This article explores various alternatives to payday loans, providing insights into safer and more sustainable financial options for those in need of quick cash in 2025.

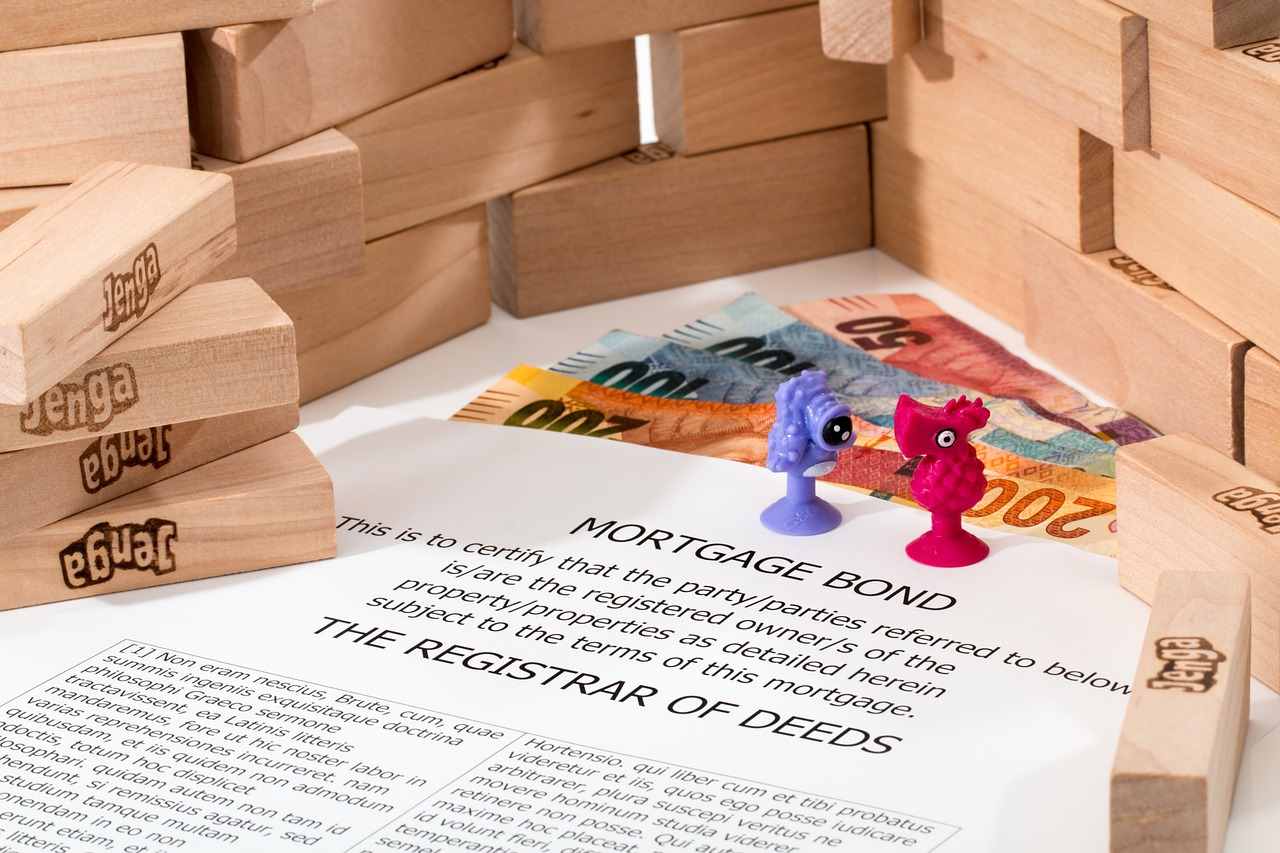

Understanding Payday Loans

Payday loans are typically short-term, high-interest loans designed to cover urgent expenses. They often come with exorbitant fees and can lead borrowers into a cycle of debt. Understanding how these loans work is crucial for anyone considering them, as the risks can far outweigh the benefits.

Why Consider Alternatives to Payday Loans?

The drawbacks of payday loans include high fees, potential for debt cycles, and negative impacts on credit scores. Exploring alternatives can provide safer financial options that help avoid these pitfalls.

Credit Unions: A Community-Focused Option

Credit unions often offer lower interest rates and more personalized services compared to traditional banks. They are member-owned and can provide affordable loans and financial education, making them a viable option for those in need.

Personal Installment Loans Explained

Unlike payday loans, personal installment loans provide a fixed amount of money that is repaid in manageable installments. They typically come with lower interest rates and longer repayment periods, making them a more sustainable choice.

Peer-to-Peer Lending Platforms

Peer-to-peer lending connects borrowers directly with individual lenders, often resulting in better rates than traditional loans. These platforms can offer flexible terms and a more personal lending experience.

Emergency Savings Funds

Establishing an emergency savings fund can serve as a financial buffer. By setting aside even a small amount regularly, individuals can build a safety net to cover unexpected expenses, reducing the need for costly loans.

Credit Cards as an Alternative

If managed wisely, credit cards can be a viable alternative to payday loans. They offer rewards and benefits, but it’s essential to avoid high-interest debt by paying off balances promptly.

Side Gigs and Freelancing Opportunities

Supplementing income through side gigs can alleviate financial pressure. Options like freelancing, pet sitting, or driving for ride-share services can provide extra cash when needed.

Community Assistance Programs

Many communities offer assistance programs for those in financial distress. Local charities and government programs can provide temporary relief without the burdens of high interest.

Negotiating with Creditors

If you’re struggling to make ends meet, negotiating with creditors may provide some relief. Open communication can lead to reduced payments or extended deadlines.

Financial Counseling Services

Seeking help from financial counseling services can provide guidance on managing debt and improving financial literacy. These professionals can help you devise a plan to regain control over your finances.

Long-Term Financial Planning

Creating a comprehensive financial plan can help prevent the need for payday loans in the future. Essential components include budgeting, saving, and investing, all aimed at fostering long-term financial health.

Understanding Payday Loans

Payday loans are a type of short-term financing that typically features high-interest rates and are designed to provide quick cash to borrowers facing urgent financial needs. These loans are often marketed as a convenient solution for unexpected expenses, such as car repairs, medical bills, or overdue rent. However, the mechanics of payday loans can lead to significant financial strain for borrowers.

When an individual takes out a payday loan, they usually agree to repay the amount plus interest by their next payday, which is typically within two to four weeks. The loan amount is often small, ranging from $100 to $1,500, but the annual percentage rate (APR) can soar as high as 400% or more. This exorbitant interest can trap borrowers in a cycle of debt, as many find themselves unable to repay the loan on time, leading to the need for additional loans to cover the original debt.

One of the primary risks associated with payday loans is the potential for debt cycles. Borrowers may find themselves repeatedly borrowing to pay off previous loans, resulting in escalating fees and a growing financial burden. Furthermore, these loans can negatively impact credit scores if payments are missed, making it difficult for individuals to access more favorable financing options in the future.

Given these risks, many individuals are increasingly seeking alternatives to payday loans. Understanding the mechanics and implications of payday loans is crucial for making informed financial decisions. By exploring safer and more sustainable options, borrowers can avoid the pitfalls associated with these high-interest loans and work towards achieving greater financial stability.

Why Consider Alternatives to Payday Loans?

When facing financial emergencies, many individuals turn to payday loans for quick cash. However, it is crucial to understand the significant drawbacks associated with these loans. One of the primary concerns is the high fees that accompany payday loans, often leading to a cycle of debt that can be difficult to escape.

Payday loans typically charge exorbitant interest rates, which can range from 300% to over 500% annually. This means that a borrower who takes out a $500 loan could end up paying back more than $1,500 within a few weeks. Such steep fees can quickly accumulate, trapping borrowers in a cycle where they must take out new loans to pay off old ones, thereby creating a debt spiral.

Moreover, the short repayment terms of payday loans—often just a few weeks—do not provide sufficient time for borrowers to recover financially. Many find themselves unable to meet the repayment deadline, leading to further borrowing and increasing their financial strain. This vicious cycle can severely impact one’s credit score and overall financial health.

Understanding these risks highlights the importance of seeking safer financial options. Alternatives such as credit unions, personal installment loans, and community assistance programs can provide more sustainable solutions. These options often come with lower interest rates, longer repayment periods, and more manageable terms, allowing borrowers to regain control over their finances.

In conclusion, recognizing the pitfalls of payday loans is essential in making informed financial decisions. By exploring safer alternatives, individuals can avoid the high fees and debilitating debt cycles associated with payday loans, paving the way for a more stable financial future.

Credit Unions: A Community-Focused Option

Credit unions are increasingly recognized as a community-focused alternative to traditional banks, offering a range of benefits that can significantly improve the financial well-being of their members. Unlike conventional banks, which prioritize profit, credit unions operate as non-profit entities, meaning any earnings are reinvested back into the organization to benefit members directly.

One of the most compelling advantages of credit unions is their lower interest rates. This is particularly beneficial for individuals seeking loans, as credit unions typically offer rates that are significantly lower than those of traditional banks. For example, the average interest rate on a personal loan from a credit union can be several percentage points lower than that of a bank, making it more affordable for borrowers.

Additionally, credit unions often provide more personalized services. Members are treated as part of a community rather than just customers. This results in tailored financial advice and support, which can be especially valuable for those navigating financial challenges. Credit unions also tend to have a more flexible approach to lending, often considering individual circumstances rather than strictly adhering to credit scores.

Accessing the services of a credit union is straightforward. Individuals can typically join by meeting certain eligibility criteria, such as living in a specific area or working for a particular employer. Once a member, individuals can enjoy a variety of financial products, including savings accounts, loans, and credit cards, often with more favorable terms than those offered by traditional banks.

In summary, credit unions represent a valuable resource for individuals seeking financial assistance. With their focus on community and member service, they provide lower costs and personalized support, making them an attractive alternative to payday loans and traditional banking options.

Personal Installment Loans Explained

Personal installment loans are a type of borrowing that allows individuals to receive a specific amount of money, which is then paid back over a set period through regular installments. Unlike payday loans, which often require repayment within a short timeframe and come with exorbitant interest rates, personal installment loans offer a more manageable repayment structure.

One of the key benefits of personal installment loans is the predictability they provide. Borrowers know exactly how much they will pay each month, making it easier to budget and plan for future expenses. This fixed repayment schedule can significantly reduce the risk of falling into a cycle of debt, which is a common issue with payday loans.

Additionally, personal installment loans typically come with lower interest rates compared to payday loans. While rates can vary based on creditworthiness and lender policies, borrowers can often find more favorable terms that make repayment less burdensome. This is especially important for those who may already be facing financial challenges.

Moreover, personal installment loans can be used for a variety of purposes, including consolidating debt, covering unexpected expenses, or financing larger purchases. This flexibility allows borrowers to tailor their loan to their specific needs, further distinguishing them from payday loans, which are often intended for short-term, emergency needs only.

In summary, personal installment loans provide a more sustainable and manageable alternative for those in need of quick cash. By understanding their benefits and how they differ from payday loans, borrowers can make informed decisions that support their financial well-being.

Peer-to-Peer Lending Platforms

Peer-to-peer lending platforms have emerged as a revolutionary financial solution, bridging the gap between borrowers and individual lenders. Unlike traditional lending institutions, these platforms enable direct transactions, effectively eliminating the middleman. This innovative approach allows borrowers to access funds quickly and with potentially lower interest rates compared to conventional loans.

At the core of peer-to-peer lending is the concept of a marketplace where individuals can lend money to one another. Borrowers can present their financial needs, and lenders can choose to fund these requests based on their risk appetite. This system not only democratizes lending but also creates an opportunity for lenders to earn higher returns compared to traditional savings accounts.

One of the primary advantages of peer-to-peer lending is its flexibility. Borrowers can often secure loans without the stringent requirements imposed by banks, such as high credit scores or extensive documentation. This accessibility makes it a viable alternative for those who may have been turned away by traditional lenders.

Additionally, peer-to-peer lending platforms typically offer transparent terms and conditions, allowing borrowers to understand the total cost of their loans upfront. This transparency is crucial in avoiding the hidden fees often associated with payday loans, which can trap borrowers in a cycle of debt.

Moreover, the competitive nature of these platforms often drives interest rates down, benefiting borrowers. Lenders, on the other hand, can diversify their investments by funding multiple loans, reducing their overall risk.

In summary, peer-to-peer lending represents a modern alternative to payday loans, offering greater accessibility, transparency, and potentially lower costs. As financial technology continues to evolve, these platforms are likely to play an increasingly significant role in the lending landscape.

Emergency Savings Funds

Establishing an emergency savings fund is a crucial step in achieving financial stability. This fund acts as a financial buffer during unexpected situations, such as medical emergencies, job loss, or urgent home repairs. By having a dedicated savings account, individuals can avoid relying on high-interest loans, such as payday loans, which can lead to a cycle of debt.

To effectively build and maintain an emergency savings fund, consider the following strategies:

- Set a Clear Goal: Determine how much you want to save. A common target is to have three to six months’ worth of living expenses set aside.

- Create a Budget: Analyze your monthly income and expenses. Identify areas where you can cut back to allocate more towards your savings.

- Automate Your Savings: Set up automatic transfers from your checking account to your savings account. This makes saving easier and ensures consistency.

- Start Small: If you’re unable to save a large amount initially, start with a manageable sum. Even a small contribution can add up over time.

- Use High-Interest Savings Accounts: Look for savings accounts that offer higher interest rates. This will help your money grow faster.

Maintaining your emergency fund is equally important. Regularly review your savings goals and adjust them as your financial situation changes. Additionally, avoid using this fund for non-emergent expenses. If you do dip into your savings, make a plan to replenish it as soon as possible.

In conclusion, an emergency savings fund is an essential component of a sound financial strategy. By implementing these strategies, you can create a robust safety net that provides peace of mind and financial security.

Credit Cards as an Alternative

Credit cards can serve as a valuable alternative to payday loans when used judiciously. Unlike payday loans, which often come with exorbitant interest rates and short repayment terms, credit cards offer a more flexible and potentially cost-effective solution for managing unexpected expenses. However, it is crucial to understand both the advantages and the risks associated with credit card use.

One of the primary benefits of using credit cards is the availability of a grace period. This period allows cardholders to pay off their balance without incurring interest, provided they settle the amount before the due date. This feature can significantly reduce the cost of borrowing when compared to payday loans, which typically require repayment within a few weeks at high interest rates.

Additionally, many credit cards offer rewards programs, cash back, and other incentives that can provide added value for everyday purchases. By using a credit card responsibly, individuals can not only manage their finances more effectively but also earn rewards that can be beneficial in the long run.

| Benefits of Credit Cards | Potential Pitfalls |

|---|---|

| Flexible repayment options | High interest rates if balances are not paid in full |

| Rewards and cash back | Potential for overspending |

| Emergency fund access | Risk of debt accumulation |

On the flip side, relying on credit cards can lead to significant financial challenges if not managed properly. The temptation to overspend is a common issue, especially when individuals view their credit limit as disposable income. Furthermore, failure to make timely payments can result in high interest rates and damage to credit scores.

In conclusion, while credit cards can be a viable alternative to payday loans, it is essential for users to approach them with caution. By understanding the benefits and pitfalls, individuals can make informed decisions that enhance their financial well-being.

Side Gigs and Freelancing Opportunities

In today’s fast-paced world, supplementing income through side gigs has become a popular strategy for many individuals looking to alleviate financial pressure. With the rising cost of living and unexpected expenses, having an additional source of income can provide much-needed relief. This section explores various avenues for finding freelance work that aligns with your unique skills and interests.

One of the most effective ways to start is by identifying your strengths. Consider what skills you possess that could be monetized. For instance, if you have a knack for writing, graphic design, or programming, there are numerous platforms available that connect freelancers with clients seeking these services. Websites like Upwork, Fiverr, and Freelancer offer opportunities to showcase your talents and bid on projects that match your expertise.

Another popular option is to explore the gig economy through apps. If you enjoy driving, consider becoming a driver for ride-sharing services like Uber or Lyft. Alternatively, if you have a vehicle, you could deliver food through platforms such as DoorDash or Grubhub. These flexible opportunities allow you to work on your own schedule, making them ideal for those with other commitments.

Networking can also play a crucial role in finding freelance work. Attend local meetups, workshops, or online forums related to your field of interest. Engaging with others in your industry can lead to valuable connections and potential job offers. Additionally, leveraging social media platforms like LinkedIn can enhance your visibility and attract clients.

When pursuing side gigs, it’s essential to manage your time effectively. Create a schedule that allows you to balance your primary job and freelance work without compromising your well-being. Setting clear boundaries will help you maintain productivity and avoid burnout.

In conclusion, exploring side gigs and freelancing opportunities can significantly contribute to your financial stability. By identifying your skills, utilizing online platforms, networking, and managing your time wisely, you can find fulfilling work that not only supplements your income but also enhances your professional growth.

Community Assistance Programs

play a crucial role in supporting individuals and families facing financial hardships. Many communities recognize the challenges that arise during tough economic times and have established programs designed to offer temporary relief without the burden of high interest rates typically associated with payday loans.

To find local resources, start by visiting your community’s official website or local government offices. Many municipalities provide directories of available assistance programs, including:

- Food Assistance: Programs like food banks and meal services can help alleviate grocery costs.

- Housing Assistance: Local agencies often provide rental assistance or emergency shelter services.

- Utility Assistance: Programs that help cover utility bills during difficult times are widely available.

- Healthcare Services: Some communities offer free or low-cost medical care for those in need.

In addition to government resources, consider reaching out to non-profit organizations and faith-based groups. These organizations frequently have programs aimed at helping those in financial distress. They may offer:

- Financial literacy workshops to help you manage your finances better.

- Emergency loans with lower interest rates than payday loans.

- Support groups that provide community and emotional assistance.

It’s important to remember that these programs are designed to provide short-term support. They can help you navigate through tough times, allowing you to regain your financial footing without falling into a cycle of debt. Always check eligibility requirements and application processes to ensure you receive the assistance you need.

By leveraging local community assistance programs, you can find the support necessary to manage your financial challenges effectively, ultimately leading you towards a more stable future.

Negotiating with Creditors

When financial difficulties arise, can be a vital step towards regaining control over your finances. Many individuals find themselves in situations where they are unable to meet their monthly payment obligations. In such cases, effective communication with lenders can lead to more manageable repayment terms.

Understanding Your Situation

Before initiating negotiations, it is crucial to evaluate your financial situation thoroughly. Create a detailed list of your income, expenses, and outstanding debts. This will help you present a clear picture to your creditors and justify your request for adjustments.

Strategies for Effective Negotiation

- Be Honest and Transparent: When speaking with creditors, honesty about your financial struggles can foster understanding. Explain your situation clearly and provide any necessary documentation.

- Know Your Rights: Familiarize yourself with consumer protection laws that may apply to your situation. This knowledge can empower you during negotiations.

- Propose Realistic Solutions: Instead of merely asking for lower payments, come prepared with specific proposals, such as a temporary reduction in interest rates or an extended repayment period.

- Stay Calm and Professional: Maintain a respectful tone during conversations. A calm demeanor can help facilitate a more productive dialogue.

Follow Up in Writing

After your initial conversation, it is advisable to follow up with a written summary of your discussion. This not only reinforces your commitment to resolving the issue but also serves as a record of any agreed-upon changes.

Seek Professional Help if Needed

If negotiations become overwhelming, consider seeking assistance from a financial counselor. These professionals can provide valuable insights and support throughout the negotiation process.

By taking proactive steps to negotiate with creditors, you can potentially alleviate financial stress and pave the way for a more sustainable financial future.

Financial Counseling Services

In today’s complex financial landscape, seeking help from financial counseling services has become increasingly important for individuals facing challenges in managing their debt and enhancing their financial literacy. These services provide invaluable guidance, helping clients navigate their financial situations with clarity and confidence.

Financial counseling services offer a range of benefits. Firstly, they provide personalized advice tailored to individual circumstances. Counselors assess your financial situation, including income, expenses, and debts, and help create a customized plan to improve your financial health. This personalized approach ensures that you receive specific strategies that resonate with your unique needs.

Moreover, these services can significantly enhance your financial literacy. Many counselors offer educational resources and workshops that cover essential topics such as budgeting, saving, and debt management. By improving your understanding of these concepts, you can make informed decisions that positively impact your financial future.

Another critical aspect of financial counseling is the ability to develop effective debt management strategies. Counselors can assist in negotiating with creditors, creating payment plans, and exploring alternatives to high-interest loans. This support can alleviate the stress associated with debt and help you regain control over your finances.

In addition, financial counseling services often provide ongoing support. Whether you need assistance during a financial crisis or guidance in achieving long-term financial goals, having a professional by your side can make a significant difference. This continuous support fosters accountability and encourages positive financial behaviors.

In conclusion, the advantages of seeking professional financial advice through counseling services are manifold. From personalized guidance and enhanced financial literacy to effective debt management strategies, these services empower individuals to take charge of their financial lives and work towards a more secure future.

Long-Term Financial Planning

is crucial for achieving financial stability and independence. By creating a comprehensive financial plan, individuals can effectively manage their finances and significantly reduce the likelihood of resorting to payday loans in times of need. This section delves into the essential components of effective financial planning.

- Setting Clear Financial Goals: Establishing specific, measurable, achievable, relevant, and time-bound (SMART) goals is the first step in financial planning. Whether it’s saving for a home, retirement, or education, having clear objectives helps to direct your financial decisions.

- Creating a Budget: A well-structured budget is the backbone of any financial plan. It helps track income and expenses, ensuring that you live within your means. Regularly reviewing and adjusting your budget can prevent overspending and promote savings.

- Building an Emergency Fund: An emergency fund acts as a financial safety net. Aim to save at least three to six months’ worth of living expenses. This fund can cover unexpected costs without the need for high-interest loans.

- Investing for the Future: Investing is vital for long-term wealth accumulation. Consider diverse investment options such as stocks, bonds, and mutual funds to grow your savings over time. Understanding risk tolerance and investment horizons is essential.

- Debt Management: Managing existing debt is critical. Prioritize paying off high-interest debts first and consider consolidating loans to reduce interest rates. This strategy can alleviate financial pressure and improve credit scores.

- Regular Financial Reviews: Periodically reviewing your financial plan is essential to adapt to changing circumstances. Life events such as job changes, marriage, or having children can impact your financial goals and strategies.

By incorporating these components into your financial strategy, you can create a robust plan that not only addresses immediate needs but also lays the groundwork for a secure financial future. This proactive approach helps mitigate the risks associated with financial emergencies and reduces reliance on payday loans.

Frequently Asked Questions

- What are payday loans?

Payday loans are short-term, high-interest loans that are typically due on your next payday. They are designed to provide quick cash for urgent expenses but can lead to a cycle of debt due to their high fees.

- Why should I consider alternatives to payday loans?

Alternatives to payday loans often come with lower interest rates and more manageable repayment plans. By exploring these options, you can avoid the pitfalls of high fees and debt cycles that payday loans often create.

- How can credit unions help me?

Credit unions offer community-focused financial services with lower interest rates and personalized support compared to traditional banks. Joining a credit union can provide you with better loan options and financial advice.

- What is a personal installment loan?

A personal installment loan is a fixed amount of money that you repay in regular installments over a set period. Unlike payday loans, they typically have lower interest rates and longer repayment terms, making them a more manageable alternative.

- How do peer-to-peer lending platforms work?

Peer-to-peer lending connects borrowers directly with individual lenders through online platforms. This can result in lower interest rates and more flexible terms compared to traditional lending options.

- What are some strategies for building an emergency savings fund?

To build an emergency savings fund, start by setting a specific savings goal, automate your savings, and consider cutting back on non-essential expenses. Even small, regular contributions can add up over time.