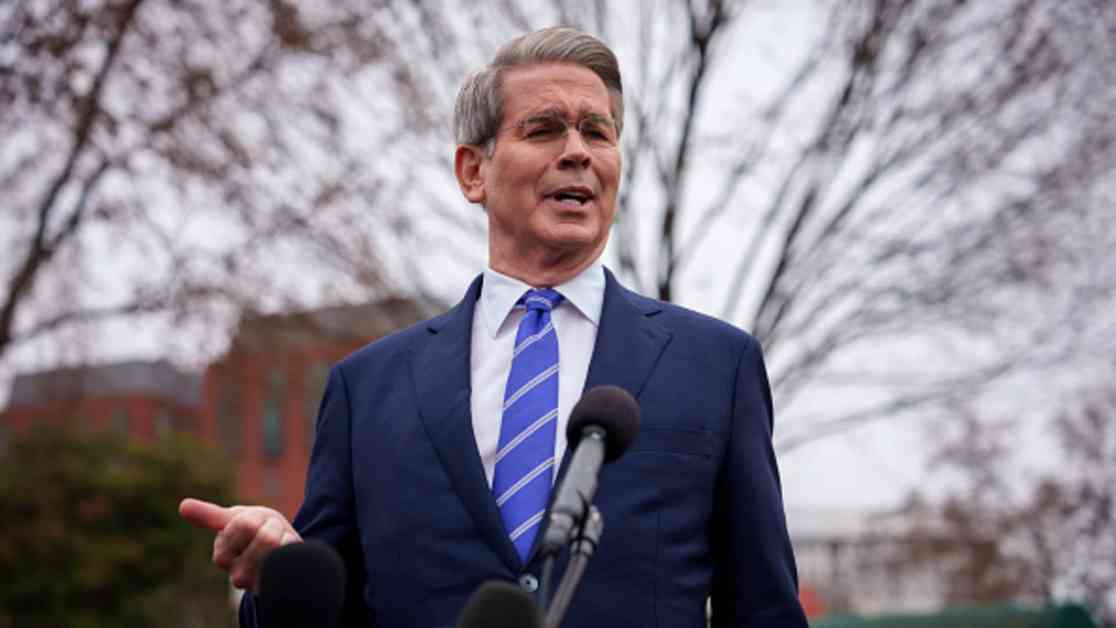

Treasury Secretary Scott Bessent emphasized the Trump administration’s commitment to the long-term stability of the economy and markets, brushing off short-term fluctuations as inconsequential. In an interview on CNBC’s “Squawk on the Street,” Bessent underscored the administration’s focus on the real economy and its potential to drive sustained growth for both the market and the American people.

Market volatility has been a hot topic lately, with President Donald Trump’s tariff policies sparking uncertainty among investors. The Dow Jones Industrial Average has dipped more than 7% in the past month, pushing the markets closer to correction territory. However, Bessent remains unfazed, expressing confidence in the administration’s ability to steer the economy and markets in a positive direction over time.

Expert Insight on Long-Term Investing

Bessent emphasized the importance of taking a long-term view when it comes to investing in stocks, highlighting their safety and potential for growth over extended periods. While acknowledging the short-term fluctuations, he stressed the need to focus on medium- and long-term goals to mitigate risks and maximize returns.

In the face of ongoing market volatility, Bessent’s reassurance comes as a beacon of hope for investors looking for stability amid turbulent times. By keeping the bigger picture in mind and implementing sound policies, he believes that the economy can weather the storm and continue to see positive gains in income, jobs, and asset value.

Market Response to Economic Indicators

As Bessent addressed the public, the markets showed signs of volatility, reflecting the uncertainty that continues to grip investors. Despite the fluctuations, there were positive indicators on the economic front, with reports of flat wholesale inflation in February and a slight decrease in consumer price rates. These figures provided some relief to investors concerned about the impact of Trump’s tariffs on inflation.

The Bureau of Labor Statistics’ data on wholesale inflation and consumer prices offered a glimmer of hope, suggesting that inflation may be under control, easing fears of further economic instability. Bessent noted that this development could boost market confidence, potentially leading to a more stable investment environment in the future.

In conclusion, Bessent’s remarks underscore the administration’s commitment to the long-term health of the economy and markets, steering away from short-lived market fluctuations. By emphasizing the importance of a strategic, forward-thinking approach to investing, he instills confidence in investors and policymakers alike, paving the way for sustained growth and stability in the financial landscape.