This article provides essential insights into securing an online loan, covering the types of loans available, application processes, and tips for choosing the right lender.

Understanding Online Loans

Online loans are financial products that can be conveniently accessed through various digital platforms. It is important to recognize their structure, benefits, and potential drawbacks to make informed borrowing decisions. The ease of application and speed of funding are key advantages, but borrowers must also be aware of the risks associated with high-interest rates and fees.

Types of Online Loans

There are several types of online loans, each designed to meet different financial needs:

- Personal Loans: These are versatile options that can be used for purposes such as debt consolidation, medical expenses, or home improvements. They generally feature fixed interest rates and predefined repayment terms.

- Payday Loans: Short-term loans meant to cover urgent expenses, payday loans often come with high interest rates and should be used cautiously.

- Installment Loans: These loans allow borrowers to repay in fixed installments over a specified period, making budgeting easier.

How to Apply for an Online Loan

The application process for an online loan typically involves several steps:

- Researching Lenders: It is crucial to choose a reputable lender. Look for online reviews, compare interest rates, and verify their licensing.

- Preparing Your Documentation: Lenders usually require proof of income, identification, and credit history. Having these documents ready can help expedite your application.

Factors Affecting Loan Approval

Loan approval is influenced by various factors, including:

- Credit Score: A higher credit score often leads to better loan terms and approval chances. Understanding your credit profile is essential.

- Income Verification: Lenders assess your income to determine your ability to repay. Accurate documentation can enhance your approval odds.

Tips for Choosing the Right Online Lender

Selecting the right online lender is vital for a positive borrowing experience. Here are some tips:

- Comparing Interest Rates: Interest rates can vary significantly. Take the time to compare offers to find the most affordable option.

- Evaluating Customer Reviews: Reading customer reviews can provide valuable insights into a lender’s reputation and service quality. Look for feedback regarding customer support and transparency in fees.

Understanding Online Loans

Online loans are increasingly popular financial products that can be accessed through various digital platforms, making borrowing more convenient than ever. These loans offer a range of options tailored to meet different financial needs, from personal expenses to unexpected emergencies. To make informed decisions, it is essential to understand their structure, benefits, and potential drawbacks.

One of the primary advantages of online loans is the speed of the application process. Many lenders provide quick approvals, often within hours, allowing borrowers to access funds rapidly. Additionally, the online nature of these loans means that applicants can complete the process from the comfort of their homes, eliminating the need for in-person visits to banks or credit unions.

However, it is crucial to recognize that online loans can come with higher interest rates compared to traditional loans. This is particularly true for short-term options like payday loans, which can lead to significant repayment amounts if not managed carefully. Borrowers should always read the fine print and understand the terms before committing.

Another important aspect to consider is the variety of online loan types available. These include:

- Personal Loans: These are versatile loans that can be used for various purposes, including debt consolidation and home renovations.

- Payday Loans: Short-term loans designed for emergency expenses, often with high fees.

- Installment Loans: Loans that are paid back in fixed installments over a specified period.

When considering an online loan, potential borrowers should also evaluate the reputation of lenders. Researching online reviews and comparing interest rates can help in selecting a trustworthy lender. Additionally, understanding the documentation required, such as proof of income and credit history, can streamline the application process.

In summary, while online loans offer convenience and accessibility, they also require careful consideration of terms and lender credibility. By being informed about the structure and implications of online borrowing, individuals can make better financial decisions that align with their needs.

Types of Online Loans

When it comes to financing options available online, understanding the different is essential for making informed decisions. Each type of loan serves distinct financial needs and comes with its own set of terms and conditions. Below, we delve into the most common types of online loans.

- Personal Loans

Personal loans are versatile financial products that can be used for a variety of purposes, such as debt consolidation, home improvements, or unexpected expenses. They typically feature fixed interest rates and set repayment terms, making them easier to budget for.

- Payday Loans

Payday loans are short-term loans designed to cover urgent expenses until your next paycheck. While they provide quick access to cash, they often come with high interest rates and fees, making them a risky option for borrowers who may struggle to repay them on time.

- Installment Loans

Installment loans allow borrowers to receive a lump sum upfront and repay it over time through fixed monthly payments. These loans can be used for larger purchases or projects and typically offer lower interest rates compared to payday loans.

- Student Loans

Student loans are specifically designed to help cover educational costs. These loans often have lower interest rates and more flexible repayment options, making them a viable choice for students seeking to finance their education.

- Auto Loans

Auto loans are used to finance the purchase of a vehicle. They can be secured by the vehicle itself, which often results in lower interest rates. Borrowers should carefully consider the terms to avoid falling into a cycle of debt.

Each type of online loan has its advantages and disadvantages. It is crucial for borrowers to assess their financial situation, consider their repayment capabilities, and choose the loan that best suits their needs.

Personal Loans

have become increasingly popular due to their versatility and ease of access. These loans can be utilized for a wide range of purposes, including debt consolidation, home improvements, medical expenses, or even funding a vacation. Unlike specific loans that are tied to a particular purpose, personal loans offer borrowers the flexibility to use the funds as they see fit.

One of the key features of personal loans is their typically fixed interest rates. This means that borrowers can enjoy predictable monthly payments, making it easier to manage their finances. Additionally, these loans usually come with fixed repayment terms, which can range from a few months to several years, allowing borrowers to choose a timeline that best suits their financial situation.

When considering a personal loan, it’s essential to understand the difference between secured and unsecured loans. Secured loans require collateral, such as a car or savings account, which can lower the interest rate but puts the asset at risk if the borrower defaults. On the other hand, unsecured loans do not require collateral, making them less risky for the borrower but often come with higher interest rates.

Interest rates for personal loans can vary significantly based on several factors, including the borrower’s credit score, income level, and the lender’s policies. It’s crucial for potential borrowers to shop around and compare rates from different lenders to find the most favorable terms. This not only helps in securing a lower rate but also in identifying the best loan structure that aligns with their financial goals.

In summary, personal loans are a flexible financial tool that can cater to various needs. By understanding the different types, rates, and terms, borrowers can make informed decisions that will benefit their financial health.

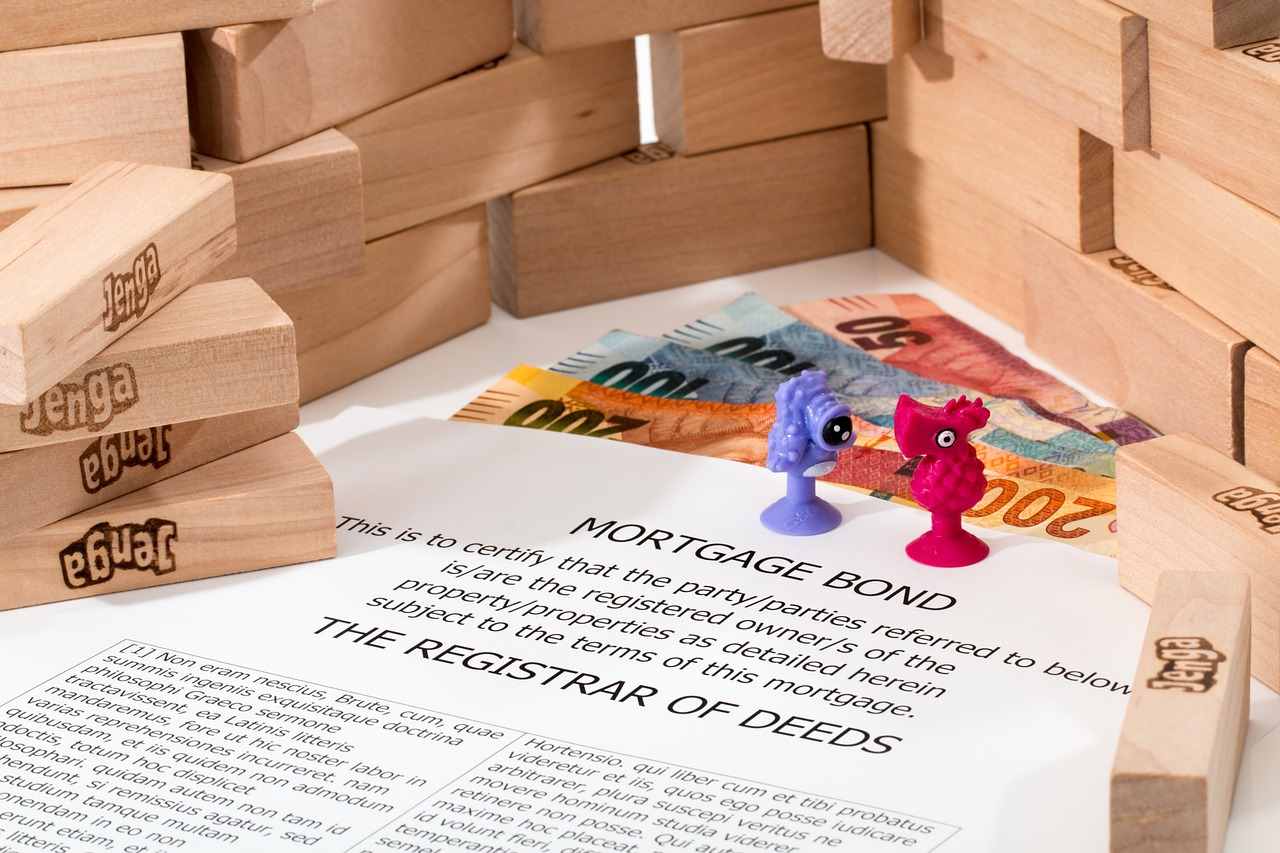

Secured vs. Unsecured Personal Loans

When considering personal loans, understanding the difference between secured and unsecured options is essential for making informed financial decisions. Each type of loan has its unique characteristics, benefits, and potential risks that can significantly impact your financial situation.

Secured personal loans require the borrower to provide collateral, which can be any asset of value such as a car, home, or savings account. This collateral acts as a safety net for the lender; if the borrower defaults on the loan, the lender has the right to seize the collateral to recover their losses. Because of this added security, secured loans typically come with lower interest rates and more favorable terms. They can be an excellent choice for individuals with a good credit score looking to finance larger expenses, such as home renovations or debt consolidation.

On the other hand, unsecured personal loans do not require collateral, making them a more accessible option for many borrowers. These loans are granted based on the borrower’s creditworthiness, income, and overall financial stability. While they offer the advantage of not risking personal assets, unsecured loans often come with higher interest rates due to the increased risk for lenders. They are ideal for smaller expenses or emergencies, such as medical bills or unexpected repairs, where the borrower may not have valuable assets to use as collateral.

Ultimately, the choice between secured and unsecured personal loans depends on your financial situation, credit history, and the purpose of the loan. By carefully evaluating your needs and understanding the implications of each loan type, you can make a more informed decision that aligns with your financial goals.

| Feature | Secured Loans | Unsecured Loans |

|---|---|---|

| Collateral Required | Yes | No |

| Interest Rates | Lower | Higher |

| Risk of Asset Loss | Yes | No |

| Loan Amounts | Typically Larger | Typically Smaller |

Interest Rates and Terms

When considering personal loans, one of the most crucial aspects to understand is the variation in interest rates and terms offered by different lenders. These rates can differ significantly, influenced by factors such as the borrower’s credit score, income level, and the overall economic climate. It is essential for borrowers to conduct thorough research and comparison to secure the most favorable loan conditions tailored to their financial needs.

Interest rates on personal loans typically fall within a wide range. For example, borrowers with excellent credit may qualify for rates as low as 5%, while those with poor credit might face rates exceeding 30%. This disparity underscores the importance of understanding how your creditworthiness affects the rates you are offered.

In addition to interest rates, the terms of the loan—including repayment duration and fees—also vary. Most personal loans come with fixed terms, usually ranging from two to five years, which can help borrowers plan their finances more effectively. However, some lenders may impose additional fees, such as origination fees or prepayment penalties, which can significantly impact the overall cost of the loan.

To find the most advantageous conditions, borrowers should utilize online comparison tools to evaluate multiple lenders simultaneously. This process not only helps in identifying lower interest rates but also allows for a comprehensive view of various loan terms available in the market. Additionally, reading customer reviews and seeking recommendations can provide valuable insights into a lender’s service quality and hidden costs.

Ultimately, taking the time to compare interest rates and loan terms can empower borrowers to make informed decisions that align with their financial goals. Remember, a well-informed choice today can lead to significant savings and better financial health in the long run.

Payday Loans

are a type of short-term borrowing that is often used to address immediate financial needs. These loans are typically characterized by their high-interest rates and quick approval processes, making them appealing for those facing unexpected expenses. However, it is important to understand the implications of taking out a payday loan before proceeding.

One of the primary reasons individuals consider payday loans is their ability to provide fast cash. The application process is usually straightforward and can often be completed online, allowing borrowers to receive funds within a day or even within hours. This speed can be crucial for emergencies, such as medical bills or car repairs.

However, the convenience of payday loans comes with significant risks. The interest rates on these loans can be exorbitantly high, sometimes exceeding 400% APR. This makes repayment challenging for many borrowers, leading to a cycle of debt where individuals may need to take out additional loans to cover the costs of the first. In fact, according to various studies, a significant percentage of payday loan borrowers end up taking out multiple loans in quick succession, exacerbating their financial difficulties.

When considering a payday loan, it is vital to evaluate your financial situation carefully. Ask yourself the following questions:

- Can I afford to repay the loan within the specified timeframe?

- Are there alternative options available, such as personal loans or credit from family and friends?

- What are the total costs associated with the loan, including fees and interest?

Additionally, it’s essential to research potential lenders thoroughly. Look for reputable companies with transparent terms and conditions. Reading customer reviews and checking for any complaints can provide valuable insights into the lender’s practices.

In summary, while payday loans can serve as a quick financial solution, they carry significant risks that necessitate careful consideration. Being fully informed and exploring all options can help individuals make better financial decisions.

How to Apply for an Online Loan

Applying for an online loan can seem daunting, but breaking it down into manageable steps can simplify the process significantly. Understanding the various stages involved in securing a loan will not only help you feel more confident but also ensure that you make informed decisions.

Researching Lenders

The first step in applying for an online loan is researching potential lenders. Look for lenders that are reputable and have positive customer reviews. Utilize online comparison tools to evaluate interest rates, fees, and loan terms. It’s essential to ensure that the lender is licensed and regulated to avoid scams.

Preparing Your Documentation

Once you’ve selected a lender, the next step involves preparing your documentation. Most lenders require specific documents to assess your financial situation. Common documentation includes:

- Proof of income (pay stubs, bank statements)

- Identification (driver’s license, passport)

- Credit history report

Having these documents ready will expedite the application process and increase your chances of approval.

Submitting Your Application

After gathering the necessary documentation, you can proceed to submit your application. This usually involves filling out an online form where you provide information about your financial situation, loan amount, and purpose of the loan. Be honest and thorough; inaccuracies can lead to delays or denials.

Loan Approval Process

Once submitted, your application will undergo a review process. Lenders will evaluate your credit score, income, and overall financial health. Understanding the factors that influence approval, such as your debt-to-income ratio, can help you anticipate the outcome and improve your chances.

Receiving Your Funds

If approved, you will receive a loan agreement outlining the terms and conditions. Review this document carefully before signing. Once you agree to the terms, funds are typically disbursed quickly, often within one to three business days.

By following these steps and being well-prepared, you can navigate the online loan application process with ease and confidence.

Researching Lenders

When it comes to securing a loan online, is a critical step that can significantly impact your borrowing experience. With the vast number of lenders available, it is essential to approach this task methodically to ensure you select a reputable and trustworthy lender.

First and foremost, online reviews can provide valuable insights into the experiences of other borrowers. Websites that aggregate reviews often highlight both positive and negative feedback, which can help you gauge a lender’s reliability and customer service quality. Look for patterns in the reviews; consistent complaints about hidden fees or poor customer support can be red flags.

Next, it’s important to compare interest rates across different lenders. Rates can vary significantly, and even a small difference can lead to substantial savings over the life of the loan. Utilize online comparison tools that allow you to input your loan requirements and receive tailored quotes from multiple lenders. This step helps you identify the most affordable options available to you.

Additionally, ensure that the lenders you are considering are licensed and regulated by the appropriate authorities. This information can typically be found on the lender’s website or by checking with your local financial regulatory body. A licensed lender adheres to specific laws and regulations, providing an added layer of security for your financial transaction.

Furthermore, consider the customer service aspect of the lending process. A lender that offers robust support can make your borrowing experience much smoother. Look for options to contact customer service, such as phone support, live chat, or email, and assess their responsiveness and helpfulness.

Lastly, be sure to read the fine print of any loan agreement. Understanding the terms and conditions, including repayment schedules and potential penalties, will help you avoid unpleasant surprises later on. By taking these steps, you can confidently choose a lender that meets your financial needs while ensuring a positive borrowing experience.

Preparing Your Documentation

When it comes to securing an online loan, one of the most critical steps is . Lenders typically require a variety of documents to assess your eligibility and ensure that you can meet the repayment terms. Having these documents ready not only expedites the application process but also enhances your chances of approval.

The essential documents you will need include:

- Proof of Income: This can be in the form of recent pay stubs, tax returns, or bank statements. Lenders want to verify that you have a stable income to support your loan repayments.

- Identification: A government-issued ID such as a driver’s license or passport is usually required. This helps lenders confirm your identity and ensure that you meet their age and residency requirements.

- Credit History: Lenders will typically check your credit score and history as part of their evaluation process. Having a good credit history can significantly improve your chances of securing a loan.

In addition to these core documents, some lenders may ask for:

- Employment Verification: This could involve contacting your employer or requiring a letter of employment to confirm your job status.

- Debt-to-Income Ratio Documentation: Lenders may want to see your monthly debt obligations compared to your income to assess your financial health.

To ensure a smooth application process, it’s advisable to gather all these documents in advance. This proactive approach can save you time and help you avoid unnecessary delays. Furthermore, being organized and prepared can give you a better sense of confidence as you navigate the loan application process.

Factors Affecting Loan Approval

When seeking a loan, it’s crucial to understand the various factors that can influence the approval process. These elements not only determine whether you qualify but also affect the terms of the loan you may receive. Here, we delve into the key components that lenders consider when evaluating your application.

Your credit score is one of the most significant factors in the loan approval process. It reflects your creditworthiness based on your credit history, including payment history, outstanding debts, and the length of your credit accounts. A higher credit score typically leads to better loan terms, including lower interest rates. To improve your credit score, consider the following:

- Pay bills on time

- Reduce outstanding debt

- Avoid opening multiple new accounts simultaneously

Lenders assess your income level to gauge your ability to repay the loan. A stable and sufficient income can significantly enhance your chances of approval. It’s essential to provide accurate documentation, such as pay stubs or tax returns, to verify your income. Consider the following tips:

- Ensure your income documentation is up-to-date

- Include any additional income sources, such as bonuses or side jobs

The debt-to-income (DTI) ratio is a critical metric used by lenders to evaluate your overall financial health. It compares your monthly debt payments to your gross monthly income. A lower DTI ratio indicates that you have a manageable level of debt relative to your income, improving your chances of loan approval. To calculate your DTI:

DTI (Total Monthly Debt Payments / Gross Monthly Income) x 100

Strive to keep your DTI below 36% for optimal loan eligibility. If your DTI is high, consider paying down existing debts before applying for a loan.

Beyond credit score, income, and DTI, lenders also consider your credit history and employment stability. A long history of responsible credit use and a stable job can positively influence your application. Ensure that your employment history is consistent and that you maintain a good relationship with your creditors.

By understanding these factors, potential borrowers can take proactive steps to improve their loan approval chances. Whether it’s enhancing your credit score or managing your debt levels, being informed is key to a successful loan application.

Credit Score Importance

A good credit score plays a critical role in the financial landscape, especially when it comes to loan approval. Understanding how your credit score influences your borrowing options is essential for anyone looking to secure a loan online.

Your credit score is a numerical representation of your creditworthiness, calculated based on your credit history, payment behavior, and overall financial habits. Lenders use this score to assess the risk of lending you money. A higher credit score typically indicates to lenders that you are a responsible borrower, which can significantly enhance your chances of obtaining a loan.

- Loan Eligibility: Most lenders have a minimum credit score requirement. If your score falls below this threshold, you may be denied a loan outright.

- Interest Rates: A good credit score can qualify you for lower interest rates, which can save you significant amounts over the life of the loan. Conversely, a lower score may result in higher rates or unfavorable loan terms.

- Loan Amounts: Lenders are more likely to approve larger loan amounts for borrowers with higher credit scores, as they are perceived as less risky.

Additionally, understanding the factors that contribute to your credit score is vital. These include:

1. Payment History: 35% of your score2. Credit Utilization: 30% of your score3. Length of Credit History: 15% of your score4. Types of Credit: 10% of your score5. New Credit Inquiries: 10% of your score

To improve your credit score, consider making timely payments, reducing outstanding debts, and regularly checking your credit report for errors. By actively managing your credit, you can enhance your eligibility for loans and secure better interest rates.

In summary, understanding the importance of your credit score is crucial for effective financial planning. By recognizing its impact on loan approval, you can take proactive steps to improve your score and achieve your borrowing goals.

Income Verification

When applying for an online loan, one of the most critical aspects lenders evaluate is your income. This assessment is crucial as it helps them determine your ability to repay the loan. Lenders want to ensure that you have a steady income stream that can cover your monthly payments, which is why providing accurate income documentation is essential.

Income verification typically involves submitting various documents that prove your earnings. Commonly required documents include:

- Pay stubs: Recent pay stubs provide a clear picture of your income.

- Tax returns: These documents help verify your total annual income.

- Bank statements: They can show consistent deposits that reflect your earning stability.

- Employment verification letters: These letters from your employer can confirm your job status and income level.

By submitting these documents, you not only facilitate the verification process but also enhance your chances of loan approval. Lenders look favorably on applicants who can clearly demonstrate their financial stability. If you fail to provide accurate or complete information, it may raise red flags and lead to a denial of your application.

Moreover, your debt-to-income ratio plays a significant role in the approval process. This ratio compares your total monthly debt payments to your gross monthly income. A lower ratio indicates that you have a manageable level of debt relative to your income, which can positively influence your loan application.

Ultimately, being transparent and thorough with your income documentation can significantly improve your chances of securing the loan you need. Lenders appreciate applicants who present clear evidence of their financial situation, making the process smoother and more efficient.

Tips for Choosing the Right Online Lender

When it comes to securing a loan online, selecting the right lender is a critical step that can significantly influence your overall borrowing experience. With numerous options available, it is essential to navigate this landscape carefully. Here are some key factors to consider:

- Interest Rates: One of the most important aspects to evaluate is the interest rate offered by the lender. Rates can vary widely, impacting your monthly payments and the total cost of the loan. Always compare rates from multiple lenders to ensure you are getting the best deal.

- Loan Terms: Different lenders provide various loan terms, including repayment periods and conditions. Make sure to read the fine print and understand the terms associated with your loan. This includes any potential fees, penalties for early repayment, and the flexibility of payment options.

- Customer Service: Excellent customer service can make a significant difference in your borrowing experience. Look for lenders that offer responsive support through multiple channels, such as phone, email, and chat. Reading customer reviews can provide insights into the level of service you can expect.

- Reputation: Research the lender’s background and reputation in the industry. Verify their licensing and check for any complaints with consumer protection agencies. A reputable lender is more likely to offer fair terms and transparent practices.

- Loan Amounts: Ensure that the lender offers loan amounts that meet your needs. Some lenders specialize in smaller loans, while others may cater to larger amounts. Choose a lender that aligns with your financial requirements.

By carefully considering these factors, you can make an informed decision that not only meets your financial needs but also contributes to a positive borrowing experience. Remember, the right lender can help you achieve your financial goals with confidence.

Comparing Interest Rates

When it comes to securing a loan, interest rates play a pivotal role in determining the overall cost of borrowing. It is essential to recognize that interest rates can vary significantly between lenders, which can greatly impact your financial situation. Therefore, it is crucial to engage in thorough rate comparison before committing to any loan agreement.

Different lenders may offer varying rates based on a multitude of factors, including your credit score, income, and the type of loan you are seeking. For instance, personal loans might come with lower interest rates compared to payday loans, which typically have much higher rates due to their short-term nature and high-risk profile. Understanding these differences can save you a considerable amount of money over the life of the loan.

To effectively compare interest rates, consider the following steps:

- Research Multiple Lenders: Don’t settle for the first offer you receive. Explore various lenders, including traditional banks and online platforms, to gauge the range of available rates.

- Utilize Online Comparison Tools: Many websites allow you to input your information and receive quotes from multiple lenders, making it easier to see which offers the best rate.

- Examine the APR: Always look at the Annual Percentage Rate (APR), which includes both the interest rate and any additional fees. This will give you a clearer picture of the total cost of the loan.

- Consider Loan Terms: The length of the loan can also affect the interest rate. Shorter loan terms may have lower rates, but higher monthly payments, while longer terms can lead to higher overall costs.

By taking the time to compare rates, you can ensure that you find the most affordable option that aligns with your financial needs. This diligence not only helps you save money but also contributes to a more sustainable financial future.

Evaluating Customer Reviews

When it comes to securing an online loan, one of the most critical steps is . These reviews serve as a valuable resource for potential borrowers, offering insights into a lender’s reputation and the quality of their services. By taking the time to read what previous customers have to say, you can make a more informed decision about which lender to choose.

Customer feedback often highlights various aspects of the lending experience, including customer support, transparency regarding fees, and the overall ease of the application process. For instance, if a lender consistently receives negative reviews about their customer service, it may indicate that borrowers face challenges in communication or resolving issues. This can be a red flag for those who value responsive support during their borrowing journey.

Moreover, many reviews delve into the fees associated with loans. Hidden fees can significantly increase the cost of borrowing, so it’s essential to choose a lender with a transparent fee structure. Positive reviews often mention lenders who clearly outline their fees upfront, helping borrowers avoid unexpected charges that can arise later in the loan term.

In addition to looking for red flags, it’s also beneficial to seek out positive reviews that highlight lenders with favorable terms and excellent service. These testimonials can provide assurance that the lender is trustworthy and committed to customer satisfaction. Consider creating a comparison table of lenders based on their reviews, interest rates, and fees to visualize your options better.

Ultimately, taking the time to evaluate customer reviews can save you from poor lending experiences and help you find a lender that meets your financial needs effectively. Always remember that informed borrowing begins with thorough research and consideration of others’ experiences.

Frequently Asked Questions

- What types of online loans are available?

Online loans come in various forms, including personal loans, payday loans, and installment loans. Each type is tailored for different financial needs, so it’s essential to choose one that fits your situation.

- How do I apply for an online loan?

Applying for an online loan typically involves researching lenders, preparing necessary documentation like proof of income and identification, and submitting your application through the lender’s website.

- What factors affect my loan approval?

Loan approval is influenced by several factors, including your credit score, income level, and debt-to-income ratio. Understanding these can help you improve your chances of securing a loan.

- How can I find the best interest rates?

To find the best interest rates, it’s crucial to compare offers from multiple lenders. This way, you can ensure you’re getting the most favorable terms for your financial situation.

- Are payday loans safe?

While payday loans can provide quick cash, they are often high-interest and can lead to a cycle of debt. It’s essential to approach them with caution and consider alternatives if possible.