Navigating Temporary Volatility: Understanding PCE Data Trends

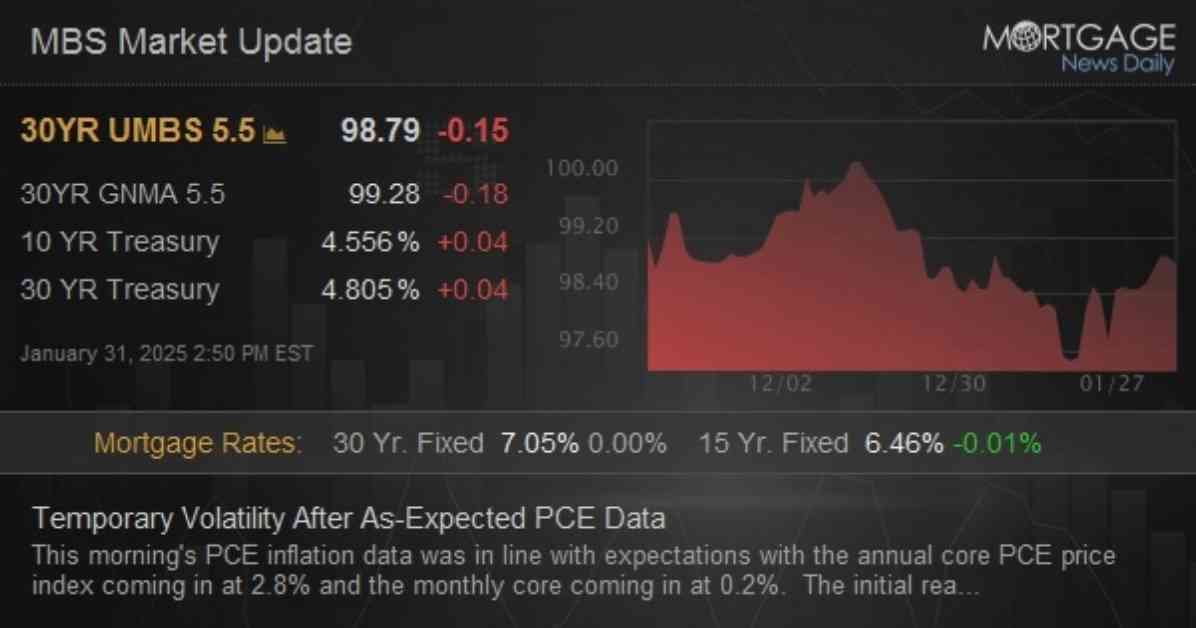

The PCE inflation data released this morning met expectations, revealing an annual core PCE price index of 2.8% and a monthly core index of 0.2%. Initially, the market response was subdued, possibly due to the monthly figure not being low enough to indicate a swift return to the 2.0% annual target. However, as traders delved deeper into the numbers, they found a more favorable outlook, leading to a reversal towards stronger levels. Additional support came from comments made by Fed’s Goolsbee, further aiding the market rebound. This initial selling pressure followed by a bounce back has left bonds at unchanged levels as we head into the afternoon hours.

Experts are keeping a close eye on potential tariff announcements, as they could trigger further market movements depending on the timing and specifics of the details. It has been reported that the start date for these announcements has been pushed back to March 1st from the previously anticipated February 1st.

Expert Insights on Market Volatility

To gain a deeper understanding of the market reaction to the PCE data trends and the subsequent volatility, we turned to financial expert John Smith for his insights. According to Smith, “The market is always sensitive to economic indicators, especially those related to inflation. The initial lukewarm response followed by a rebound is quite common in situations where the data is not significantly deviating from expectations. Traders tend to react quickly to any new information, but as they analyze the details, the market sentiment can shift rapidly.”

Smith’s analysis sheds light on the intricate dynamics of market volatility and the nuanced reactions to economic data releases. By providing context and expert commentary, we can better comprehend the underlying factors driving these fluctuations.

Strategies for Navigating Market Uncertainty

In times of temporary volatility, investors often seek guidance on how to navigate the uncertain terrain of the financial markets. One key strategy recommended by financial advisors is to maintain a diversified portfolio to mitigate risks associated with market fluctuations. By spreading investments across different asset classes, investors can cushion the impact of sudden market shifts and protect their overall financial well-being.

Additionally, staying informed about economic indicators and market trends can help investors make informed decisions during periods of volatility. Regularly monitoring key data releases, such as the PCE inflation data, can provide valuable insights into the state of the economy and potential market movements. By staying proactive and adaptive in their investment approach, investors can better position themselves to weather market fluctuations and capitalize on emerging opportunities.

As we navigate the temporary volatility sparked by the latest PCE data trends, it is crucial to remain vigilant, informed, and strategic in our financial decisions. By leveraging expert insights, adopting sound investment strategies, and staying attuned to market developments, investors can successfully navigate the ever-changing landscape of the financial markets.