This article delves into the various types of loans that consumers can apply for, providing essential information on their features, benefits, and eligibility requirements. Understanding these different options is crucial for making informed financial decisions.

- Personal Loans: Unsecured loans that can be utilized for multiple purposes, such as consolidating debt or covering unexpected expenses. Typically, they come with fixed interest rates and repayment terms, making them a convenient choice for those in need of quick cash.

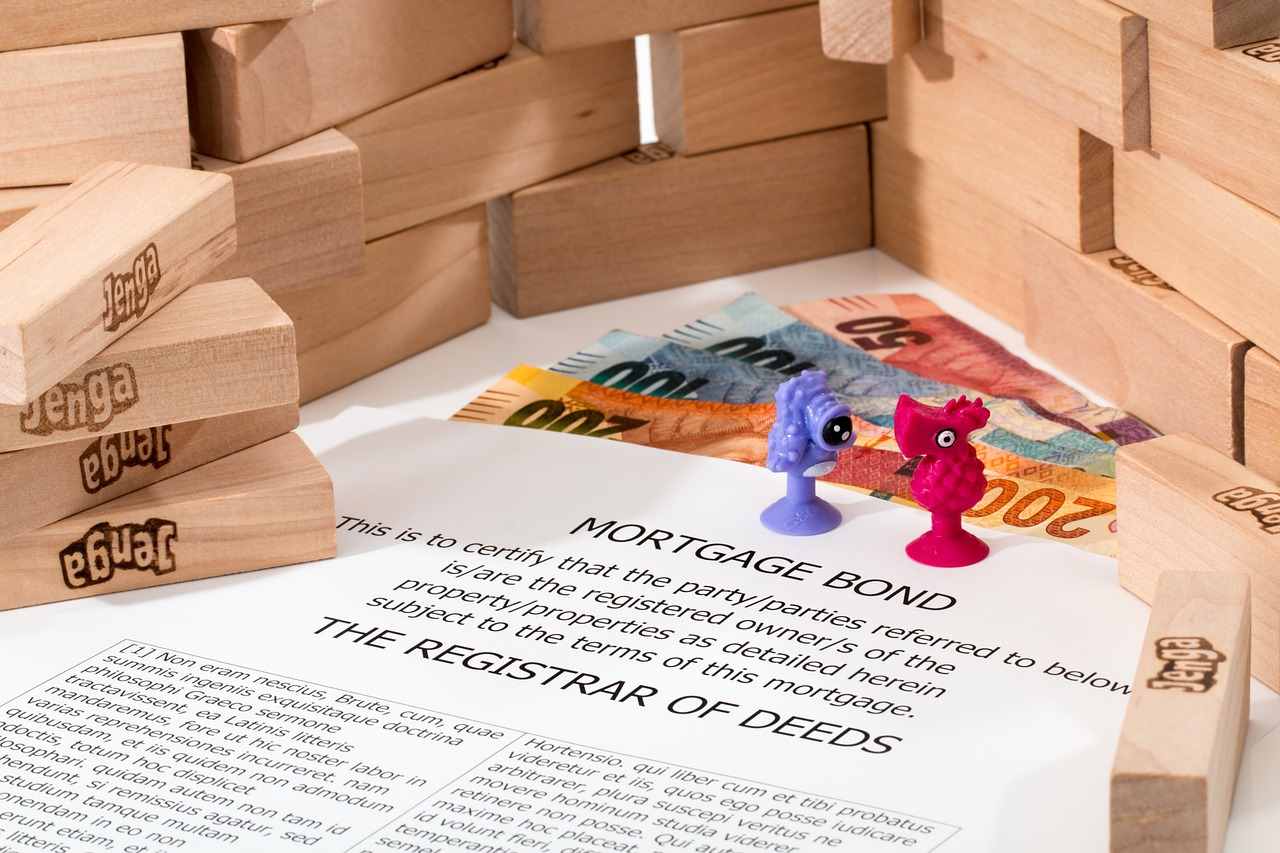

- Home Loans: Also known as mortgages, these loans are specifically tailored for purchasing real estate. They can be divided into several categories:

- Fixed-Rate Mortgages: These loans maintain a consistent interest rate throughout the term, allowing for predictable monthly payments. This stability is appealing to many homebuyers.

- Adjustable-Rate Mortgages (ARMs): Initially offer lower interest rates that can change after a specified period, which may result in fluctuating monthly payments.

- Student Loans: Designed to finance higher education, these loans are categorized into:

- Federal Student Loans: Generally feature lower interest rates and flexible repayment options, making them a preferred choice for many students.

- Private Student Loans: Offered by banks and credit unions, these loans often require a credit check and may have less favorable terms than federal options.

- Business Loans: Essential for entrepreneurs, these loans can fund various business needs, including startup costs and expansion efforts. Types include:

- SBA Loans: Backed by the Small Business Administration, these loans offer favorable terms to small businesses that may face challenges securing traditional financing.

- Term Loans: Provide a one-time lump sum that businesses repay over a set period, often used for significant investments.

- Auto Loans: Specifically designed for purchasing vehicles, these loans can be either secured or unsecured. Key considerations include:

- Secured Auto Loans: Require collateral (the vehicle itself), which can lead to lower interest rates.

- Unsecured Auto Loans: Do not require collateral, but may come with higher interest rates.

By understanding these loan types, their features, and their eligibility requirements, you can better navigate your financial options and choose the loan that best suits your needs.

Understanding Personal Loans

In today’s financial landscape, personal loans have emerged as a crucial resource for individuals seeking immediate funding without the need for collateral. These unsecured loans can be utilized for a variety of purposes, including debt consolidation, home improvements, medical expenses, or even unexpected emergencies. The flexibility offered by personal loans is one of the primary reasons they are so popular among consumers.

One of the defining features of personal loans is their fixed interest rates and repayment terms. This structure allows borrowers to have a clear understanding of their monthly payments, making budgeting easier. Typically, the loan amounts can range from a few hundred to several thousand dollars, depending on the lender’s policies and the borrower’s creditworthiness.

- Quick Access to Funds: Personal loans often have a streamlined application process, allowing for quick access to funds, sometimes within a day or two.

- No Collateral Required: As unsecured loans, they do not require any assets to back them, reducing the risk for borrowers.

- Improved Credit Score: Responsible repayment can positively impact credit scores, enhancing future borrowing capabilities.

However, it is essential to be mindful of the interest rates and fees associated with personal loans. While they can be advantageous, some lenders may impose higher rates for those with lower credit scores. Therefore, it is crucial for potential borrowers to shop around and compare different loan offers to find the most favorable terms.

In summary, personal loans provide a valuable financial tool for those in need of quick cash without the burden of collateral. By understanding their features and implications, borrowers can make informed decisions that align with their financial goals.

Exploring Home Loans

Home loans, commonly referred to as mortgages, are essential financial products specifically tailored for purchasing property. Understanding the various types of home loans available can empower buyers to make informed decisions that align with their financial goals. This section delves into the most popular mortgage types, including fixed-rate, adjustable-rate, and government-backed loans.

- Fixed-Rate Mortgages: These loans provide a stable interest rate for the entire duration of the mortgage, which typically ranges from 15 to 30 years. The predictability of monthly payments is a significant advantage, making them a popular choice for many homebuyers.

- Adjustable-Rate Mortgages (ARMs): Unlike fixed-rate mortgages, ARMs have interest rates that may change after an initial period. They often start with lower rates, which can be appealing to first-time buyers. However, borrowers should be aware of potential increases in their monthly payments.

- Government-Backed Loans: These include FHA, VA, and USDA loans, designed to assist specific groups of borrowers. For instance, FHA loans are ideal for first-time homebuyers with lower credit scores, while VA loans offer favorable terms for veterans and active military personnel.

When considering a home loan, it’s crucial to evaluate your financial situation, including your credit score, income, and long-term goals. Each loan type has its own set of eligibility requirements and benefits:

| Loan Type | Advantages | Disadvantages |

|---|---|---|

| Fixed-Rate | Stable payments, protection from interest rate hikes | Higher initial rates compared to ARMs |

| Adjustable-Rate | Lower initial payments, potential for lower overall costs | Risk of payment increases, less predictability |

| Government-Backed | Lower down payments, flexible credit requirements | Loan limits and specific eligibility criteria |

Ultimately, choosing the right home loan involves careful consideration of your financial landscape and future plans. With the right information, you can navigate the mortgage landscape and secure a loan that best fits your needs.

Fixed-Rate Mortgages

are a popular financing option for homebuyers, providing a stable and predictable monthly payment throughout the life of the loan. This consistency is particularly appealing in a fluctuating interest rate environment, allowing homeowners to manage their budgets more effectively. Unlike adjustable-rate mortgages, which can lead to variable payments over time, fixed-rate mortgages lock in an interest rate for the entire loan term, typically ranging from 15 to 30 years.

One of the key benefits of is the peace of mind they offer. Borrowers are safeguarded against potential interest rate hikes, ensuring that their monthly payments remain the same regardless of market trends. This stability is especially valuable for first-time homebuyers who may have limited experience navigating the complexities of the housing market.

Moreover, fixed-rate mortgages can make long-term financial planning much easier. Homeowners can project their housing costs with greater accuracy, allowing for better allocation of resources toward savings, investments, or other financial goals. This predictability often makes fixed-rate mortgages the preferred choice for many individuals and families.

However, it’s essential to consider the disadvantages of fixed-rate mortgages as well. Typically, the initial interest rates on these loans may be higher than those offered by adjustable-rate mortgages. This can result in higher monthly payments at the outset, which might not align with the financial situations of all borrowers. Therefore, it’s crucial to assess your long-term plans and financial stability before committing to a fixed-rate mortgage.

In summary, fixed-rate mortgages provide a reliable and stable option for home financing, making them an attractive choice for those looking to purchase a home without the uncertainty of fluctuating interest rates.

Advantages of Fixed-Rate Mortgages

Fixed-rate mortgages are a popular choice among homebuyers due to their inherent stability and predictability. One of the most significant advantages of these loans is the protection they offer against fluctuations in interest rates. This feature is particularly beneficial for borrowers who prefer to have a clear understanding of their financial commitments over the life of the loan.

With a fixed-rate mortgage, the interest rate remains constant throughout the duration of the loan. This means that homeowners can effectively budget their monthly payments without the concern of rising rates impacting their financial situation. Such predictability allows borrowers to plan for the long term, making it easier to allocate funds for other essential expenses, such as education, retirement savings, or unexpected emergencies.

Moreover, fixed-rate mortgages provide peace of mind during economic uncertainty. In times of market volatility, when interest rates may rise significantly, borrowers with fixed-rate loans can rest assured that their monthly payments will not change. This stability can be a crucial factor for families looking to maintain their current lifestyle without the stress of fluctuating mortgage costs.

Additionally, fixed-rate mortgages often come with a variety of terms, allowing borrowers to choose a repayment period that aligns with their financial goals. Whether opting for a 15, 20, or 30-year term, homeowners can select a duration that fits their budget and long-term plans.

In summary, the advantages of fixed-rate mortgages extend beyond just stable payments. They offer financial security, ease of budgeting, and peace of mind, making them an attractive option for many homebuyers navigating the complex world of real estate financing.

Disadvantages of Fixed-Rate Mortgages

When considering fixed-rate mortgages, it is essential to be aware of the potential drawbacks that may affect your financial situation. While these loans offer stability and predictability, they also come with some significant disadvantages that could impact your long-term financial health.

One of the main disadvantages is the higher initial interest rates compared to adjustable-rate mortgages (ARMs). Fixed-rate mortgages are designed to provide consistent monthly payments throughout the loan term, which can be beneficial for budgeting purposes. However, this stability often comes at a cost, as the initial rates may be considerably higher than those of ARMs, which typically start lower. This can make fixed-rate mortgages less appealing for individuals who are looking to minimize their upfront costs.

Additionally, fixed-rate mortgages may not be suitable for everyone, especially those who plan to move or refinance within a few years. If you anticipate selling your home or refinancing your mortgage shortly after purchase, locking in a higher rate may not be the most economical choice. In such cases, an ARM could offer lower initial payments, allowing you to save money during the early years of the loan.

Moreover, the interest rate environment can also play a significant role in the effectiveness of a fixed-rate mortgage. If interest rates decline after you secure your loan, you might find yourself stuck with a higher rate than what is currently available in the market. This scenario can limit your options for refinancing or obtaining a better rate, potentially leading to higher overall costs over the life of the loan.

In summary, while fixed-rate mortgages provide certain benefits, such as predictable payments and protection against rising rates, they also come with higher initial costs and may not be the best fit for everyone. It is crucial to evaluate your personal financial situation and future plans before committing to this type of mortgage.

Adjustable-Rate Mortgages

Adjustable-rate mortgages (ARMs) are unique financial products that offer borrowers an initial period of fixed interest rates, followed by variable rates that can fluctuate over time. This structure can lead to significantly lower initial payments compared to traditional fixed-rate mortgages, making ARMs an attractive option for many homebuyers.

Typically, the first phase of an ARM lasts anywhere from three to ten years, during which the interest rate remains stable. After this initial period, the rate adjusts periodically based on a specified index, which can result in increased monthly payments. Understanding how these adjustments work is crucial for potential borrowers.

Benefits of Adjustable-Rate Mortgages

- Lower Initial Payments: The initial fixed-rate period allows borrowers to enjoy lower monthly payments, which can be particularly beneficial for first-time homebuyers or those looking to manage their cash flow.

- Potential for Decreased Rates: If market interest rates decline, borrowers may benefit from lower payments without the need to refinance.

- Flexibility: ARMs can be ideal for individuals who plan to move or refinance before the adjustable period begins, allowing them to take advantage of lower rates without long-term commitments.

Risks Associated with ARMs

- Payment Increases: After the fixed period, borrowers may face significant increases in their monthly payments, which can strain budgets if not planned for.

- Market Volatility: The potential for rising interest rates can lead to uncertainty regarding future payments, making it essential for borrowers to assess their risk tolerance.

- Complexity: The terms and conditions of ARMs can be complicated, and borrowers must fully understand their mortgage agreements to avoid unpleasant surprises.

In conclusion, can be a valuable option for those who understand the associated benefits and risks. It is crucial to analyze personal financial situations and market conditions before opting for this type of mortgage.

Understanding Student Loans

is essential for anyone looking to finance their higher education. These loans are specifically designed to help students cover the costs associated with tuition, fees, books, and living expenses while attending college or university. In this section, we will delve into the two main categories of student loans: federal and private, highlighting their unique features, benefits, and repayment options.

Federal student loans are funded by the government and typically offer lower interest rates compared to private loans. They come with various repayment plans, including income-driven repayment options that adjust monthly payments based on your income. Some of the key types of federal loans include:

- Direct Subsidized Loans: These loans are available to undergraduate students with demonstrated financial need. The government pays the interest while you are in school.

- Direct Unsubsidized Loans: Available to both undergraduate and graduate students, these loans do not require financial need, and interest accrues while you’re in school.

- Direct PLUS Loans: These loans are for graduate students and parents of dependent undergraduate students, allowing them to borrow up to the total cost of education minus any other financial aid.

Private student loans are offered by banks, credit unions, and other financial institutions. They often require a credit check and may have variable interest rates, which can be higher than federal loans. While they can cover any remaining costs after federal aid, it’s important to consider:

- Credit Requirements: Many private lenders require a good credit score or a co-signer to qualify.

- Repayment Options: These loans may not offer the same flexible repayment plans as federal loans, making it crucial to understand the terms before borrowing.

In summary, understanding the differences between federal and private student loans is crucial for making informed decisions about financing your education. By evaluating your options carefully, you can choose a loan that best fits your financial situation and educational goals.

Federal Student Loans

When it comes to financing higher education, understanding the different types of student loans is crucial for students and their families. Among these options, stand out due to their favorable terms and conditions.

are government-funded financial aids that provide students with the necessary resources to cover tuition and other educational expenses. One of the most significant advantages of federal loans is their lower interest rates, which are generally more affordable compared to private loans. This characteristic makes them an attractive option for many students.

In addition to lower interest rates, federal student loans offer flexible repayment options. Borrowers can choose from various repayment plans, including income-driven repayment plans that adjust monthly payments based on the borrower’s income and family size. This flexibility can alleviate financial stress, especially for recent graduates entering the workforce.

Another important aspect of federal student loans is the availability of deferment and forbearance options. These features allow borrowers to temporarily pause their payments without facing severe penalties, providing a safety net during challenging financial times.

Furthermore, federal loans often come with additional benefits, such as loan forgiveness programs for those who work in public service or non-profit sectors. This can significantly reduce the overall financial burden on graduates, making federal loans a more attractive choice.

In contrast, private student loans typically require a credit check and may not offer the same level of flexibility or benefits. They often come with higher interest rates and less favorable repayment terms, making them less appealing for many students.

In summary, federal student loans are a vital resource for students seeking financial assistance for their education. With their lower interest rates, flexible repayment options, and additional benefits, they remain a preferred choice for many individuals pursuing higher education.

Private Student Loans

Private student loans are an essential financial resource for many students seeking to fund their education. Unlike federal student loans, which are backed by the government, are offered by banks, credit unions, and other financial institutions. These loans generally require a credit check, which can impact eligibility and terms based on the borrower’s creditworthiness.

One of the primary advantages of private student loans is their ability to fill funding gaps that federal loans may not cover. This is particularly beneficial for students attending expensive institutions or those pursuing advanced degrees. However, it is crucial to understand that private loans often come with less favorable terms compared to federal loans. For instance, interest rates may be higher, and repayment options can be less flexible.

When considering private student loans, borrowers should evaluate several factors:

- Interest Rates: Private loans can have fixed or variable rates. Fixed rates remain constant throughout the loan term, while variable rates may fluctuate based on market conditions.

- Repayment Options: Some lenders offer deferment or forbearance options, but these may not be as generous as those provided by federal loans.

- Loan Limits: Private lenders often set their own borrowing limits, which may vary significantly from one institution to another.

- Cosigner Requirements: Many private loans require a cosigner, especially for students with limited credit history.

In summary, while private student loans can be a valuable tool for financing education, it is essential for borrowers to conduct thorough research and consider all options available. Understanding the terms and conditions of these loans can help students make informed decisions that align with their financial goals.

Business Loans Explained

Business loans are essential financial tools that provide funding for a wide range of business needs. Whether you’re looking to cover startup costs, finance expansion, or manage operational expenses, understanding the various types of loans available can help you make informed decisions.

- SBA Loans: These loans are partially guaranteed by the Small Business Administration, making them an attractive option for small businesses that may not qualify for traditional financing. They typically offer lower interest rates and longer repayment terms.

- Term Loans: A popular choice for established businesses, term loans provide a lump sum of capital that is repaid over a fixed period. These loans are often used for significant investments such as purchasing equipment or real estate.

- Lines of Credit: A business line of credit offers flexibility, allowing businesses to withdraw funds as needed up to a certain limit. Interest is only paid on the amount drawn, making it ideal for managing cash flow fluctuations.

- Invoice Financing: This type of financing allows businesses to borrow against their unpaid invoices. It can be a quick way to access cash without waiting for clients to pay.

- Equipment Financing: Specifically designed for purchasing equipment, this loan type uses the equipment itself as collateral. This can help businesses acquire necessary tools without a significant upfront investment.

Business loans can offer numerous advantages, including:

- Access to Capital: They provide essential funding to help businesses grow and thrive.

- Improved Cash Flow: With the right financing, businesses can manage their cash flow more effectively, ensuring they have the resources needed to operate smoothly.

- Flexible Use of Funds: Business loans can be used for various purposes, from purchasing inventory to hiring staff, allowing entrepreneurs to tailor their financing to their specific needs.

SBA Loans

are a vital resource for small businesses seeking financial assistance. These loans, which are partially guaranteed by the Small Business Administration, provide a safety net for lenders, making it easier for small enterprises to secure funding. This is particularly beneficial for businesses that may find it challenging to qualify for traditional loans due to limited credit history or insufficient collateral.

One of the most appealing aspects of SBA loans is their favorable terms. Borrowers often enjoy lower interest rates compared to conventional loans, which can significantly reduce the overall cost of borrowing. Additionally, the repayment periods for SBA loans can extend up to 25 years, providing businesses with the flexibility to manage their cash flow effectively.

There are several types of SBA loans available, including the 7(a) loan program, which is the most common and versatile option. This program can be used for a variety of purposes, such as purchasing equipment, refinancing debt, or funding working capital. Another option is the 504 loan program, which is specifically designed for purchasing fixed assets like real estate and large equipment, allowing businesses to invest in their growth.

Eligibility for SBA loans typically requires a thorough examination of the business’s financial health, creditworthiness, and operational history. While the application process may seem daunting, the potential benefits far outweigh the challenges. Businesses that successfully secure SBA loans can leverage the funding to expand operations, hire new employees, and ultimately enhance their market presence.

In summary, SBA loans represent an invaluable opportunity for small businesses to access capital that might otherwise be out of reach. With government backing, these loans not only offer competitive terms but also foster economic growth by empowering entrepreneurs to pursue their business ambitions.

Term Loans

are a crucial financing option for businesses, providing a lump sum of capital that is typically repaid over a predetermined period. These loans are often utilized for significant investments, such as purchasing equipment, acquiring real estate, or funding large-scale projects. Understanding the characteristics and benefits of term loans can help businesses make informed financial decisions.

Term loans are generally categorized into two types: short-term and long-term loans. Short-term loans usually have repayment periods ranging from a few months to a year, making them suitable for immediate financial needs or seasonal businesses. In contrast, long-term loans extend over several years, often up to 10 years or more, allowing businesses to manage larger investments with more manageable monthly payments.

One of the key advantages of term loans is their fixed interest rates, which provide predictability in budgeting and cash flow management. Borrowers can plan their finances without worrying about fluctuating interest rates, making it easier to forecast future expenses. Additionally, term loans can enhance a business’s credit profile when repaid on time, potentially improving access to future financing opportunities.

However, businesses must consider the eligibility requirements and potential drawbacks of term loans. Lenders typically assess credit history, financial statements, and business plans before approval. Furthermore, the obligation to make regular payments can strain cash flow, particularly for businesses facing economic downturns.

In summary, term loans serve as a vital tool for businesses aiming to invest in growth and expansion. By understanding the different types of term loans and their implications, businesses can leverage this financial resource effectively to achieve their goals.

Auto Loans Overview

Auto loans are financial products specifically tailored for the purpose of purchasing vehicles. Understanding the intricacies of these loans is essential for consumers looking to make informed decisions. In this section, we will delve into how auto loans function, the various terms and interest rates associated with them, and key considerations to keep in mind before applying.

Auto loans typically involve borrowing a specific amount of money to purchase a vehicle, which is then repaid over a predetermined period. The vehicle itself usually serves as collateral, meaning that if the borrower fails to make payments, the lender has the right to repossess the vehicle.

Auto loans can vary significantly in terms of duration, usually ranging from 36 to 72 months. The interest rates on these loans are influenced by various factors, including:

- Credit Score: A higher credit score often results in lower interest rates.

- Loan Term: Shorter loan terms typically come with lower interest rates.

- Down Payment: A larger down payment can reduce the loan amount and potentially lower the interest rate.

When considering an auto loan, borrowers can choose between secured and unsecured loans. Secured loans are backed by the vehicle itself, which can lead to lower interest rates. In contrast, unsecured loans do not require collateral but may come with higher rates due to the increased risk for lenders.

Before applying for an auto loan, it is crucial to assess your financial situation. Consider the following:

- Your Budget: Ensure that the monthly payments fit within your budget.

- Loan Comparisons: Shop around to compare rates and terms from different lenders.

- Pre-Approval: Obtaining pre-approval can give you a better idea of your budget and strengthen your negotiating position.

By understanding the elements of auto loans, consumers can make better financial decisions when purchasing a vehicle.

Secured vs. Unsecured Auto Loans

When considering auto loans, borrowers often encounter two primary types: secured and unsecured auto loans. Understanding the differences between these loan types is crucial for making informed financial decisions.

Secured auto loans are loans that require the vehicle itself as collateral. This means that if the borrower fails to make the required payments, the lender has the right to repossess the vehicle. Because these loans are backed by collateral, they often come with lower interest rates and more favorable terms. Borrowers with good credit can benefit significantly from this type of loan, as lenders are more willing to offer better rates when they have an asset to secure the loan against.

On the other hand, unsecured auto loans do not require collateral. This means that the lender cannot claim the vehicle if the borrower defaults on the loan. However, because these loans are riskier for lenders, they typically come with higher interest rates and stricter eligibility requirements. Borrowers with less-than-perfect credit may find it challenging to secure an unsecured loan, or they may face significantly higher costs.

When deciding between secured and unsecured auto loans, borrowers should consider their financial situation, credit history, and ability to make regular payments. Here are some key points to consider:

- Interest Rates: Secured loans generally offer lower rates.

- Risk: With secured loans, there is a risk of losing the vehicle.

- Credit Impact: Unsecured loans may negatively impact credit scores if payments are missed.

- Loan Amount: Secured loans may allow for larger amounts due to collateral.

In summary, understanding the nuances of secured and unsecured auto loans can empower borrowers to make choices that align with their financial goals. Whether opting for the security of a collateralized loan or the flexibility of an unsecured option, careful consideration is essential.

Loan Terms and Interest Rates

When it comes to auto loans, understanding the nuances of loan terms and interest rates is crucial for securing the best deal. Auto loans are generally available in a range of terms, typically spanning from 36 to 72 months. The length of the loan can significantly impact your monthly payments and the overall cost of the vehicle.

Interest rates on auto loans can vary widely based on several factors, including your credit score, the lender’s policies, and the type of vehicle being financed. Generally, borrowers with higher credit scores can access lower interest rates, which can save them a substantial amount over the life of the loan.

- Credit Score: A higher credit score often translates to lower interest rates. Lenders view individuals with good credit as lower risk.

- Lender Policies: Different lenders have varying criteria for determining interest rates. It’s essential to shop around for the best offers.

- New vs. Used Vehicles: Financing a new car typically comes with lower interest rates compared to used vehicles, as new cars are seen as more reliable collateral.

To secure the most favorable rates, consider the following strategies:

- Improve Your Credit Score: Before applying for a loan, take steps to enhance your credit score by paying down debts and ensuring timely payments.

- Compare Offers: Obtain quotes from multiple lenders to find the most competitive rates. Online tools can assist in comparing different loan offers.

- Negotiate: Don’t hesitate to negotiate the terms with your lender. Sometimes, they may be willing to offer better rates or terms to close the deal.

By understanding these elements and taking proactive steps, you can position yourself to secure the best auto loan rates available, ultimately making your vehicle purchase more affordable.

Frequently Asked Questions

- What is a personal loan?

A personal loan is an unsecured loan that you can use for various purposes, like consolidating debt or covering unexpected expenses. They usually come with fixed interest rates and set repayment terms, making them a straightforward option for quick cash needs.

- What are the different types of home loans?

Home loans primarily include fixed-rate mortgages, adjustable-rate mortgages (ARMs), and government-backed loans. Fixed-rate mortgages offer consistent payments, while ARMs can start with lower rates that may change over time.

- What are federal student loans?

Federal student loans are government-funded loans that typically offer lower interest rates and more flexible repayment options compared to private loans. They are designed to help students cover the costs of higher education.

- What is an SBA loan?

An SBA loan is a type of business loan partially guaranteed by the Small Business Administration. These loans provide favorable terms for small businesses that may struggle to secure traditional financing.

- What is the difference between secured and unsecured auto loans?

Secured auto loans require collateral, usually the vehicle you’re purchasing, while unsecured loans do not. Secured loans often come with lower interest rates, but they pose a risk of losing the car if you default.