professor of finance at the University of Illinois at Urbana-Champaign, noted that the lower mortgage rates could incentivize some homeowners to enter the market. However, she highlighted that as of March, nearly 60% of mortgage holders had rates of 4% or less, indicating that there is still a significant gap between current borrowing costs and existing rates.

Future Outlook

While the recent drop in mortgage rates is a positive development for the housing market, there is still room for improvement. Danielle Kaye, a business reporter and 2024 David Carr Fellow, emphasized the importance of lowering borrowing costs and reducing lock-in rates to stimulate market activity further. The gradual decrease in mortgage rates is a step in the right direction, but there is still progress to be made in aligning borrowing costs with market demands.

In conclusion, the plunge in U.S. mortgage rates, with the 30-year fixed-rate mortgage at 6.47%, represents a significant shift in the housing market. The decline in rates offers new opportunities for both homebuyers and sellers, potentially revitalizing market activity. As the Federal Reserve considers lowering interest rates, there is hope for further improvements in borrowing costs and market conditions.