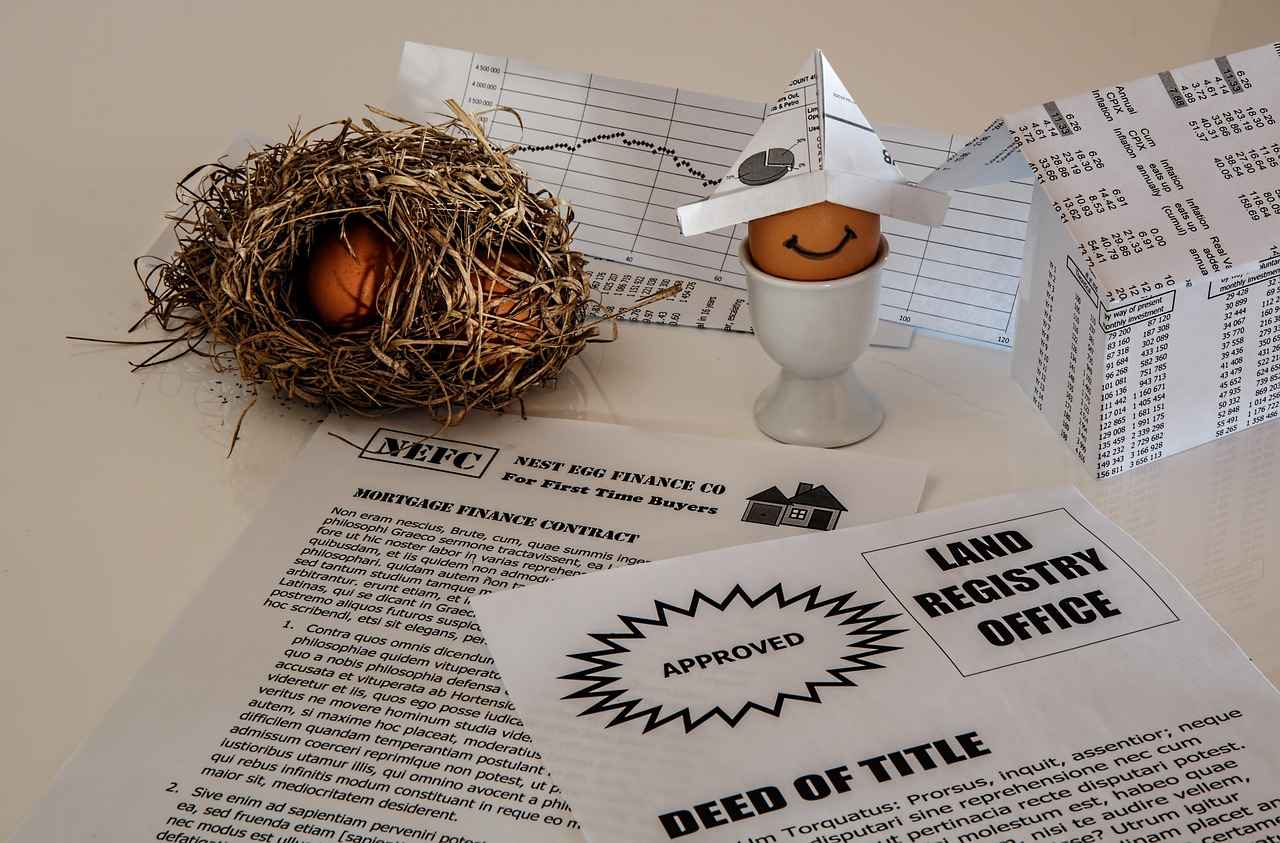

As small business owners navigate the evolving financial landscape of 2025, understanding the various SBA loan options available is crucial. The U.S. Small Business Administration (SBA) offers a range of loan programs designed to support the diverse needs of small businesses. This article will delve into the top SBA loan options, highlighting their key features, benefits, and eligibility requirements to empower you to make informed financial decisions.

Understanding SBA Loans

SBA loans are government-backed financial products aimed at providing affordable capital to small businesses. These loans are significant as they foster business growth, create jobs, and stimulate economic development. By understanding the structure and purpose of these loans, business owners can leverage them effectively.

Types of SBA Loans Available

- SBA 7(a) Loan Program: This is the most popular option, offering flexibility for various business needs. It can be used for working capital, equipment purchases, and real estate.

- SBA 504 Loan Program: Designed for purchasing fixed assets, this program offers long-term, fixed-rate financing for major capital investments.

- Microloans: Ideal for startups and small businesses, microloans provide smaller amounts of funding with fewer eligibility requirements.

SBA 7(a) Loan Program

The SBA 7(a) loan program stands out for its versatility. It offers loan amounts up to $5 million, with terms ranging from 10 to 25 years. Eligibility typically requires a solid business plan, good credit history, and a demonstration of the ability to repay the loan.

Microloans: A Flexible Option

Microloans are particularly beneficial for businesses needing smaller amounts of capital, generally up to $50,000. These loans can be used for various purposes, including inventory purchases, equipment financing, and working capital. Finding a suitable microloan lender involves researching local community organizations and non-profits that specialize in small business funding.

Choosing the Right SBA Loan for Your Business

To select the appropriate SBA loan, assess your business needs and financial situation. Key questions to consider include: What is the purpose of the loan? How much funding do you require? Consulting with a financial advisor can provide valuable insights into the best options tailored to your specific circumstances.

Understanding SBA Loans

SBA loans are a vital resource for small businesses, offering financial support through government-backed funding. Their primary purpose is to bridge the gap between traditional financing options and the specific needs of small enterprises. By understanding the significance of these loans, small business owners can leverage them to foster growth and stability.

The Small Business Administration (SBA) provides these loans to encourage entrepreneurship and economic development. Unlike conventional loans, SBA loans come with lower interest rates and longer repayment terms, making them more accessible for small business owners who may struggle to secure funding from traditional banks. This financial assistance can be crucial for startups, established businesses looking to expand, and those seeking to manage cash flow effectively.

One of the key benefits of SBA loans is their ability to support a wide range of business activities. Whether it’s purchasing equipment, acquiring real estate, or funding working capital, these loans provide the necessary capital for various operational needs. Furthermore, the government backing significantly reduces the risk for lenders, which in turn encourages them to offer loans to businesses that might otherwise be deemed too risky.

Moreover, these loans play a significant role in fostering innovation and job creation. By providing small businesses with the financial resources they need, SBA loans can stimulate local economies and contribute to a more dynamic business landscape. As small businesses grow, they create new jobs and opportunities, enhancing community development.

In summary, understanding SBA loans is essential for small business owners looking to navigate the financial landscape. These loans not only provide necessary funding but also empower entrepreneurs to pursue their visions, ultimately leading to sustainable business growth and economic progress.

Types of SBA Loans Available

When it comes to financing options for small businesses, understanding the different types of SBA loans available is crucial. The Small Business Administration (SBA) offers various loan programs, each designed to meet specific business needs and circumstances. Below, we explore the most common types of SBA loans, along with their unique features and benefits.

- SBA 7(a) Loan Program: This is the most popular SBA loan option, ideal for a variety of business purposes, including working capital, equipment purchases, and real estate acquisition. The loan amounts can reach up to $5 million, with repayment terms extending up to 25 years for real estate.

- SBA 504 Loan Program: Tailored for businesses looking to purchase fixed assets, such as real estate or large equipment, the 504 loan provides long-term financing with fixed interest rates. This program typically covers up to 90% of the project’s cost, making it a valuable option for businesses aiming to expand.

- SBA Microloan Program: Designed for startups and smaller businesses, microloans offer amounts up to $50,000. This program is particularly beneficial for entrepreneurs who may not qualify for traditional loans, as it provides a more flexible financing option.

- SBA Disaster Loans: In the event of a natural disaster, these loans are available to help businesses recover. They can cover physical damage and economic loss, providing crucial support during challenging times.

Each of these loan types serves distinct purposes and comes with specific eligibility criteria. Understanding these differences can help business owners make informed decisions that align with their financial goals and operational needs.

In summary, whether you are looking to expand your business, purchase equipment, or recover from a disaster, there is likely an SBA loan type tailored to your needs. It is essential to evaluate the features and benefits of each option to determine the best fit for your unique situation.

SBA 7(a) Loan Program

The stands out as the most popular financing option for small business owners in the United States. This program is not just a financial tool; it serves as a lifeline for many entrepreneurs looking to start or expand their businesses. In this section, we will delve into the benefits of the SBA 7(a) loan, the loan amounts available, and the eligibility requirements that potential borrowers must meet.

The primary benefit of the SBA 7(a) loan is its flexibility. These loans can be used for a variety of purposes, including purchasing inventory, acquiring real estate, and refinancing existing debt. The maximum loan amount for an SBA 7(a) loan is currently set at $5 million, making it a substantial option for small businesses that need significant funding. Additionally, the repayment terms can extend up to 25 years for real estate and 10 years for equipment and working capital, allowing businesses to manage their cash flow effectively.

Eligibility for the SBA 7(a) loan program requires businesses to meet certain criteria. To qualify, a business must be considered a small business according to SBA size standards, operate for profit, and be based in the United States. Furthermore, the business owner must have invested their own time and resources into the business, demonstrating a commitment to its success. Creditworthiness is another crucial factor, as lenders will evaluate the borrower’s credit history and financial stability.

In summary, the SBA 7(a) loan program offers numerous advantages that cater to the diverse needs of small business owners. With its flexible usage, significant loan amounts, and structured eligibility requirements, it remains a vital resource for entrepreneurs aiming to achieve their business goals.

Loan Amounts and Terms

Understanding the loan amounts and repayment terms of the SBA 7(a) program is essential for effective business planning. This program is designed to provide financial support to small businesses, allowing them to grow and thrive in a competitive market.

The SBA 7(a) loan program offers a variety of loan amounts, typically ranging from $5,000 to $5 million. This flexibility enables small business owners to secure funding that meets their specific needs, whether for purchasing equipment, expanding operations, or managing working capital. The maximum loan amount can vary based on the purpose of the loan and the applicant’s qualifications.

In addition to the loan amounts, understanding the repayment terms is crucial. SBA 7(a) loans generally have terms of up to 25 years for real estate, and up to 10 years for equipment and working capital. This extended repayment period can significantly ease the financial burden on small business owners, allowing for manageable monthly payments.

Moreover, the interest rates for SBA 7(a) loans are typically competitive, ranging from 5% to 10% , depending on the lender and the borrower’s creditworthiness. These rates are often lower than those of traditional loans, making SBA loans an attractive option for many entrepreneurs.

It’s important for business owners to carefully assess their financial situation and repayment capabilities before applying. A thorough understanding of the loan amounts and terms will aid in developing a realistic business plan and ensure that the chosen financing aligns with their long-term goals.

In summary, the SBA 7(a) program provides valuable financial resources with flexible loan amounts and favorable repayment terms, making it a vital tool for small business growth and sustainability.

Eligibility Criteria

The for the SBA 7(a) loan program can seem overwhelming at first glance. However, understanding these requirements is essential for potential borrowers looking to secure funding for their small businesses. This section aims to clarify the key factors that determine eligibility.

- Business Size: To qualify, your business must be classified as a small business according to the SBA’s size standards, which vary by industry. Generally, this means having fewer than 500 employees or meeting specific revenue thresholds.

- Business Type: The SBA 7(a) program is available for various business types, including sole proprietorships, partnerships, and corporations. However, certain businesses, such as those engaged in illegal activities or speculative ventures, are ineligible.

- Creditworthiness: A good credit score is typically required. While the SBA does not set a minimum score, most lenders look for a score of at least 650. Your credit history will be evaluated to assess your ability to repay the loan.

- Business Purpose: The funds from an SBA 7(a) loan must be used for legitimate business purposes, such as purchasing equipment, working capital, or refinancing existing debt. Lenders will scrutinize your intended use of the funds.

- Personal Guarantee: Borrowers must provide a personal guarantee, which means you are personally responsible for repaying the loan if your business fails. This requirement underscores the lender’s commitment to ensuring the loan is repaid.

In summary, while the eligibility criteria for the SBA 7(a) loan program may seem complex, breaking them down into manageable components can help potential borrowers assess their qualifications. Understanding these factors is crucial for navigating the application process successfully.

SBA 504 Loan Program

The is a vital financial resource designed specifically for small businesses looking to acquire fixed assets. This program is particularly beneficial for those who wish to invest in long-term assets such as real estate, machinery, or equipment. Understanding how this program operates and who can take advantage of it is essential for small business owners aiming for growth and stability.

One of the key features of the SBA 504 loan program is its structure, which typically involves a partnership between a certified development company (CDC) and a private lender. The CDC provides up to 40% of the total project cost through a long-term fixed-rate loan, while the private lender covers 50%. The remaining 10% is usually contributed by the borrower as a down payment. This collaborative approach makes it easier for small businesses to access the capital they need without overextending their financial resources.

Eligibility for the SBA 504 loan program is generally open to small businesses that meet the SBA’s size standards, which vary by industry. Additionally, businesses must occupy at least 51% of the property being financed and demonstrate a need for the funds to support their operations. The program is particularly advantageous for businesses looking to expand their operations, as it allows for the purchase of property that can appreciate over time.

Moreover, the benefits of the SBA 504 loan program extend beyond just financing. Business owners can enjoy lower down payments, fixed interest rates, and longer repayment terms, which can significantly improve cash flow. These features make the SBA 504 loan an attractive option for businesses aiming to invest in their future.

In summary, the SBA 504 loan program serves as an essential tool for small businesses seeking to invest in fixed assets. By understanding its structure, eligibility requirements, and benefits, business owners can make informed decisions that align with their growth strategies.

Microloans: A Flexible Option

Microloans represent a vital financing option for startups and small businesses, providing access to capital that might not be available through traditional lending channels. With amounts typically ranging from $500 to $50,000, these loans cater specifically to entrepreneurs who may lack the credit history or collateral required for larger loans. This section delves into the numerous advantages of microloans and highlights how they differ from conventional loan options.

One of the key advantages of microloans is their flexibility. Unlike traditional loans, which often come with strict guidelines on usage, microloans can be utilized for a variety of purposes, including

- Purchasing inventory

- Covering operational expenses

- Investing in marketing efforts

- Funding equipment purchases

Additionally, microloans are typically easier to obtain, as many lenders focus on the potential of the business rather than solely on the credit score of the borrower. This accessibility makes them particularly appealing for underserved communities and individuals looking to start a business with limited resources.

Moreover, microloan programs often come with lower interest rates compared to payday loans or credit cards, making them a more affordable option for small business owners. The repayment terms are also generally more manageable, allowing borrowers to pay back the loan in a way that aligns with their cash flow.

In summary, microloans serve as an essential financial tool for small businesses, offering a range of benefits that set them apart from traditional loan options. With their flexible usage, easier access, and more favorable terms, they empower entrepreneurs to realize their business dreams and foster economic growth within their communities.

Funding Limits and Uses

Microloans are an increasingly popular financing option for small businesses and startups that require flexible funding solutions. These loans typically have specific funding limits, often ranging from $500 to $50,000, making them accessible for entrepreneurs who may not qualify for larger, traditional loans. Understanding how to effectively utilize these funds can significantly impact the success of a small business.

Microloans can be used for a variety of purposes, including:

- Startup Costs: Entrepreneurs can use microloans to cover initial expenses such as inventory, equipment, or marketing.

- Working Capital: These loans can provide the necessary cash flow to manage day-to-day operations, ensuring that businesses can meet their financial obligations.

- Business Expansion: Small businesses looking to grow can use microloans to finance new locations or product lines.

- Training and Development: Investing in employee training and development can enhance productivity and service quality, making microloans a valuable resource.

It’s important for business owners to understand that while microloans offer flexibility, they also come with specific terms and conditions. Borrowers should carefully assess their needs and ensure that the intended use of the funds aligns with their business goals. For instance, using a microloan for inventory purchases may be ideal for a retail business, while a service-based company might prioritize using the funds for marketing efforts.

In summary, microloans serve as a versatile financial tool for small businesses, enabling them to address various funding needs effectively. By understanding the limits and potential uses of these loans, entrepreneurs can make informed decisions that foster growth and sustainability.

Finding a Microloan Lender

Finding the right microloan lender is a critical step for small business owners seeking financial support. With a variety of lenders available, it is essential to approach this process with care and consideration. Below are some key tips and factors to keep in mind when searching for a microloan lender.

- Research Local and Online Lenders: Start by exploring both local community lenders and online platforms. Local lenders may offer personalized service and a better understanding of the regional market, while online lenders often provide quick application processes and competitive rates.

- Evaluate Lender Reputation: Look for reviews and testimonials from previous borrowers. Websites like Better Business Bureau and Yelp can provide insights into lender reliability and customer service.

- Understand Loan Terms: Before committing, carefully review the loan terms, including interest rates, repayment schedules, and any fees. Make sure you fully understand the total cost of borrowing and how it fits into your business budget.

- Check for Flexibility: Some lenders offer flexible repayment options that can be beneficial for small businesses with fluctuating cash flows. Look for lenders that allow you to customize your repayment plan based on your business cycle.

- Assess Customer Support: Good customer service can make a significant difference in your borrowing experience. Choose a lender that is responsive and willing to answer your questions throughout the application process.

Additionally, it is advisable to consult with a financial advisor who can help you evaluate different lenders and determine which one aligns best with your business needs. By taking the time to find the right microloan lender, you can secure the funding necessary to support your business growth and success.

Choosing the Right SBA Loan for Your Business

Choosing the right SBA loan for your business is a crucial step in securing the necessary funding for growth and sustainability. With various options available, it’s essential to assess your specific needs and financial situation carefully. This section will guide you through the key considerations to help you make an informed decision.

Before diving into the loan selection process, start by evaluating your business’s unique requirements. Consider the following questions:

- What is the purpose of the loan? Determine whether you need funds for equipment, real estate, working capital, or other expenses.

- How much capital do you require? Estimate the total amount needed, including any additional costs that may arise during the loan period.

- What is your repayment capability? Analyze your current cash flow and revenue projections to ensure you can meet monthly payments.

Engaging a financial advisor can provide invaluable insights into the complexities of SBA loans. An expert can help you:

- Understand different loan types: They can explain the nuances between various SBA loans, such as 7(a), 504, and microloans.

- Evaluate your financial health: A financial advisor can assess your creditworthiness and guide you on improving it if necessary.

- Navigate the application process: They can assist you in preparing the required documentation and ensuring your application is strong.

Ultimately, selecting the right SBA loan involves a careful balance of your business’s needs and your financial situation. By taking the time to assess these factors and seeking expert advice, you can make a choice that supports your business’s growth and success.

Assessing Your Business Needs

When it comes to securing funding for your business, understanding your specific financial needs is paramount. This clarity not only simplifies the loan selection process but also ensures that you choose an option that aligns with your goals and operational requirements. Here are some critical questions to consider when assessing your business needs:

- What is the purpose of the loan? – Determine whether you need funds for expansion, equipment purchase, working capital, or another purpose. This will guide you toward the most suitable loan type.

- How much funding do you require? – Estimate the total amount needed. Be specific about your financial needs to avoid over-borrowing or under-borrowing, which can impact your business’s cash flow.

- What is your repayment capacity? – Analyze your current financial situation to understand how much you can afford to repay monthly. This includes evaluating your revenue, expenses, and existing debt obligations.

- What is your business’s credit profile? – Your credit history can significantly influence your loan options. Assess your credit score and address any issues before applying, as this will improve your chances of securing favorable terms.

- What are the potential risks? – Consider the risks associated with taking on debt. Evaluate how fluctuations in the market or changes in your business environment could affect your ability to repay the loan.

- Do you have a solid business plan? – A comprehensive business plan not only helps you clarify your financial needs but also serves as a valuable tool when presenting your case to lenders.

By thoughtfully answering these questions, you can streamline the loan selection process and ensure that you choose the right SBA loan that meets your business’s unique financial needs.

Consulting with a Financial Advisor

Engaging a financial advisor can be a transformative step for small business owners navigating the complex landscape of SBA loans. With their expertise, these professionals provide invaluable insights that can significantly enhance your chances of securing funding. This section delves into how expert guidance can streamline the application process and optimize your financial strategy.

- Tailored Financial Advice: A financial advisor can assess your unique business situation and recommend the most suitable SBA loan options. They understand the nuances of various loan programs, ensuring you apply for the one that aligns with your goals.

- Understanding Eligibility: The eligibility criteria for SBA loans can be intricate. A financial advisor can help you navigate these requirements, ensuring that you meet all necessary qualifications and avoid common pitfalls.

- Preparing Documentation: One of the most daunting aspects of applying for an SBA loan is gathering the required documentation. Advisors can guide you on what documents are essential, helping you compile a comprehensive application that meets lender expectations.

- Strategic Financial Planning: Beyond just securing a loan, financial advisors assist in developing a long-term financial strategy. This includes budgeting for loan repayments and planning for future growth, which is crucial for sustaining your business.

Moreover, the knowledge and experience of a financial advisor can help you understand the broader economic landscape. They can provide insights into market trends, interest rates, and potential risks, empowering you to make informed decisions. This holistic approach not only aids in securing funding but also positions your business for long-term success.

In summary, consulting with a financial advisor is a strategic move for small business owners looking to navigate the SBA loan landscape effectively. Their expertise can simplify the process, enhance your application, and ultimately contribute to your business’s financial health and growth.

Frequently Asked Questions

- What are SBA loans?

SBA loans are government-backed financial products designed to help small business owners access funding. They come with favorable terms and lower interest rates, making them a popular choice for entrepreneurs looking to grow their businesses.

- What types of SBA loans are available?

There are several types of SBA loans, including the SBA 7(a) loan, SBA 504 loan, and microloans. Each type serves different business needs, from general working capital to purchasing fixed assets or providing smaller amounts for startups.

- How do I determine if I am eligible for an SBA loan?

Eligibility criteria can vary by loan type, but generally, you must be a small business as defined by the SBA, operate for profit, and have a good credit history. It’s essential to review specific requirements for each loan program before applying.

- What is the maximum amount I can borrow with an SBA 7(a) loan?

The maximum loan amount for an SBA 7(a) loan is typically $5 million. However, the exact amount you can borrow depends on your business’s financial situation and needs.

- How can I find a microloan lender?

To find a microloan lender, start by researching local nonprofit organizations and community banks that specialize in small business financing. Additionally, online platforms can connect you with lenders who offer microloans tailored to your needs.