This article delves into the essential aspects of installment loans in 2025, focusing on their benefits, risks, and trends. By understanding these factors, consumers can make informed financial decisions that suit their needs.

Understanding Installment Loans

Installment loans are a form of borrowing where the borrower repays the loan amount in fixed installments over a predetermined period. These loans are commonly used for various purposes, such as financing a car, home, or personal expenses. The structured repayment plan allows borrowers to manage their finances more effectively.

Types of Installment Loans

- Personal Loans: Unsecured loans for various personal needs.

- Auto Loans: Specifically for purchasing vehicles.

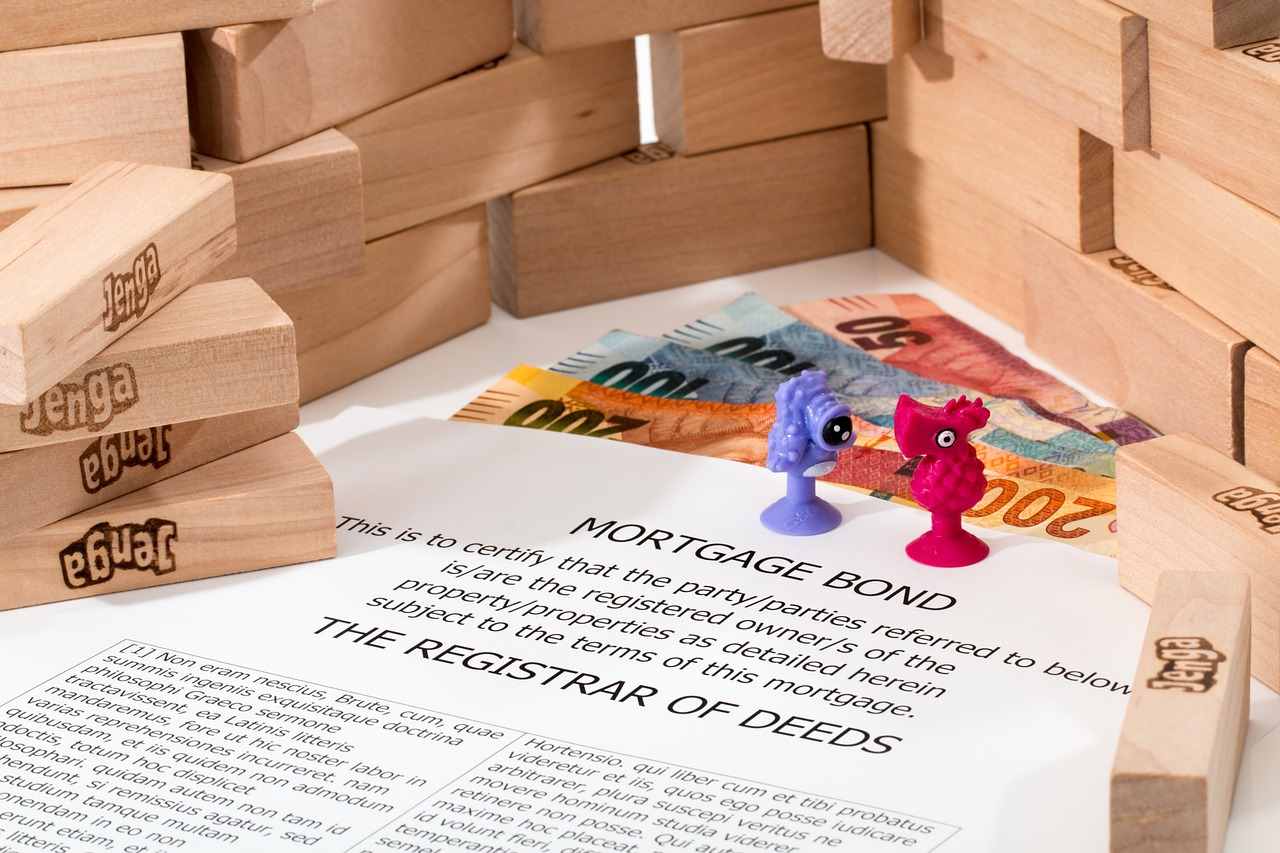

- Mortgages: Long-term loans for real estate purchases.

Current Trends in Installment Loans

As of 2025, the installment loan landscape is influenced by several key trends:

- Technological Advancements: Online platforms are making loan applications faster and more accessible.

- Regulatory Changes: New regulations are improving transparency and consumer protection.

- Borrower Preferences: A shift towards more flexible repayment options is evident.

Risks and Considerations

While installment loans offer numerous advantages, they also come with inherent risks. Understanding loan terms, interest rates, and the potential for debt accumulation is crucial. Borrowers must assess their financial situation carefully before committing to a loan.

How to Choose the Right Installment Loan

Selecting the best installment loan requires a thorough evaluation of available options. Consider factors such as interest rates, loan terms, and monthly payments. Additionally, reviewing your financial goals and current obligations can help you find the loan that best fits your needs.

Understanding Installment Loans

Installment loans represent a significant component of the borrowing landscape, allowing individuals to manage their finances more effectively. In essence, these loans enable borrowers to receive a lump sum of money upfront, which they then repay in fixed installments over a predetermined period. This structured repayment method not only simplifies budgeting but also offers a clear timeline for loan completion.

One of the primary features of installment loans is their predictability. Borrowers can expect consistent monthly payments, which typically include both principal and interest. This predictability aids in financial planning, as individuals can allocate funds accordingly each month without the worry of fluctuating payments.

Installment loans are commonly utilized for various purposes, including:

- Debt Consolidation: Many borrowers use installment loans to consolidate high-interest debts into a single, more manageable payment.

- Home Improvement: Homeowners often take out installment loans to finance renovations or repairs, enhancing their property’s value.

- Major Purchases: Whether it’s a new appliance or a vacation, installment loans can help spread the cost of significant expenses over time.

In terms of eligibility, lenders typically consider factors such as credit score, income, and debt-to-income ratio. These criteria help determine the loan amount, interest rate, and repayment terms. It’s essential for borrowers to review their financial situation and choose a loan that aligns with their needs and capabilities.

As we move through 2025, understanding the nuances of installment loans can empower consumers to make informed decisions. By recognizing their benefits and potential risks, borrowers can navigate the lending landscape with confidence, ensuring they select the right loan for their financial goals.

Types of Installment Loans

When it comes to financing options, installment loans have gained significant popularity due to their structured repayment plans. Understanding the various types of installment loans available can help borrowers make informed financial decisions. Below, we categorize these loans and highlight their unique features and purposes.

- Personal Loans

- These are unsecured loans that can be used for a variety of purposes, such as debt consolidation, home improvements, or unexpected expenses.

- Typically, personal loans have fixed interest rates and repayment terms ranging from 2 to 7 years.

- Auto Loans

- Specifically designed for purchasing vehicles, auto loans are usually secured by the vehicle itself.

- They often come with competitive interest rates and repayment terms that can span from 3 to 7 years.

- Mortgages

- Mortgages are long-term loans used to buy real estate, typically repaid over 15 to 30 years.

- There are various types of mortgages, including fixed-rate and adjustable-rate options, each with distinct features.

- Student Loans

- These loans are designed to help students cover their educational expenses.

- They often have lower interest rates and flexible repayment options, making them accessible for many borrowers.

- Home Equity Loans

- These loans allow homeowners to borrow against the equity in their homes, often used for major expenses like renovations or debt consolidation.

- Home equity loans typically have fixed interest rates and longer repayment terms.

Each type of installment loan serves a specific purpose, catering to different financial needs. Understanding these loans can empower consumers to choose the right option for their circumstances.

Personal Installment Loans

are a versatile financial tool that allows individuals to borrow money without the need for collateral. Unlike secured loans, which require the borrower to pledge an asset, personal installment loans offer the freedom to use the funds for a variety of purposes, such as consolidating debt, financing a major purchase, or covering unexpected expenses.

One of the primary benefits of personal installment loans is their flexibility. Borrowers can typically choose the loan amount and repayment term that best suits their financial situation. This adaptability makes them an attractive option for those who may not have access to traditional credit options. Additionally, personal loans often come with fixed interest rates, meaning that monthly payments remain consistent throughout the term of the loan, which aids in budgeting and financial planning.

| Typical Terms of Personal Installment Loans | Details |

|---|---|

| Loan Amount | $1,000 to $50,000 |

| Repayment Terms | 2 to 7 years |

| Interest Rates | 6% to 36% |

However, it’s important to consider the eligibility requirements before applying for a personal installment loan. Lenders typically evaluate factors such as credit score, income, and debt-to-income ratio. A higher credit score can lead to better interest rates and terms, making it essential for borrowers to assess their financial health prior to application.

In summary, personal installment loans provide a valuable option for individuals seeking financial assistance. With their flexible terms and straightforward application process, they can serve as an effective solution for various financial needs. However, borrowers should remain aware of their financial circumstances and the responsibilities that come with taking on debt.

Advantages of Personal Loans

In today’s fast-paced financial landscape, personal installment loans have emerged as a popular choice for individuals seeking quick and flexible funding solutions. Unlike traditional loans, personal loans provide borrowers with the ability to access funds swiftly, often with minimal paperwork and faster approval times. This section explores the key advantages of opting for personal loans over other borrowing options.

- Flexibility in Usage: One of the most significant benefits of personal loans is their versatility. Borrowers can use these funds for various purposes, such as consolidating debt, financing home improvements, or covering unexpected expenses. This flexibility makes personal loans an appealing choice for many.

- Quick Access to Funds: Personal loans typically feature streamlined application processes, allowing borrowers to receive funds quickly—sometimes even within 24 hours. This rapid access is particularly beneficial in emergencies, where immediate financial support is essential.

- Fixed Interest Rates: Many personal loans come with fixed interest rates, enabling borrowers to plan their finances effectively. With predictable monthly payments, individuals can better manage their budgets without the worry of fluctuating rates.

- Improved Credit Score: Responsibly managing a personal loan can positively impact a borrower’s credit score. By making timely payments, individuals can demonstrate their creditworthiness, potentially improving their chances of securing favorable terms on future loans.

- Unsecured Nature: Most personal loans are unsecured, meaning borrowers do not need to provide collateral. This feature reduces the risk of losing valuable assets and makes personal loans accessible to a broader audience.

In summary, personal installment loans offer numerous advantages, including flexibility, quick access to funds, and the potential for improved credit scores. These benefits make them a compelling option for those in need of financial assistance.

Disadvantages of Personal Loans

While personal loans can provide much-needed financial assistance, it is essential to be aware of their potential downsides. Understanding these risks can help borrowers make informed decisions and avoid pitfalls that could lead to financial strain.

- Higher Interest Rates: Personal loans often come with higher interest rates compared to secured loans, such as mortgages or auto loans. This is primarily because personal loans are usually unsecured, meaning they do not require collateral. As a result, lenders may charge higher rates to mitigate their risk.

- Fees and Charges: In addition to interest rates, borrowers may encounter various fees, including origination fees, late payment fees, and prepayment penalties. These additional costs can significantly increase the total amount to be repaid, making personal loans more expensive than initially anticipated.

- Impact on Credit Score: Taking out a personal loan can affect your credit score. If you miss payments or default, it can lead to a significant drop in your credit rating. Moreover, applying for multiple loans in a short period can also negatively impact your credit score due to hard inquiries.

- Debt Accumulation: The ease of obtaining personal loans can lead to borrowers accumulating multiple debts, which can be overwhelming. Without careful budgeting and planning, individuals may find themselves in a cycle of borrowing that is difficult to escape.

- Limited Loan Amounts: Depending on the lender and the borrower’s creditworthiness, the amount available for personal loans may be limited. This can be a disadvantage for those needing larger sums for significant expenses, such as home renovations or medical bills.

In conclusion, while personal loans can offer quick access to funds, they come with inherent risks that potential borrowers must carefully consider. By being aware of these disadvantages, individuals can make more informed financial choices and potentially avoid costly mistakes.

Auto Loans

are specialized financial products created to assist consumers in purchasing vehicles. Understanding how these loans operate, their typical terms, and important considerations before applying can significantly impact your borrowing experience.

When you apply for an auto loan, you essentially borrow a sum of money from a lender to buy a car. This loan is typically secured by the vehicle itself, meaning that if you fail to make payments, the lender has the right to repossess the car. The loan amount, interest rate, and repayment term will vary based on several factors, including your credit score, income, and the vehicle’s price.

| Loan Term | Typical Duration | Monthly Payments |

|---|---|---|

| Short-term | 24-36 months | Higher payments, less interest |

| Medium-term | 48-60 months | Balanced payments |

| Long-term | 72 months or more | Lower payments, more interest |

Most auto loans come with terms ranging from 36 to 72 months, allowing borrowers to choose a duration that fits their budget. It’s essential to consider the total cost of the loan, including interest rates, which can vary significantly based on your credit history. A higher credit score typically results in lower interest rates, making it crucial to check your credit report before applying.

- Down Payment: A larger down payment can reduce the loan amount and monthly payments.

- Loan Pre-Approval: Getting pre-approved can provide a clearer picture of your budget and strengthen your negotiating position at the dealership.

- Loan Terms: Always read the fine print regarding fees and penalties for early repayment.

In summary, while auto loans can make vehicle ownership more accessible, it’s essential to conduct thorough research and understand the terms and conditions before committing. Making informed decisions can lead to a more favorable borrowing experience.

Mortgage Installment Loans

When it comes to purchasing a home, understanding is crucial for potential homebuyers. These loans are specifically designed to facilitate the acquisition of real estate, allowing individuals to spread the cost of their homes over an extended period. This section will explore the various types of mortgage loans available, their unique characteristics, and the implications for homebuyers.

There are several primary types of mortgage loans that cater to different financial situations and needs:

- Fixed-Rate Mortgages: These loans maintain a constant interest rate throughout the life of the loan, ensuring predictable monthly payments.

- Adjustable-Rate Mortgages (ARMs): Unlike fixed-rate mortgages, ARMs have interest rates that may change periodically based on market conditions, which can lead to fluctuating monthly payments.

- Interest-Only Mortgages: Borrowers pay only the interest for a specified period, after which they begin repaying the principal. This type can be beneficial for those expecting an increase in income.

- FHA Loans: Insured by the Federal Housing Administration, these loans are designed for low-to-moderate-income borrowers and typically require lower down payments.

- VA Loans: Available to veterans and active military members, VA loans offer favorable terms, including no down payment and no private mortgage insurance (PMI).

Choosing the right type of mortgage can significantly affect a homebuyer’s financial future. For instance, while a fixed-rate mortgage provides stability, an ARM may offer lower initial payments but carries the risk of increased costs later on. Homebuyers should carefully assess their financial situation, future income prospects, and risk tolerance before making a decision.

In summary, understanding the different types of mortgage installment loans and their implications is essential for making informed decisions in the home-buying process. By considering the features and potential risks of each loan type, homebuyers can choose the option that best suits their needs and financial goals.

Fixed-Rate Mortgages

are a popular choice for homebuyers seeking stability in their monthly payments. Unlike adjustable-rate mortgages, which can fluctuate over time, fixed-rate mortgages maintain a consistent interest rate throughout the life of the loan. This feature provides borrowers with predictable budgeting, making it easier to manage finances over the long term.

One of the primary benefits of fixed-rate mortgages is the peace of mind that comes from knowing your payment will not change. This is particularly advantageous in a rising interest rate environment, where borrowers can lock in a lower rate compared to future market rates. Additionally, fixed-rate mortgages often offer longer repayment terms, typically ranging from 15 to 30 years, allowing for lower monthly payments.

However, there are also drawbacks to consider. Fixed-rate mortgages may come with higher initial interest rates compared to adjustable-rate mortgages, which can be appealing in the short term. This means that if market rates drop, borrowers with fixed-rate loans may miss out on potential savings. Additionally, the long-term commitment of a fixed-rate mortgage can be a disadvantage for those who anticipate moving or refinancing within a few years.

When evaluating whether a fixed-rate mortgage is the right choice, it is essential to consider your financial situation and long-term goals. Factors such as job stability, income growth potential, and plans for homeownership can influence your decision. Furthermore, potential homeowners should also assess their credit score, as this will impact the interest rate they receive.

In summary, fixed-rate mortgages offer a blend of stability and predictability, making them a favored option for many borrowers. By understanding the benefits and drawbacks, individuals can make informed decisions that align with their financial objectives.

Adjustable-Rate Mortgages

Adjustable-rate mortgages (ARMs) are a popular choice for many homebuyers due to their unique structure, which features fluctuating interest rates. Unlike fixed-rate mortgages, where the interest rate remains constant throughout the loan term, ARMs offer a variable rate that can change over time. This section will explore the advantages and risks associated with ARMs, helping potential borrowers make informed decisions.

One of the primary advantages of ARMs is the potential for lower initial interest rates. Typically, ARMs start with a fixed rate for an initial period—often 5, 7, or 10 years—after which the rate adjusts periodically based on market conditions. This can result in significantly lower monthly payments compared to fixed-rate mortgages during the initial phase. For buyers who plan to move or refinance before the adjustment period, ARMs can be particularly appealing.

Another benefit is the possibility of benefiting from decreasing interest rates. If market rates drop, the interest rate on an ARM may also decrease, leading to lower payments. This can be advantageous for borrowers who anticipate favorable market conditions. Additionally, ARMs often come with caps on how much the interest rate can increase at each adjustment, providing some level of protection against drastic rate hikes.

However, ARMs also come with inherent risks. The most significant risk is the potential for rising interest rates, which can lead to increased monthly payments. Borrowers may find themselves facing financial strain if their payments rise significantly after the initial fixed period. Moreover, understanding the terms of adjustment can be complex, and some borrowers may not fully grasp how their payments could change over time.

Furthermore, ARMs can lead to uncertainty in long-term financial planning. Unlike fixed-rate mortgages, where borrowers can predict their payments with certainty, ARMs introduce variability that can complicate budgeting and financial stability.

In summary, while adjustable-rate mortgages offer enticing advantages such as lower initial rates and potential savings, they also carry significant risks that borrowers must consider. It is crucial for potential homeowners to carefully evaluate their financial situation and risk tolerance before opting for an ARM.

Current Trends in Installment Loans

As we approach 2025, the landscape of installment loans is evolving rapidly, influenced by a variety of factors. This section explores the key trends that are currently shaping the industry, including advancements in technology, shifts in regulatory frameworks, and changing borrower preferences.

- Technological Innovations: The rise of digital platforms and mobile applications has revolutionized how consumers access installment loans. Borrowers can now complete applications online, receive instant approvals, and manage their loans through user-friendly interfaces. This technological shift has not only enhanced the customer experience but also increased competition among lenders.

- Regulatory Changes: In recent years, governments have introduced new regulations aimed at protecting consumers from predatory lending practices. These changes often require lenders to disclose more information about loan terms and fees, promoting transparency. As a result, borrowers are becoming more informed and cautious when choosing loan products.

- Shifting Borrower Preferences: Today’s borrowers are increasingly seeking flexible and tailored loan options. Many prefer loans with customizable terms that can adapt to their financial situations. This trend has led lenders to offer more personalized solutions, such as variable repayment plans and loan amounts based on individual credit profiles.

- Focus on Financial Wellness: As financial literacy improves, borrowers are becoming more aware of their financial health. This awareness is driving demand for installment loans that come with educational resources, helping consumers make better borrowing decisions. Lenders are responding by providing tools and resources that promote responsible borrowing.

- Increased Use of Alternative Data: Traditional credit scores are no longer the sole measure of a borrower’s creditworthiness. Lenders are increasingly using alternative data, such as payment histories for utilities and rent, to assess risk. This approach allows more individuals to qualify for loans, particularly those with limited credit histories.

In summary, the installment loan market in 2025 is characterized by technological advancements, regulatory changes, and evolving borrower preferences. These trends are not only reshaping how loans are offered but also enhancing the overall borrowing experience for consumers.

Risks and Considerations

When considering installment loans, it is crucial to acknowledge that, while they can provide significant financial relief, they are not without their risks. Understanding the terms of the loan, including interest rates and repayment schedules, is essential to avoid falling into a cycle of debt.

One of the primary risks associated with installment loans is the potential for debt accumulation. Borrowers may find themselves taking out multiple loans to cover existing debts, leading to a precarious financial situation. It is vital to assess your financial health before committing to any loan.

- Loan Terms: Always read the fine print. Understanding the specifics of your loan agreement, such as the duration of the loan and the total repayment amount, can prevent unpleasant surprises.

- Interest Rates: Interest rates can vary significantly based on your credit score and the lender. A higher interest rate can increase the total cost of the loan, making it essential to shop around for the best rates.

- Fees and Charges: Many lenders impose additional fees, such as origination fees or late payment penalties. Be sure to factor these into your total loan cost.

Moreover, financial literacy plays a crucial role in managing installment loans effectively. Borrowers should educate themselves about budgeting and repayment strategies to ensure they can meet their obligations without jeopardizing their financial stability.

In summary, while installment loans can be a useful financial tool, they come with inherent risks that require careful consideration. By understanding the loan terms, interest rates, and the potential for debt accumulation, borrowers can make informed decisions that align with their financial goals.

How to Choose the Right Installment Loan

Selecting the best installment loan is a crucial financial decision that requires careful consideration of various factors. To help you navigate through the myriad of options available, here are some practical tips to evaluate loan choices effectively.

- Assess Your Financial Situation: Begin by reviewing your current financial status. Understand your income, expenses, and any existing debts. This will help you determine how much you can afford to borrow and repay.

- Understand Loan Types: Familiarize yourself with different types of installment loans, such as personal loans, auto loans, and mortgages. Each type has unique terms, interest rates, and purposes, so choose one that aligns with your needs.

- Compare Interest Rates: Interest rates can significantly affect the total amount you’ll pay over the loan term. Shop around and compare rates from various lenders to find the most competitive offers.

- Review Loan Terms: Look beyond interest rates and examine the loan terms, including repayment periods and any associated fees. A longer repayment term may lower your monthly payment but could lead to higher overall costs.

- Check Lender Reputation: Research potential lenders to ensure they have a good reputation. Read reviews and check their ratings with consumer protection agencies to gauge their reliability and customer service.

- Understand Your Credit Score: Your credit score plays a significant role in loan approval and interest rates. Knowing your score can help you anticipate the types of loans you may qualify for and the terms you can expect.

- Ask Questions: Don’t hesitate to ask lenders about anything you don’t understand. Clear communication can help you avoid surprises later on, ensuring you fully comprehend your obligations.

By following these tips, you can make a more informed decision when selecting an installment loan that fits your financial situation. Remember, the right loan can help you achieve your goals without compromising your financial stability.

Frequently Asked Questions

- What are installment loans?

Installment loans are a type of borrowing where you repay the loan amount in fixed payments over a set period. Think of it like paying for a new gadget in monthly chunks instead of one big hit to your wallet!

- What are the common types of installment loans?

Common types include personal loans, auto loans, and mortgages. Each serves a different purpose, like personal loans for emergencies, auto loans for your dream car, and mortgages for buying a home.

- What are the advantages of personal installment loans?

Personal installment loans offer flexibility and quick access to cash. They can be used for anything from unexpected expenses to big purchases. It’s like having a financial safety net when you need it most!

- Are there any risks associated with installment loans?

Yes, while they can be helpful, risks include high interest rates and the potential for accumulating debt if not managed properly. It’s crucial to read the fine print and understand what you’re getting into.

- How can I choose the right installment loan for me?

Choosing the right loan involves evaluating your financial situation, comparing interest rates, and understanding the terms. Take your time—it’s like picking the best flavor at an ice cream shop!