Feel free to use our Equipment Finance Calculator

**Note: For exceeding 120 no. of payments, a group of 12 payments will be combined into a single payment number for better chart visibility.

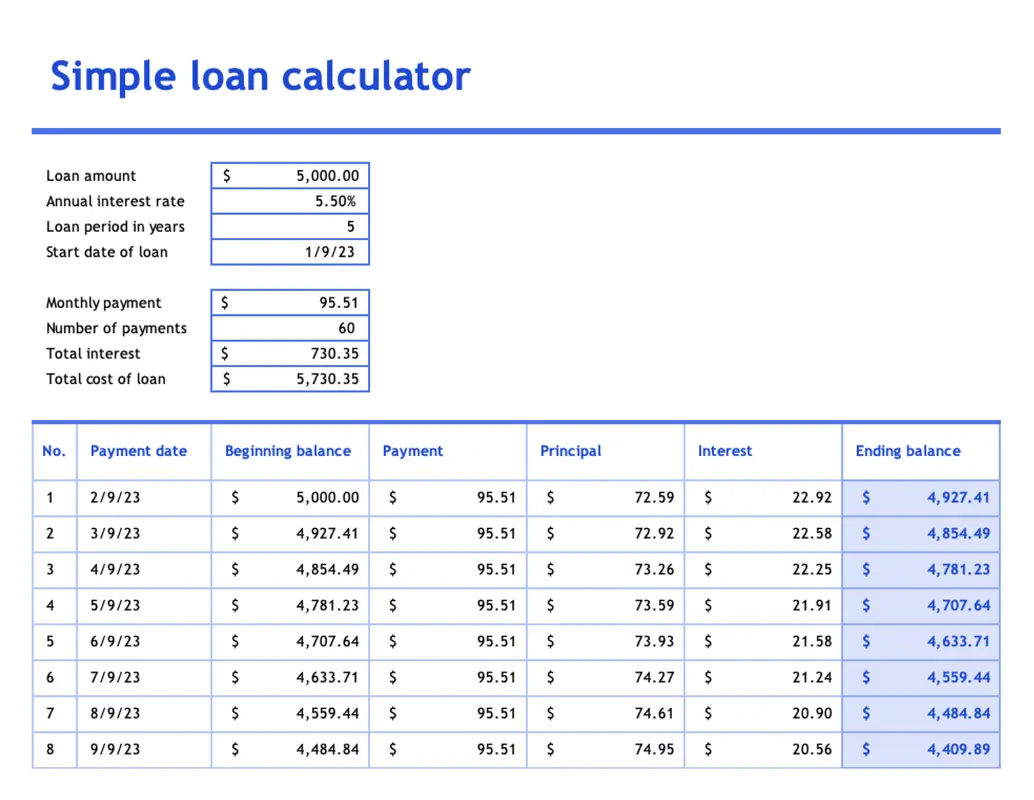

| Period | Payment | Interest | Balance |

|---|

Application fee

$500

Monthly fee

$10

Total regular fees

$1440

Total fees

$1940

Calculator Disclaimer

The repayment amount shown using this calculator is an estimate, based on information you have provided. It is provided for illustrative purposes only and actual repayment amounts may vary. To find out actual repayment amounts, contact us. This calculation does not constitute a quote, loan approval, agreement or advice by My Finance. It does not take into account your personal or financial circumstances.

In today’s financial landscape, understanding various loan types and their intricacies is essential for professionals such as accountants, financial advisors, and bankers. A Loan Calculator serves as a vital tool that streamlines the loan assessment process, providing accuracy and clarity for both clients and advisors. This comprehensive guide delves into the importance of utilizing a Loan Calculator, including the different types available, such as the Mortgage Loan Calculator, Personal Loan Calculator, and Auto Loan Calculator. By exploring how these calculators function and emphasizing their benefits, financial professionals can better equip themselves to assist clients in making informed financial decisions. Moreover, this guide will address common pitfalls to avoid when utilizing these tools, ensuring that users maximize the effectiveness of their calculations.

Understanding Loan Calculators

In the realm of finance, particularly for professionals such as accountants, financial advisors, and bankers, loan calculators serve as essential tools. These digital resources simplify complex calculations regarding various types of loans, allowing users to make informed decisions.

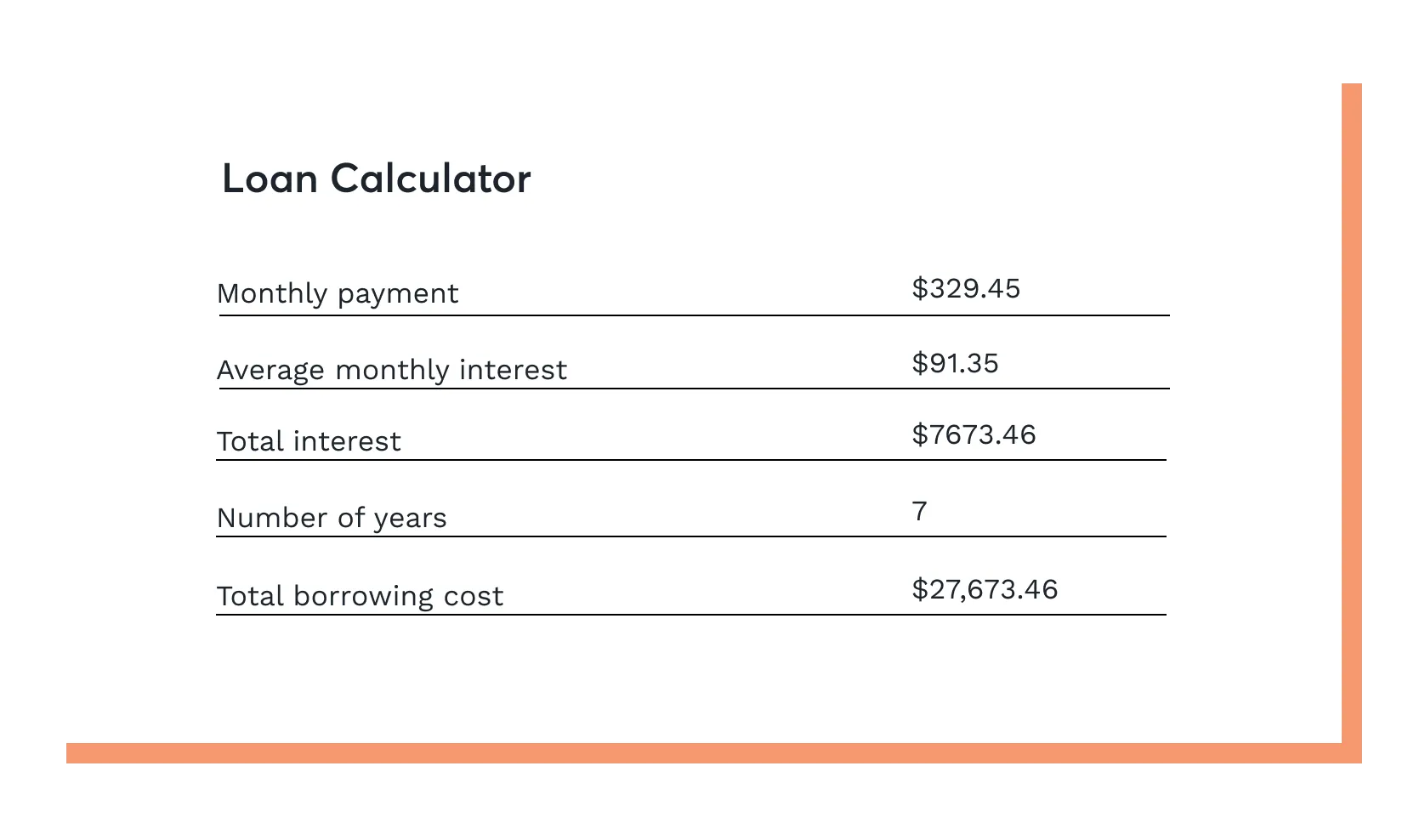

A loan calculator aids in determining key financial metrics, primarily focusing on:

- Monthly Payment: Assessing how much one needs to pay each month.

- Total Borrowing Costs: Evaluating the overall expense incurred over the life of the loan, including interest.

- Amortization Schedules: Providing a detailed view of how payments are applied to principal and interest over time.

Types of Loan Calculators

Loan calculators come in varying forms, each tailored to specific loan types. Here are some common varieties:

| Type of Loan Calculator | Functionality |

|---|---|

| Online Loan Calculator | Computes various loan payment scenarios quickly |

| Mortgage Loan Calculator | Focused on mortgage payments and amortization |

| Personal Loan Calculator | Designed for unsecured loans |

| Auto Loan Calculator | Targets auto financing and related expenses |

Professionals utilize these calculators to project financial commitments and convey clarity to clients. They help in crafting strategic repayment plans and projecting future financial conditions based on current loan terms.

Why Understanding Loan Calculators Matters

Familiarity with loan calculators empowers financial professionals to:

- Provide Accurate Estimates: Giving clients a clearer picture of potential payment structures.

- Facilitate Better Planning: Enabling both the professional and client to strategize effectively around budgeting and financial goals.

- Enhance Communication: Creating a common language of numbers that resonates with clients, thereby fostering trust and transparency.

In summary, understanding how loan calculators function is paramount for financial professionals to offer valuable insights and to guide clients through their loan-related decisions with confidence.

The Importance of Using a Loan Calculator

Loan calculators have emerged as vital tools in the realm of financial planning and budgeting. Their significance can be attributed to various factors that enhance both understanding and decision-making related to loans. Financial professionals, including accountants, financial advisors, and bankers, often recommend the use of these calculators to ensure clients make informed choices.

Key Benefits of Using Loan Calculators

- Efficiency in Calculations: Manually calculating loan payments can be tedious and prone to errors. Online loan calculators streamline this process, providing quick and accurate results, saving valuable time for professionals and their clients.

- Clarity in Options: Different loan types come with various terms and conditions. Whether dealing with a Mortgage Loan Calculator, Personal Loan Calculator, or Auto Loan Calculator, these tools simplify the complexities involved in comparing different loan options.

- Financial Literacy: Clients can better understand the implications of loan terms, interest rates, and repayment schedules. For example, utilizing a Mortgage Loan Calculator can help borrowers grasp how changes in interest rates affect monthly payments, fostering a more comprehensive financial literacy.

Usage Scenarios

| Scenario | Recommended Calculator | Key Insight |

|---|---|---|

| Buying a Home | Mortgage Loan Calculator | Understand total interest paid over the life of the loan. |

| Funding a Large Purchase | Personal Loan Calculator | Compare monthly payments across different loan amounts and durations. |

| Purchasing a Vehicle | Auto Loan Calculator | Analyze trade-offs between down payment amounts and monthly installments. |

In addition, loan calculators enable clients to see the full picture of their financial commitments. They allow for easy adjustments to input values such as interest rates or loan terms, making it simpler to envision different financial scenarios. This level of adaptability fosters trust and confidence between financial professionals and their clients.

Overall, the importance of using a loan calculator cannot be overstated. With the insights gained from such tools, financial professionals can guide their clients through the loan maze, ultimately leading to better financial decisions and enhanced satisfaction with their choices.

Components of a Loan Calculator

Loan calculators serve as vital tools in the financial sector, enabling professionals to perform quick and accurate computations relevant to various types of loans. Understanding the essential components of a loan calculator enhances its effectiveness, ensuring reliable outputs for both clients and advisors. Below are the primary components typically found in most loan calculators:

- Loan Amount: This is the principal sum being borrowed. Users need to input the desired amount they wish to finance.

- Interest Rate: This component allows users to specify the annual interest rate. The interest rate is crucial as it directly influences the total cost of the loan over time.

- Loan Term: The loan term signifies the period over which the loan will be repaid. Typically expressed in years, this factor plays a critical role in determining monthly payments.

- Monthly Payment: Many calculators generate an estimated monthly payment based on the above inputs. This function is integral for budgeting purposes.

- Total Interest Paid: Loan calculators often provide a breakdown of the interest that will accumulate over the life of the loan. This transparency lets financial professionals inform clients about the overall cost.

- Amortization Schedule: Some advanced calculators feature a comprehensive breakdown of each payment over the loan’s duration, including principal and interest portions.

- Additional Payments: Certain calculators allow users to input extra payments they plan to make, showcasing potential benefits like reducing the loan’s life or total interest paid.

Using an effective Online Loan Calculator can simplify these calculations, offering intuitive interfaces that require minimal input to yield accurate results. For example, a Mortgage Loan Calculator typically incorporates all these components to help evaluate potential mortgage obligations. Similarly, a Personal Loan Calculator or Auto Loan Calculator will tailor these components according to their specific loan types, facilitating more targeted financial insights.

In summary, comprehending these components equips financial professionals with the knowledge to employ loan calculators effectively, enabling clearer communication of financial obligations to clients.

Types of Loan Calculators

In the realm of finance, various Loan Calculators cater to specific needs, aiding financial professionals in providing precise guidance to their clients. Here are the primary types of loan calculators to consider:

- Online Loan Calculator: This digital solution estimates monthly payments across different loan types. It typically requires input such as loan amount, interest rate, and loan term. Financial professionals can utilize this tool for quick assessments across multiple scenarios, enhancing client discussions.

- Mortgage Loan Calculator: Specifically designed for real estate financing, this calculator assists in assessing monthly payments on a mortgage. It factors in principal, interest, taxes, and insurance (PITI). By inputting the purchase price, down payment, interest rate, and loan term, the user can derive a clearer picture of affordability.

- Personal Loan Calculator: This type targets unsecured loans often used for individual needs, from debt consolidation to medical expenses. It calculates potential monthly payments based on loan amount, interest rate, and repayment period. Financial advisors can leverage this tool to help clients determine manageable payment pathways.

- Auto Loan Calculator: Designed for car financing, this calculator helps assess loan affordability related to vehicle purchases. By inputting car price, down payment, loan term, and interest rate, users can forecast their monthly obligations. Understanding these payments can aid clients in making informed decisions about car purchases.

Here is a summary of each type of loan calculator:

| Type of Loan Calculator | Primary Use | Key Inputs |

|---|---|---|

| Online Loan Calculator | General loan payment estimation | Loan amount, interest rate, term |

| Mortgage Loan Calculator | Mortgage payment calculations | Purchase price, down payment, interest rate, term |

| Personal Loan Calculator | Estimating payments for personal financing | Loan amount, interest rate, repayment period |

| Auto Loan Calculator | Assessing vehicle financing options | Car price, down payment, loan term, interest rate |

Understanding the distinctions among these Loan Calculators empowers financial professionals to equip clients with precise insights tailored to their unique financial situations. By utilizing these tools effectively, advisers can enhance their ability to propose suitable loan options and foster informed decision-making among clients.

How Online Loan Calculators Function

Online loan calculators serve as essential tools for financial professionals by providing quick and accurate calculations for various types of loans. Understanding the underlying mechanisms of these calculators enhances their utility in advising clients effectively. Generally, these calculators incorporate sophisticated algorithms to process input data and deliver actionable insights.

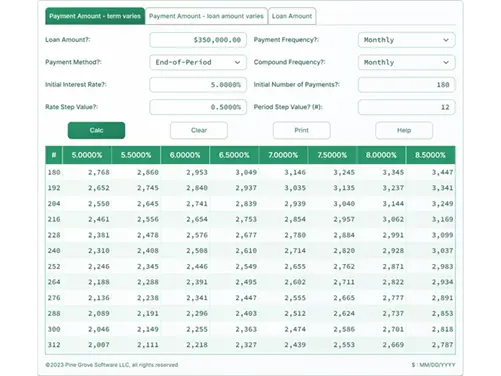

Key Features of Online Loan Calculators

- User Interface: An intuitive design allows users to enter necessary information effortlessly. This may include:

- Loan amount

- Interest rate

- Loan term (in years)

- Functionality: After entering the data, the calculator performs real-time calculations. Common outputs include:

- Monthly payment

- Total payment over the life of the loan

- Total interest paid

Process of Calculating Loan Payments

The core function of an Online Loan Calculator involves the application of specific formulas. The widely used formula for calculating monthly payments (PMT) in an amortizing loan is as follows:

[ PMT = \frac{P \times r(1 + r)^n}{(1 + r)^n – 1} ]

- P: Principal amount (initial loan amount)

- r: Monthly interest rate (annual interest rate divided by 12)

- n: Total number of payments (loan term in months)

User-Friendly Output

Once the calculations are performed, the user receives instant feedback on the loan scenario. Here’s how a typical output might look for different loan types:

| Loan Type | Monthly Payment | Total Payment | Total Interest Paid |

|---|---|---|---|

| Mortgage Loan | $1,250 | $450,000 | $150,000 |

| Personal Loan | $300 | $10,800 | $2,800 |

| Auto Loan | $500 | $18,000 | $3,000 |

These calculators make it easy for financial professionals to adjust parameters to see how changes affect the loan structure, allowing for tailored financial advice.

Overall, online loan calculators provide a streamlined approach to analyzing loan options, making them indispensable for financial professionals in their day-to-day operations. By leveraging the insights gained through these tools, professionals can guide their clients more effectively and help them make well-informed decisions regarding their financial futures.

Benefits of Using an Online Loan Calculator

Utilizing an Online Loan Calculator is becoming an indispensable tool for both financial professionals and individual borrowers. These digital resources streamline financial calculations, significantly enhancing efficiency in the decision-making process. Below are the key benefits associated with using an Online Loan Calculator:

- Quick and Accurate Calculations: One of the most significant advantages of an Online Loan Calculator is its ability to deliver immediate results. Professionals can input various loan parameters, such as interest rates and loan terms, to generate accurate monthly payments and total interest costs in seconds.

- User-Friendly Interface: Most Loan Calculators are designed with user experience in mind. The straightforward interface enables users, regardless of their financial literacy, to navigate easily through the input fields and obtain necessary calculations.

- Comparison Capabilities: Financial professionals often need to compare different loan offers. By using a Mortgage Loan Calculator, they can quickly assess various terms from multiple lenders, thus helping clients make informed decisions that align with their financial goals.

- Enhanced Financial Planning: With the aid of a Personal Loan Calculator, users can envision their future finances better. Knowing how different loan amounts and interest rates affect monthly payments aids in budgeting and strategic financial planning.

- Accessibility: Given their online nature, these calculators can be accessed from anywhere with an internet connection, which proves beneficial for busy professionals. This flexibility ensures timely assessments are always within reach.

- Cost-Free Resource: Unlike many financial services, most Online Loan Calculators are provided free of charge, allowing financial professionals to offer clients comprehensive advice without incurring additional costs.

- Visual Representation of Data: Some advanced Auto Loan Calculators feature graphical representations, such as charts and graphs, to illustrate payment schedules and total costs over time, aiding in clearer client communication.

In summary, employing an Online Loan Calculator not only enhances the efficiency of financial analyses but also enriches the overall experience for both professionals and clients. Through quick, accurate, and user-friendly calculations, financial professionals can deliver an elevated degree of service, ultimately fostering trust and satisfaction among their clients.

Understanding Mortgage Loans

Mortgage loans represent a fundamental component of real estate financing, allowing individuals or entities to purchase properties while paying back the borrowed funds over time. Financial professionals must grasp the intricacies of mortgage loans to assist clients in making informed decisions.

A mortgage loan typically involves a borrower seeking funds to buy a home or other types of real estate, secured by the property itself. Here are several key characteristics of mortgage loans:

- Collateral: The property itself acts as collateral, meaning if the borrower fails to repay, the lender can claim the property through foreclosure.

- Interest Rates: Mortgage loans can come with fixed or variable interest rates. Understanding the implications of each type is crucial for advising clients effectively.

- Term: Mortgages usually have varied terms, commonly ranging from 15 to 30 years. The term can significantly affect payment amounts and total interest paid.

- Down Payment: Most mortgage agreements require an upfront payment known as a down payment, which typically ranges from 3% to 20% of the property price. The higher the down payment, the lower the loan amount.

Benefits of Mortgage Loans

- Home Ownership: Mortgages facilitate property acquisition, enabling home ownership for individuals who may not afford full purchase upfront.

- Tax Benefits: Interest paid on mortgage loans can often be tax-deductible, providing a financial incentive to borrowers.

- Equity Building: As mortgage payments are made, borrowers build equity in their properties, enhancing their overall financial position over time.

Understanding these aspects of mortgage loans allows financial professionals to effectively guide their clients in selecting suitable mortgage options. By utilizing tools such as a Mortgage Loan Calculator, they can help clients visualize monthly payment structures and total costs, making it easier to formulate actionable financial strategies.

How to Use a Mortgage Loan Calculator

Using a Mortgage Loan Calculator can significantly ease the process of assessing mortgage options. This tool allows financial professionals to provide clients with calculations regarding monthly payments, interest rates, and total costs. Here’s a detailed step-by-step guide on how to effectively use a mortgage loan calculator:

- Gather Necessary Information Before starting, compile the following data:

- Loan Amount: This is the total amount borrowed.

- Interest Rate: The annual interest charged on the loan expressed as a percentage.

- Loan Term: The duration over which the mortgage will be repaid, typically in years (e.g., 15, 30).

- Property Taxes and Homeowners Insurance: These might be included in the total monthly payment, depending on the calculator.

- Input Data into the Calculator Enter the gathered data into the respective fields. Most online mortgage calculators include specific sections for the loan amount, interest rate, loan term, and any additional fees such as property taxes and insurance.

- Review the Outputs After inputting the data, the calculator will provide:

- Monthly Payment: This is the principal and interest payment.

- Total Interest Paid: The amount paid in interest over the life of the loan.

- Total Payment: The sum of all principal and interest payments, as well as any additional fees.

- Analyze Amortization Schedule Many calculators offer an option to view an amortization schedule, which breaks down each payment into principal and interest components over the life of the loan. This information is crucial for understanding how equity builds over time.

- Adjust Parameters for Scenarios Experimenting with different loan amounts, terms, or interest rates in the Mortgage Loan Calculator can help visualize how changes affect monthly payments. This is a valuable exercise for clients contemplating different financial situations.

Tips for Effective Use:

- Double-Check Input Data: Ensure all figures are accurate to avoid any discrepancies.

- Include Extra Costs: Consider inputting estimates for taxes and insurance for a comprehensive view.

- Use for Different Scenarios: Clients benefit from comparing various loan options, term lengths, or interest rates.

By mastering these steps, financial professionals can optimize their use of a Mortgage Loan Calculator, providing knowledgeable guidance to clients regarding their mortgage financing options.

Calculating Monthly Payments for Mortgages

Calculating monthly payments for mortgages is a crucial process for both financial professionals and their clients. Accurate calculations ensure that borrowers can manage their finances effectively and stay within budget parameters. This section sheds light on the key elements involved in determining mortgage payments, emphasizing the functionality of different loan calculators.

To calculate monthly mortgage payments, the following factors are essential:

- Loan Amount: This is the total amount financed by the lender, which can vary based on the property value and down payment.

- Interest Rate: The annual percentage rate (APR) charged by the lender, which significantly affects the overall cost of the loan.

- Loan Term: The duration over which the loan is to be repaid, typically expressed in years (e.g., 15, 20, or 30 years).

- Property Taxes and Homeowner’s Insurance: These expenses, though separate from the loan itself, can be included in the monthly payment calculation to provide a comprehensive view of what the borrower will be obligated to pay each month.

The formula for calculating monthly mortgage payments typically follows this structure:

[ M = P \times \frac{r(1+r)^n}{(1+r)^n-1} ]

Where:

- ( M ) = Total monthly mortgage payment

- ( P ) = Principal loan amount

- ( r ) = Monthly interest rate (annual rate / 12)

- ( n ) = Number of payments (loan term in months)

A Mortgage Loan Calculator can streamline this complex calculation by automating the process. These calculators allow users to input relevant data easily and receive immediate feedback.

Example Calculation

To illustrate how mortgage payments can vary, consider the following comparison table:

| Loan Amount | Interest Rate | Loan Term | Monthly Payment |

|---|---|---|---|

| $200,000 | 3.5% | 30 years | $898 |

| $200,000 | 4.0% | 30 years | $954 |

| $200,000 | 3.5% | 15 years | $1,423 |

By using a Mortgage Loan Calculator, financial professionals can provide their clients with exact monthly payment estimates, facilitating informed decisions regarding different mortgage options available in the market. Ultimately, having a thorough understanding of how to calculate monthly mortgage payments empowers both professionals and their clients to take better control of their financial futures.

Understanding Personal Loans

Personal loans represent a versatile financial product utilized by individuals for a multitude of personal reasons, typically unrelated to business. They are unsecured, meaning borrowers do not need to provide collateral to access funds. This characteristic makes them appealing; however, it also usually results in higher interest rates than secured loans. Understanding the essence of personal loans is crucial for financial professionals advising clients on borrowing options.

Key Characteristics of Personal Loans:

- Flexibility of Use: Funds from personal loans can be used for various purposes, including debt consolidation, medical expenses, home improvements, or unexpected financial emergencies.

- Fixed or Variable Rates: Borrowers can typically choose between fixed or variable interest rates, allowing for tailored repayment plans based on their financial circumstances.

- Loan Amounts and Terms: Personal loans range in amounts and generally have repayment terms from one to seven years, making them adaptable to different financial situations.

- Credit Evaluation: Lenders usually assess the borrower’s credit history and score before approving a loan, which influences the interest rates and amounts available.

Here’s a brief overview concerning personal loans in a tabular format for better clarity:

| Feature | Description |

|---|---|

| Loan Type | Unsecured |

| Interest Rates | Fixed or Variable |

| Typical Amount | $1,000 to $50,000+ |

| Repayment Period | 1 to 7 years |

| Use Cases | Debt consolidation, home improvement, medical expenses, etc. |

Providing this knowledge enables financial professionals to better assess and recommend personal loans to clients, ensuring a good match between individual needs and loan characteristics. Proper utilization of tools like Personal Loan Calculator can significantly aid in assessing the total cost and structuring payments effectively.

How to Use a Personal Loan Calculator

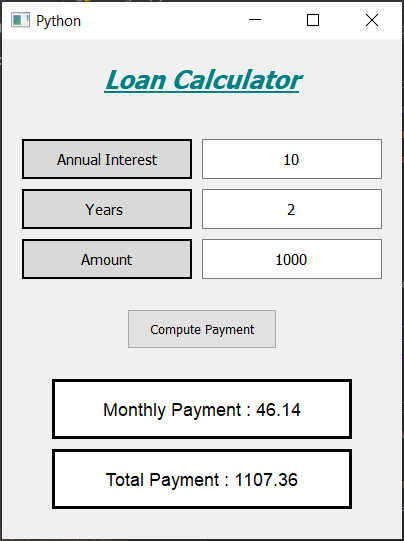

Utilizing a Personal Loan Calculator is a straightforward process that enables users to determine their potential loan repayments and manage their finances effectively. Financial professionals can enhance their client interactions by guiding them through the steps outlined below:

- Input Loan Amount:

- Begin by entering the desired loan amount. This figure should reflect the actual amount a client wishes to borrow.

- Specify the Interest Rate:

- Next, input the annual interest rate applicable to the loan. This number is crucial, as it significantly impacts the total cost of borrowing.

- Select the Loan Term:

- Select the loan term, which refers to the duration over which the loan will be repaid, often ranging from one to seven years. This choice influences monthly payments and overall interest paid.

- Choose the Payment Frequency:

- Indicate how often payments will be made (monthly, bi-weekly, etc.). Most personal loans are set on a monthly payment schedule, which should be the default option.

- Review the Results:

- Upon entering the necessary information, review the generated results. The Personal Loan Calculator will display:

- Estimated monthly payments

- Total interest paid over the loan term

- Total repayment amount

- Upon entering the necessary information, review the generated results. The Personal Loan Calculator will display:

Sample Calculation Overview

| Component | Example Values |

|---|---|

| Loan Amount | $10,000 |

| Annual Interest Rate | 5% |

| Loan Term | 5 years |

| Monthly Payment Estimate | $188.71 |

- Adjust Variables:

- Experiment with different interest rates or loan amounts to see how changes impact monthly payments, allowing clients to make informed decisions.

- Discuss the Findings:

- Discuss the implications of the results with clients, emphasizing how they can achieve their financial goals with strategic loan planning.

By mastering the use of a Personal Loan Calculator, financial professionals can provide valuable insights to their clients, ensuring they make well-informed decisions regarding their borrowing options.

Calculating Loan Payments for Personal Loans

Calculating loan payments for personal loans can be a straightforward process, especially with the aid of a Personal Loan Calculator. Understanding the methodology behind the calculations helps financial professionals provide valuable insights to clients considering personal loans.

To effectively calculate monthly payments, several key variables must be taken into account:

- Principal Amount: The total amount of money borrowed.

- Interest Rate: The annual interest rate expressed as a percentage.

- Loan Term: The duration over which the loan must be repaid, typically measured in years or months.

- Payment Frequency: The frequency of payments, often monthly.

The calculation formula for personal loan payments can be expressed as follows:

[ M = P \frac{r(1 + r)^n}{(1 + r)^n – 1} ]

Where:

- ( M ) = Total monthly payment

- ( P ) = Principal loan amount

- ( r ) = Monthly interest rate (annual rate divided by 12)

- ( n ) = Total number of payments (loan term in months)

For example, consider the following scenario:

| Component | Value |

|---|---|

| Principal Amount | $10,000 |

| Annual Interest Rate | 6% |

| Loan Term | 3 years (36 months) |

To find the monthly payment:

- Convert the annual interest rate to a monthly rate: 6% / 12 = 0.5% = 0.005 (as a decimal).

- Calculate the total number of payments: 3 years × 12 months/year = 36 months.

- Plug the values into the formula:

[ M = 10000 \frac{0.005(1 + 0.005)^{36}}{(1 + 0.005)^{36} – 1} ]

This calculation will yield a monthly payment amount, making it easier for financial professionals to guide their clients through their repayment plans.

Utilizing a Personal Loan Calculator enhances accuracy and saves time, allowing financial professionals to provide immediate feedback while educating their clients on potential payment structures. Professionals can also highlight the implications of varying the loan term and interest rate on monthly payments, emphasizing the transformative power of informed financial decisions.

Understanding Auto Loans

Auto loans are a prevalent form of financing that enables individuals to purchase vehicles without needing to pay the full amount upfront. These loans can be tailored to a range of financial needs and situations, thereby simplifying the process of acquiring a new or used vehicle. Financial professionals, including bankers and financial advisors, must understand the intricacies of auto loans to better serve their clients.

Key Features of Auto Loans

The following are critical elements that professionals should consider when discussing or advising on auto loans:

- Loan Amount: This is the total amount borrowed, which often includes the price of the vehicle, taxes, fees, and any additional costs.

- Interest Rate: The rate can be fixed or variable and typically depends on the borrower’s creditworthiness and market conditions.

- Loan Term: This refers to the duration over which the loan will be repaid, commonly ranging from 36 to 72 months.

- Down Payment: A significant upfront payment can reduce the loan amount and monthly payments, improving the loan’s overall affordability.

Benefits of Auto Loans

- Accessibility: Borrowers can purchase vehicles that may be otherwise unaffordable.

- Flexible Terms: Auto loans can be customized based on individual payment capabilities and financial circumstances.

- Credit Building: Timely payments help improve the borrower’s credit score over time.

Common Auto Loan Types

| Type | Description |

|---|---|

| New Car Loans | Tailored for purchasing brand-new vehicles. |

| Used Car Loans | Designed for financing pre-owned vehicles. |

| Refinance Loans | To secure better rates or terms on existing loans. |

| Leasing | A financing alternative that enables use without purchasing. |

In summary, an understanding of auto loans is crucial for financial professionals to help their clients navigate vehicle financing options effectively, ensuring they make informed decisions tailored to their financial circumstances.

How to Use an Auto Loan Calculator

Using an Auto Loan Calculator is a straightforward process that can yield significant insights for financial professionals dealing with clients contemplating vehicle purchases. This tool enables users to estimate monthly payments, understand total loan costs, and strategize financial planning for car purchases. Follow these steps to effectively utilize an Auto Loan Calculator:

- Input Loan Amount:

- Enter the total amount, including tax and fees, the user intends to borrow.

- Select Interest Rate:

- Input the annual interest rate. This rate can vary based on credit scores and lender conditions.

- Enter Loan Term:

- Specify the length of the loan in months (e.g., 36, 48, 60, or 72 months). Shorter terms typically lead to less interest paid but higher monthly payments.

- Assess Down Payment:

- If applicable, include any down payment amount or trade-in value. This reduces the total loan amount.

- Evaluate Taxes and Fees:

- Consider adding any applicable sales tax or fees that might affect the total loan amount.

Once all the relevant information is entered, the Auto Loan Calculator will typically display the following key outputs:

| Output | Description |

|---|---|

| Monthly Payment | The amount due each month over the term of the loan. |

| Total Interest Paid | The total amount of interest paid over the life of the loan. |

| Total Cost of Loan | The sum of principal and interest paid throughout the loan. |

These figures can aid financial professionals in advising clients accurately. Additionally, using the calculator multiple times with varying interest rates or loan amounts can help clients make informed decisions about their options. By understanding how to manipulate inputs effectively, financial experts can provide tailored advice to clients and facilitate smoother loan agreements.

Calculating Monthly Payments for Auto Loans

When it comes to financing a vehicle, accurately calculating monthly payments can significantly impact budget management. Understanding how to effectively use an Auto Loan Calculator can make this process smoother. The following steps outline how financial professionals can calculate monthly payments for auto loans.

- Gather Essential Information

- Determine the loan amount needed, which typically is the vehicle price minus any down payment.

- Identify the interest rate offered, which can vary based on credit score and lender.

- Establish the loan term, usually ranging from 36 to 72 months.

- Utilize an Auto Loan Calculator

- Input all gathered information into an Auto Loan Calculator.

- Ensure that the tool supports the calculation of principal and interest components.

- Calculate Monthly Payments

- For clarity, the formula used in calculating monthly payments is: [ M = P \frac{r(1 + r)^n}{(1 + r)^n – 1} ] Where:

- (M) = monthly payment

- (P) = principal loan amount

- (r) = monthly interest rate (annual rate divided by 12)

- (n) = number of payments (loan term in months)

- For clarity, the formula used in calculating monthly payments is: [ M = P \frac{r(1 + r)^n}{(1 + r)^n – 1} ] Where:

- Example Calculation

- For an auto loan of $25,000, at an interest rate of 5% for 60 months:

- Loan Amount (P): $25,000

- Monthly Interest Rate (r): 0.004167

- Loan Term (n): 60

- Plug these values into the formula to find:

- Monthly payment: approximately $471.78

- For an auto loan of $25,000, at an interest rate of 5% for 60 months:

- Consider Additional Costs

- It’s essential to remember that monthly payments can also include taxes, insurance, and additional fees. Incorporating these into calculations provides a comprehensive understanding of total financial commitment.

In summary, the use of an Auto Loan Calculator streamlines the process, allowing for informed financial decision-making and budget planning. Financial professionals can leverage these calculations to better advise their clients on feasible financing options for vehicle purchases.

Common Mistakes to Avoid When Using Loan Calculators

Utilizing Online Loan Calculators can significantly streamline the loan evaluation process; however, financial professionals should be wary of common pitfalls that may distort results or lead to misinformation. Here are some prevalent mistakes to avoid:

- Neglecting Input Accuracy: Users often input incorrect figures, such as an inaccurate loan amount or interest rate. Ensuring correct data entry is paramount for obtaining realistic calculations.

- Ignoring Loan Terms: Failing to account for the duration of the loan can result in distorted monthly payments. It’s crucial to select the right term to reflect the actual repayment schedule.

- Not Considering Additional Costs: Many calculators focus solely on principal and interest. Users should factor in additional costs such as taxes, insurance, and fees when using a Mortgage Loan Calculator or any other type.

- Assuming Fixed Rates: Loan calculators often provide results based on fixed rates, but many loans come with variable rates. Financial professionals must adjust calculations accordingly, especially for personal or auto loans.

- Disregarding Amortization: Neglecting to understand how amortization works can lead to incorrect assessments of interest paid over the life of the loan. Familiarity with amortization schedules is essential.

Here’s a summary table of common mistakes:

| Common Mistake | Impact | Avoidance Tip |

|---|---|---|

| Neglecting Input Accuracy | Misleading calculations | Double-check all figures before submission |

| Ignoring Loan Terms | Incorrect monthly payment and repayment period | Always verify the loan duration selected |

| Not Considering Additional Costs | Underestimating total expenses | Include all potential fees and costs in estimates |

| Assuming Fixed Rates | Inaccurate payment projections under variable rates | Clarify whether rates are fixed or variable |

| Disregarding Amortization | Misinterpretation of interest over the loan’s duration | Study the amortization schedule thoroughly |

Recognizing these common mistakes enables financial professionals to leverage Personal Loan Calculators and Auto Loan Calculators effectively. By avoiding these pitfalls, they can provide clients with accurate financial projections and insights, enhancing their overall loan processing experience.

Frequently Asked Questions

What is a loan calculator and how does it work?

A loan calculator is an online tool designed to help individuals estimate the monthly payments of a loan based on various factors such as the loan amount, interest rate, and loan term. Users input these details into the calculator, which then applies specific formulas to generate a projection of the monthly installments. Additionally, the calculator may provide a breakdown of total payment amounts, interest paid over the life of the loan, and sometimes even an amortization schedule to help borrowers understand their repayment plans better.

What types of loans can be calculated using this calculator?

This loan calculator can be used for various types of loans including personal loans, mortgage loans, auto loans, and student loans. Each type of loan has different terms and specifications, but the fundamental principles of calculating payments remain the same. Users simply need to input the relevant data specific to their loan type, such as principal amount, interest rate, and the period over which they plan to repay, allowing the calculator to deliver tailored results based on their needs.

Can I use the loan calculator for refinancing my mortgage?

Yes, a loan calculator can be effectively utilized for assessing refinancing options for a mortgage. By inputting the existing mortgage balance, interest rate, and new proposed terms for the refinanced loan, individuals can evaluate potential monthly savings, changes in overall interest costs, and how long it may take for the refinancing to pay off in terms of savings versus costs. This analysis can be crucial for making informed decisions about pursuing refinancing as a strategy for better financial management.

Is the loan calculator accurate, and can it replace getting a quote from a lender?

While the loan calculator provides a good estimate based on the inputs given, it should not be solely relied upon for the most accurate financial planning. Factors such as precision in interest rates, fees, and possible changes in financial circumstances can significantly affect the actual loan terms. Therefore, while the calculator is a helpful tool for preliminary comparisons, individuals are encouraged to seek quotes directly from lenders to obtain the most precise terms and conditions tailored to their specific situations.