As the financial markets continue to fluctuate, all eyes are on the upcoming release of Wednesday’s inflation data. With bonds experiencing losses overnight in tandem with European bonds, the local session remained relatively unchanged and uneventful. Federal Reserve Chair Jerome Powell’s recent testimony provided little new information for those following his previous appearances, leaving the stage set for the highly anticipated CPI data release.

The looming release of the Consumer Price Index (CPI) data on Wednesday has sparked a wave of anticipation and uncertainty among investors and analysts alike. The early-year inflation data has historically proven to be a challenging metric to predict accurately, adding an element of suspense to the upcoming report. While forecasts typically account for changes in the annual CPI based on older data cycling out of the calculation, the intricate nature of inflation dynamics can still catch many off guard.

In addition to the forecasting challenges, market participants are eagerly awaiting insights into whether inflation will continue its stagnation at current levels or show signs of a resurgence towards the Federal Reserve’s 2% target. The delicate balance of threading the needle between inflationary pressures and economic growth remains a critical point of interest for policymakers and market observers. Any significant indication in either direction from the CPI data release is poised to influence interest rates and market sentiment accordingly.

Market Movements and Reactions

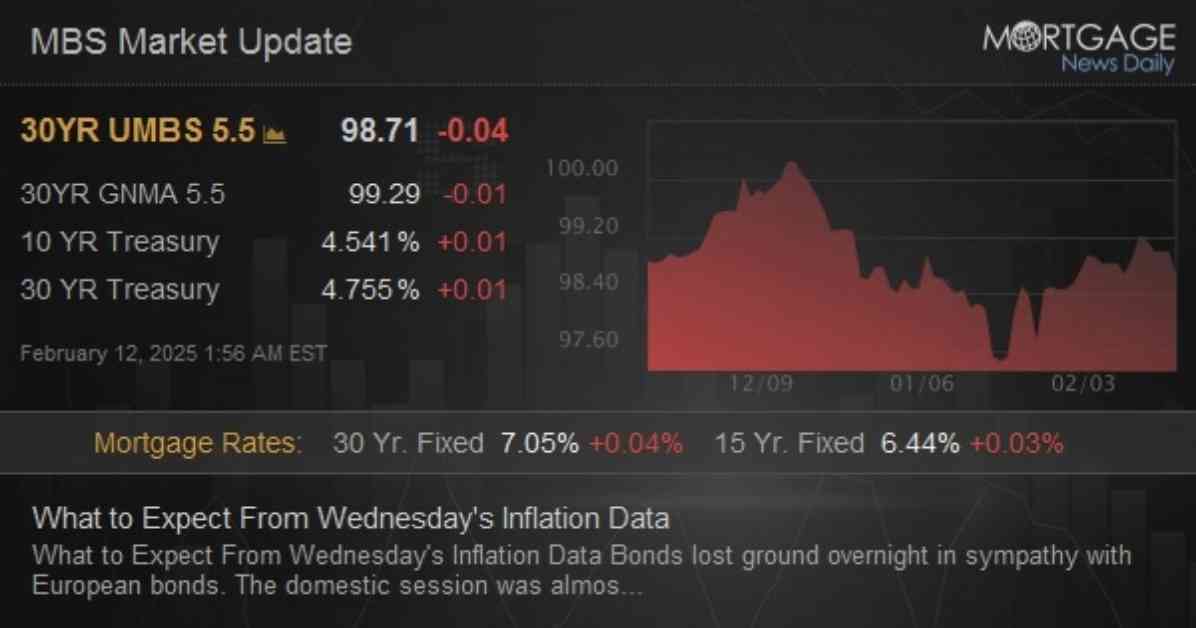

Throughout the day, market movements have been closely monitored for any signs of reaction to external stimuli or economic events. The Mortgage-Backed Securities (MBS) market experienced a slight decline of a quarter point, while the 10-year Treasury yield saw an increase of 3.7 basis points, reaching 4.531%. Despite Federal Reserve Chair Powell’s testimony and a 3-year Treasury auction, market reactions remained subdued, with MBS down slightly over a quarter point and the 10-year yield up 4.1 basis points at 4.534%. A modest rally attempt leading into the afternoon proved short-lived, as MBS fell back to a quarter point loss and the 10-year yield rose by 4.4 basis points to 4.537%.

Implications and Outlook

As the financial markets navigate the waters of uncertainty and volatility, the significance of the upcoming inflation data release cannot be understated. The implications of the CPI report extend far beyond mere numbers and statistics, shaping the trajectory of interest rates, investment strategies, and overall market sentiment. Investors and analysts alike are bracing for potential shifts in the economic landscape based on the insights gleaned from the inflation data.

In the midst of these developments, the importance of staying informed and vigilant in monitoring market movements cannot be overstated. With the potential for unexpected outcomes and market reactions, adaptability and foresight are essential qualities for navigating the ever-changing financial landscape. As we await the unveiling of Wednesday’s inflation data, the stage is set for a pivotal moment in the ongoing narrative of economic recovery and growth.

Download our mobile app to receive real-time alerts for MBS Commentary and streaming prices of MBS and Treasury securities. Stay connected with Mortgage News Daily for the latest updates and analysis on market trends and developments.